It promises to be a hectic week in the UK, with a host of key calendar events that could influence GBP/USD. Monday started on a positive note, as GDP for October climbed 0.5%, up from -0.6% in September and ahead of the 0.4% consensus. Investors will have plenty of data to digest, including employment, inflation, retail sales and the Bank of England rate decision. It should be a busy week for the pound as well.

The UK economy is likely in recession, and the markets are bracing for a winter of discontent on the public sector front. Many workers, faced with the ever-increasing cost of living, could go on strike to demand higher wages. This could trigger a cost-wage spiral, which would be a massive headache for the BoE as it would exacerbate inflationary pressures.

With inflation already at a staggering 11.1%, the BoE has little choice but to continue raising rates, and the markets have priced in 50 basis points at the final meeting of the year on Thursday. The cash rate, currently at 3.0%, is expected to continue to rise in 2023, with forecasts ranging from 3.50% to 4.75%.

The Federal Reserve will also be in the spotlight this week, with the final rate meeting on Wednesday. The Fed is on its way to a record year for tightening, with 375 bp in rate hikes already this year. Even with a torrid pace of rate hikes, the markets have been reluctant to internalize the Fed’s hawkish message, and softer-than-expected inflation reports have renewed risk appetite and hopes of a dovish Fed pivot.

The Fed recently trotted out a stream of FOMC members to drum up the message that inflation remained unacceptably high and that the Fed expects to raise rates higher than anticipated. The Fed doesn’t want to see financial conditions loosening before inflation is defeated, which makes it critical that the markets buy into the Fed’s hawkish stance.

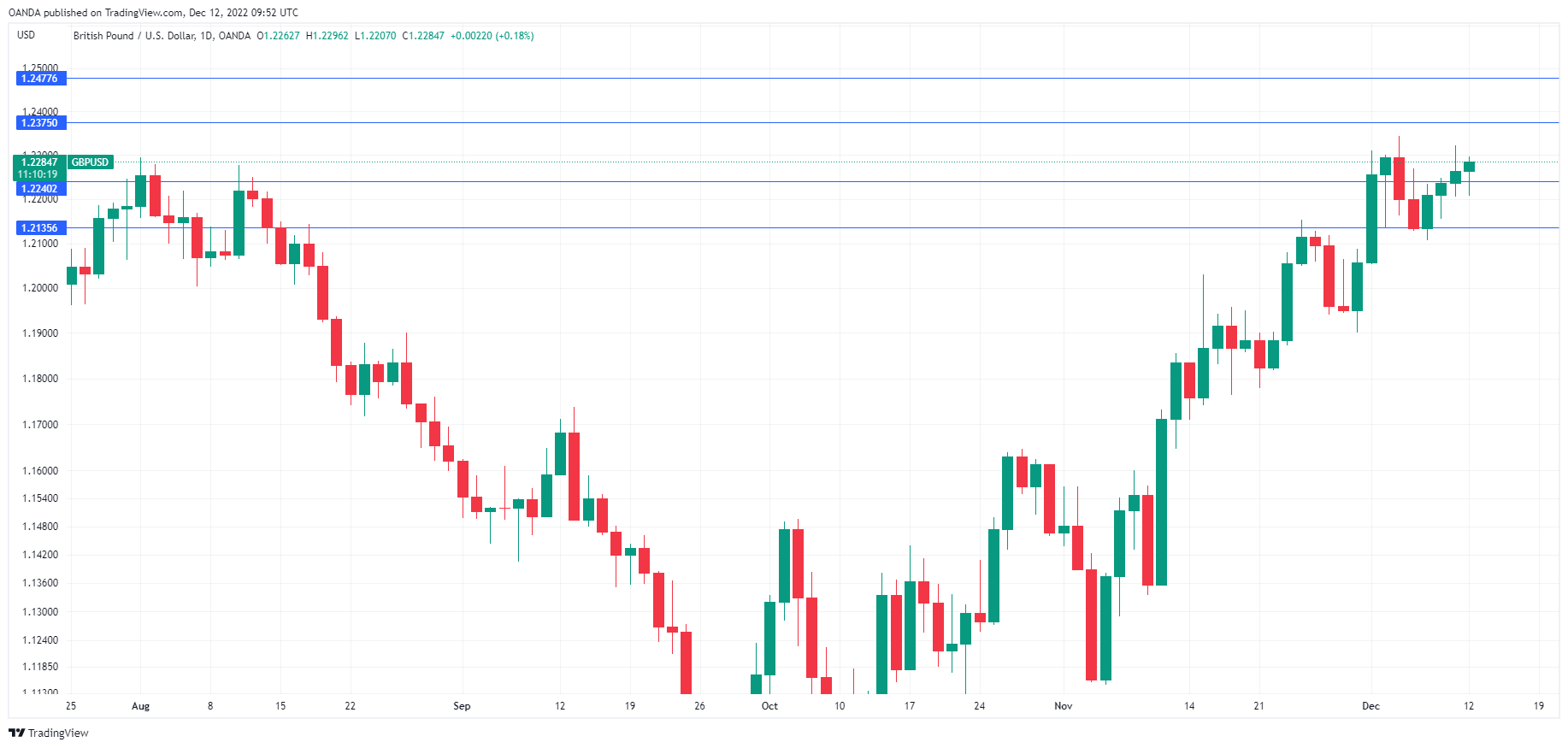

GBP/USD Technical

- 1.2240 and 1.2136 are the next support levels

- There is resistance at 1.2374 and 1.2478