The recent data coming out of the United Kingdom has prompted the Bank of England to stay its course and not change its current monetary policies. Interest rates are kept at the current 0.5 percent and its asset purchasing program stays intact as well.

According to the minutes from the meeting at the Bank of England, the decision to keep interest rates unchanged and to continue with the current monetary policies was unanimous. All voting members voted in keeping the status quo.

The members of the BOE expressed confidence in the British economy, but they also announced that there are anxieties that can cause a further rise of the pound.

The Bank of England believes that the driving forces in the recovery of the economy are consumption and stockpiling. Also the necessary term is growth of investment. Along with this there are some signs that the growth of consumption slowing. Something else that has the members of the BOE wondering is the lack of productivity growth. According to the forecasts of the Bank of England, GDP growth in the fourth quarter of this year will be 0.9%.

The view of traders on the Pound.

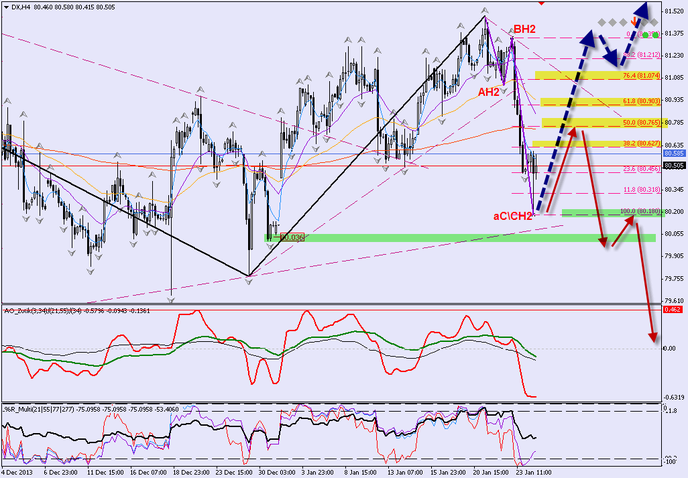

According to the contributing traders at the Binary Options Broker Optionova, the wave of (C)/C at the level H2 starting at 81.350 is over. The actual correction crosstab of this wave (C)/C are the boundaries of the 81.350 and the 80.180 levels.

The new reference point can be named the level 80.180. Up from this reference point a wave A/B with borders is formed, which goes through the 80.180 and the 80.580 levels.

If the slopping channel (SC) with figures 79.020/79.650 and pivot 80.036 are not broken, then there is a possibility for a C-Wave to form.

We may also see a fractal-zigzag retracement with a bullish move.

The upside targets are:

80.627 = 38%

80.765 = 50%

80.903 = 62%

81.074 = 76%

In order for the downtrend to continue, it is necessary to see a bearish candlestick at the recent C wave, along with a breakout to the down side of the pivot point at the 80.037 level.