After a splendid week, in which GBP/USD jumped 2.8%, the pound has reversed directions and is sharply lower today. In the North American session, GBP/USD is trading at 1.1489, down 1.07% on the day.

Markets eye Bank of England

On Thursday, the Bank of England is on track to deliver its largest interest rate hike since 1989. The markets expect a rate increase of 75 basis points, bringing the cash rate to 3 percent. There had been talking of a supersize full-point increase earlier in the week, but the change of Prime Minister and BoE bond purchases have pushed down borrowing costs.

The driver behind another oversized rate hike is soaring inflation. Headline inflation hit 10.1% in September, up from 9.9% in August. The BoE stated in October that it expects inflation to hit a staggering 11% before its peaks. Such inflationary pressures leave the BoE little choice but to remain aggressive until inflation shows signs of easing.

A complication for the BoE is the delay in the budget, which was supposed to be released before this week’s meeting but has been pushed off to November. The BoE will now have to publish economic forecasts without the benefit of knowing the details of the government’s fiscal plan. The latest forecasts are expected to show that the economic outlook continues to deteriorate and that the recession will be worse than previously anticipated.

The Federal Reserve will also be in the spotlight this week, with a policy meeting on Wednesday. On Friday, the Fed’s preferred inflation indicator, the PCE core index, rose to 5.1% in September, up from 4.9% a month earlier. That virtually cements a 75 bp rate hike on Wednesday, even though there has been talking of the Fed easing up due to concerns about the economic outlook.

The US economy is slowing down after a steady diet of oversized rate hikes, and the global economic environment remains weak. Still, the Fed is committed to curbing inflation, even if the price is a recession.

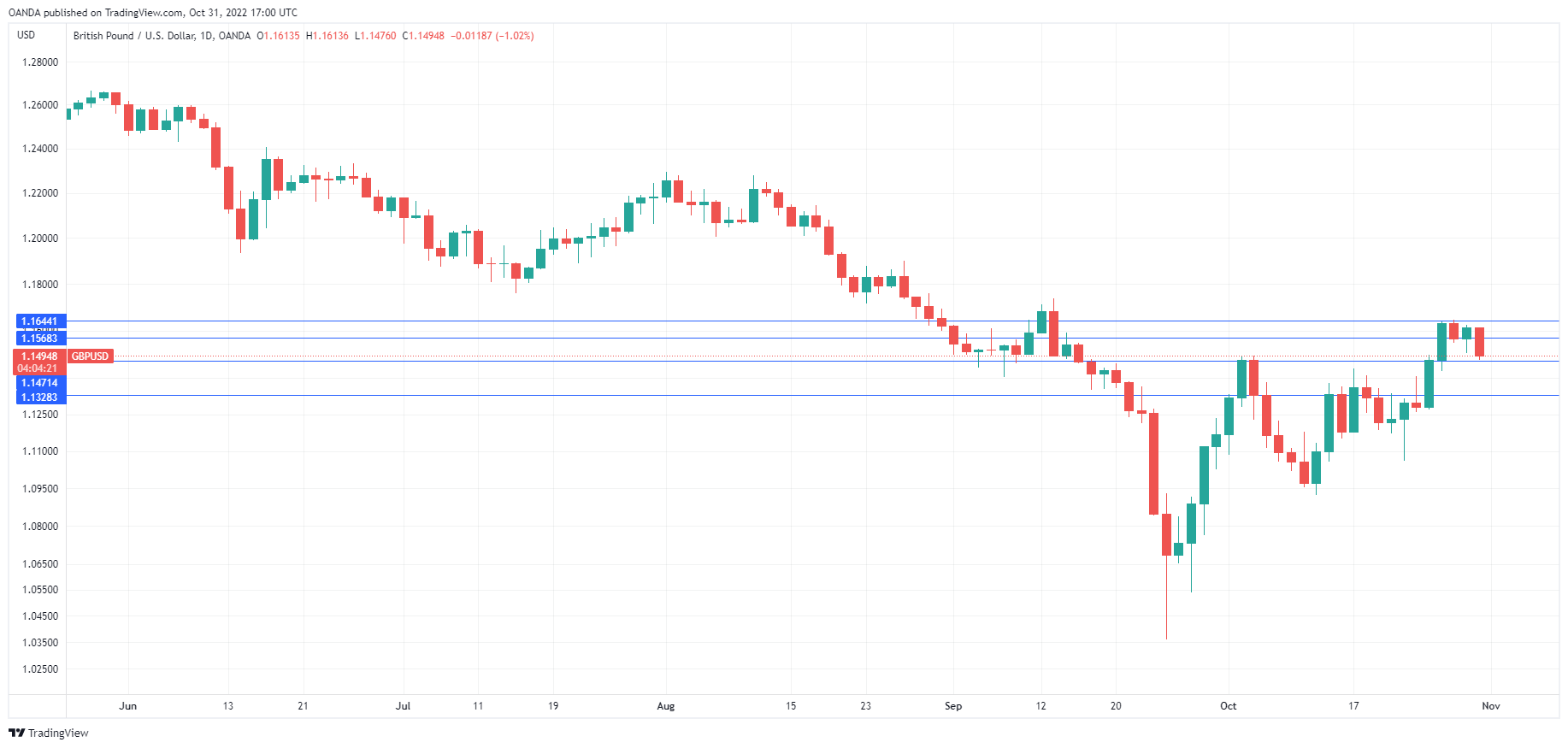

GBP/USD Technical

- There is resistance at 1.1658 and 1.1755

- GBP/USD is testing support at 1.1506. Below, there is support at 1.1367