According to the Consumer Price Index (CPI), UK headline inflation was +2.2% (YoY) in July versus the +2.3% rise forecasted and was a touch higher than June’s +2.0% print – the Bank of England’s (BoE) inflation target. The rise in headline inflation was due to energy costs falling less than the previous year.

Soft Inflation and Dovish Rate Repricing

However, UK CPI inflation was softer across the board for July, hence the decline in the British pound (GBP) and a dovish rate repricing for the BoE’s Bank Rate.

As of writing, markets are pricing in a little more than -50 basis points of easing for the year, with November’s meeting fully priced in for a 25 basis point cut (September’s meeting remains a coin toss at this point).

Core CPI rose +3.3% (YoY) in July from June’s reading of +3.5% (consensus: +3.4%). On the services side, MoM and YoY measures undershot expectations, news that will be welcomed at the BoE, particularly from the doves.

Between June and July, services inflation eased to +0.5% from +0.6% in June (consensus: +0.8%), while also in the twelve months to July, services inflation cooled to +5.2% from +5.7% in June (consensus: +5.5%).

Softer inflation follows the BoE reducing the Bank Rate by 25 basis points at the August meeting. Yet, you will recall that this rate cut was accompanied by cautionary comments from the BoE Governor Andrew Bailey, commenting that the reduction does not imply rapid easing from here on.

You may also recall that the central bank projects headline inflation will increase further in the year’s second half to +2.8%, ‘as declines in energy prices last year fall out of the annual comparison, revealing more clearly the prevailing persistence of domestic inflationary pressures’.

Recent data also follows yesterday’s employment and wage numbers. Unemployment fell to 4.2% between April and June 2024, and wage growth eased.

As a reminder, pay, including bonuses, fell to 4.5% in June (3MYY), down from 5.7% in May and softer than the market consensus of 4.6%. Pay excluding bonuses eased to 5.4% (as expected) from the upwardly revised 5.8% reading for the same period.

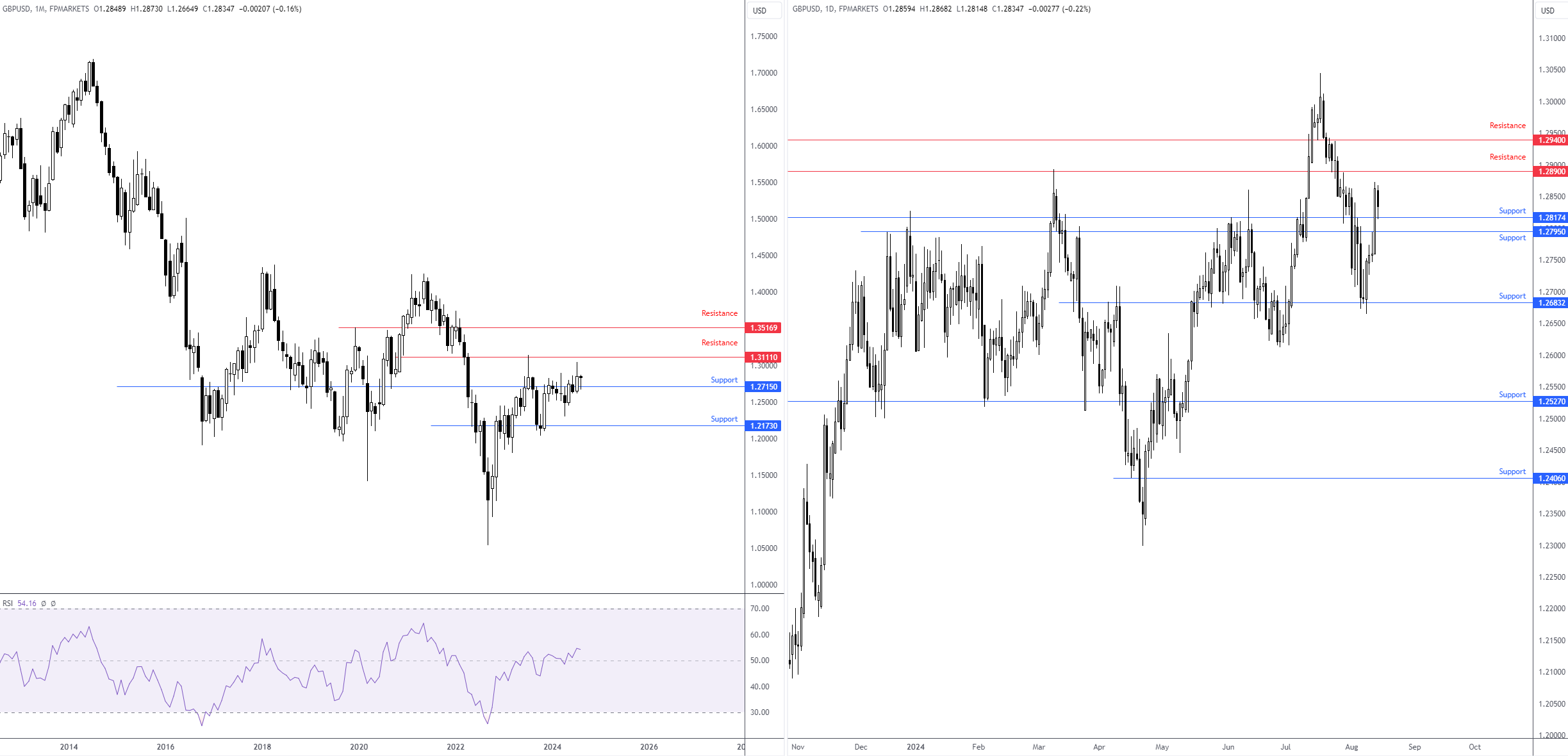

GBP/USD Testing Key Support

Sterling is holding its losses versus the US dollar in early London hours. However, the GBP/USD pair remains technically bullish, and we could see buyers step in here (profit-taking).

Note the recent rebound from monthly support at $1.2715 and today’s retest of breached daily resistance between $1.2795 and $1.2817. Chart studies, therefore, demonstrate scope to press north until reaching daily resistance coming in at $1.2890.

As a reminder, Thursday welcomes UK GDP numbers at 6:00 am GMT and retail sales data on Friday, also at 6:00 am GMT. In addition, stateside, we will receive the July CPI report today at 12:30 pm GMT.