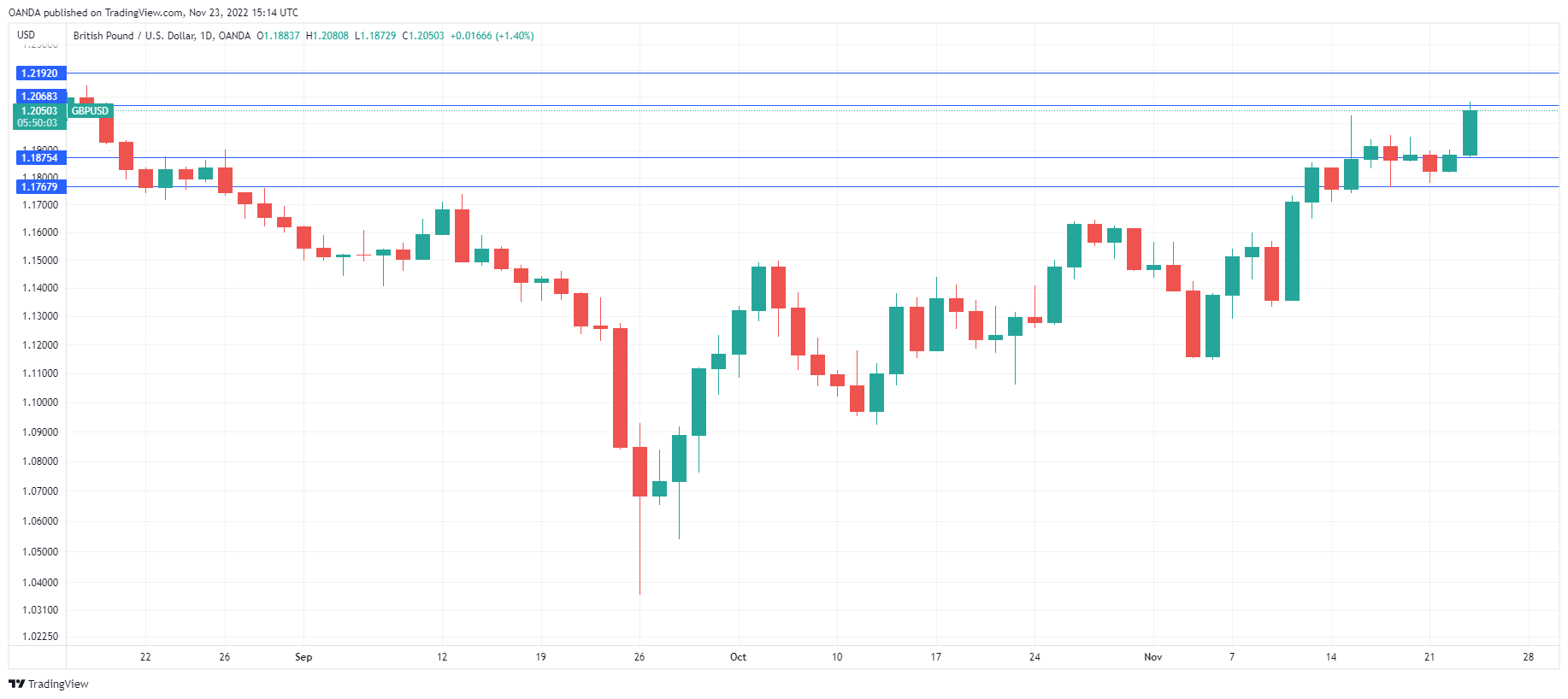

The British pound steadied today after soaring 1.4% yesterday. In the European session, GBP/USD is trading at 1.2074, up 0.17%. The pound has enjoyed a splendid November, gaining 5.3%. The upswing has been impressive but is more a case of a broad pullback in the US dollar rather than newfound strength in the pound.

The UK economy is likely in a recession, and the outlook is as gloomy as a rainy November day in London. The October Manufacturing and Services PMIs remained mired in negative territory, pointing to contraction. The labor market has been a bright spot, but that could soon change, with the Bank of England projecting unemployment rate will double to 6.5%. The UK economy declined by 0.2% in Q3, and the BoE has warned that negative growth will extend to the first half of 2024. With these formidable economic headwinds, it’s challenging to make a case for the pound to continue its upswing.

Inflation has hit a staggering 11.1%, despite the BoE raising the cash rate to 3.0%. The bank pressed harder on the rate pedal at the last meeting, raising rates by 75 basis points. The BoE expects rates to peak at 5%, which means there’s a lot more tightening on the way. The bank will have to tread carefully to avoid choking off economic growth as it continues to tighten to curb red-hot inflation.

Fed says the pace of hikes will ease

The Fed minutes reiterated what the Fed has been telegraphing for weeks; smaller rates are on the way. Fed members agreed that smaller rate increases would happen “soon” as they continue to evaluate the impact of the current policy on the economy.

Members also noted that inflation was yet to show any signs of peaking. The markets aren’t entirely convinced that we’ll see lower rates at the December meeting – the odds of a 75 basis point move are at 65%, with a 35% chance of a 50 bp increase.

GBP/USD Technical

- 1.2040 and 1.1875 are the next support levels

- There is resistance at 1.2192 and 1.2357