The refusal to leave the EU without a deal reinforced the GBP purchases against USD and EUR, but still, there are too much “but” and “if” ahead

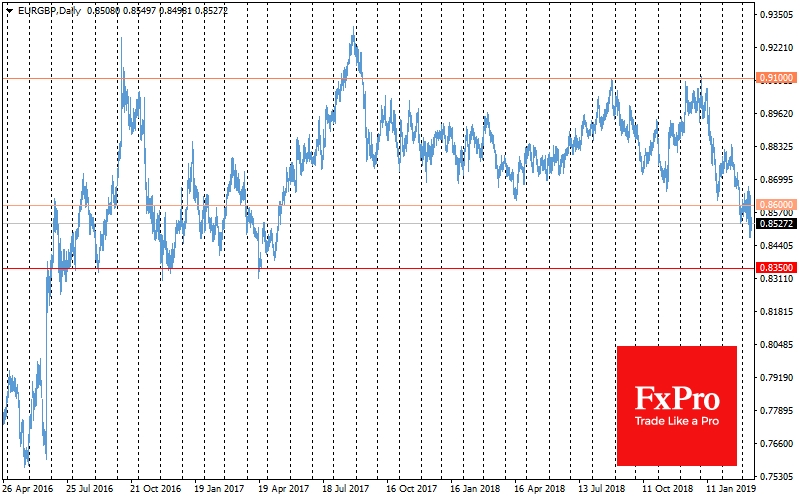

EUR/GBP out of the trading range

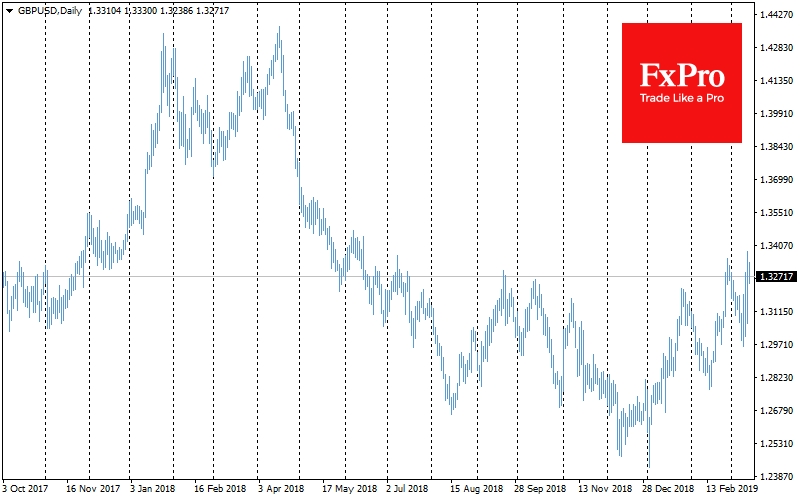

Yesterday the British pound showed intraday growth of more than 2.4%. The GBP/USD pair updated highs from June 2018 reached 1.3380. Against the euro, the pound grew to maximums since June 2017 after the British Parliament rejected the possibility of exit without a deal. Thus, the most negative exit scenario was cut off.

As for technical analysis, the British currency is feeling more and more confident outside of the established trading ranges. For example, the EURGBP mainly trades below 0.8600, sending a pair to the range with support at 0.8350.

The Brexit story is not over yet

But, as was often the case with Brexit, there are still too much “but” and “if” ahead.

Tonight, the Parliament will have to accept or reject the idea of a Brexit shift date. Observers suggest that a majority in parliament will support this decision. But this change must also be approved by the EU. In addition, the question arises, does extend the Brexit agony for another two months after nearly three years of negotiations really can change the situation? It is hardly worth waiting for fundamental changes; rather, it remains to hope for concessions from either side.

Second referendum?

The pound is growing, because in addition to cutting off the worst-case exit scenario, the chances of a second referendum increase over time, despite the fact that British lawmakers have repeatedly opposed this idea. In the end, it is the new referendum that will help overcome the deadlock in which the country's legislators find themselves.