The turmoil in global currency markets is throwing up anomalies ahead of the Rugby World Cup that starts in Britain next week.

Should South Africa’s Springboks win the sport’s showcase tournament, they’ll each receive a bonus of 1.7 million rand, or about $122,000. A year ago, that would have translated to $155,000. Meanwhile, the price of beer, food and entertainment has soared for visiting fans from rugby-besotted South Africa, Australia and New Zealand, among the favorites to win.

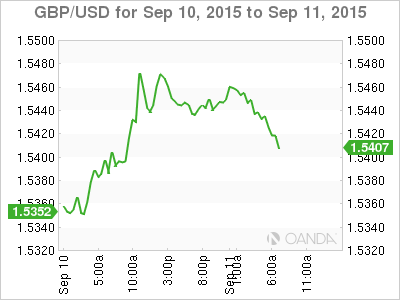

The discrepancies show just how much the currencies of commodity exporters have tumbled this year as China’s economic slowdown drove the prices of raw materials from iron ore to coal to 16-year lows. The differences are exaggerated against the pound, which has gained on speculation the Bank of England will be the first major central bank to follow the Federal Reserve in raising interest rates.

The British currency has appreciated against all but two of its 16 major peers in the past year, strengthening more than 15 percent versus the rand, Aussie and kiwi.

“If you are coming from Australia, South Africa and New Zealand to watch the rugby, you are going to find things expensive; there’s no doubt about that,” said Neil Jones, head of hedge-fund sales at Mizuho Bank Ltd. in London. “The pound might be under-performing at the moment on weaker data, but the structural direction against commodity currencies is still intact.”

The pound has climbed 7 percent in 2015 against a basket of nine developed-nation currencies, rising last month to the strongest level since October 2008. South Africa’s rand has slumped 17 percent in the period, reaching a record 21.5584 per pound on Aug. 24. New Zealand, whose All Blacks are the reigning champions, has fared even worse, with the kiwi declining 18 percent, while the Aussie has weakened 13 percent.