The British pound shows little movement on Friday after plunging 1.2% a day earlier. In the European session, GBP/USD is trading at 1.2210.

Major central bank announcements have been in the spotlight this week, including the Federal Reserve and Bank of England rate decisions. GBP/USD posted modest gains after the Fed decision, rising 0.43%. Investors liked what they heard from Fed Chair Powell, even though he warned that rates would stay high and the battle against inflation was far from over.

The markets expect inflation to fall faster than the Fed thinks and are counting on some rate cuts this year, even though Powell said yesterday that he does not expect to cut rates this year. Powell did acknowledge that disinflation had started, which boosted risk sentiment and helped send the dollar broadly lower.

Pound Slides After BoE decision

The pound fell sharply after the BoE raised rates by 50 basis points for a second straight time. As with the Fed, the markets were cheered by the dovish comments of Governor Baile,y who said that inflation had turned a corner and noted that members had removed the word “forcefully” from its forward guidance statement. Bailey warned that inflation pressures remained and inflation risks were tilted upwards, but investors ignored this part of his message.

Besides inflation, the Fed is focused on the labor market's strength, so today’s US job report could be a market-mover. Nonfarm payrolls fell from 256,000 to 223,000 in December, and the downturn is expected to continue, with an anestimatedf 190,000 for January.

The ADP payroll report showed a decline in December, but unemployment claims and JOLT job openings both moved higher, so this week’s employment releases have been mixed. The markets will also be closely examiningt hourly earnings and the unemployment rate.

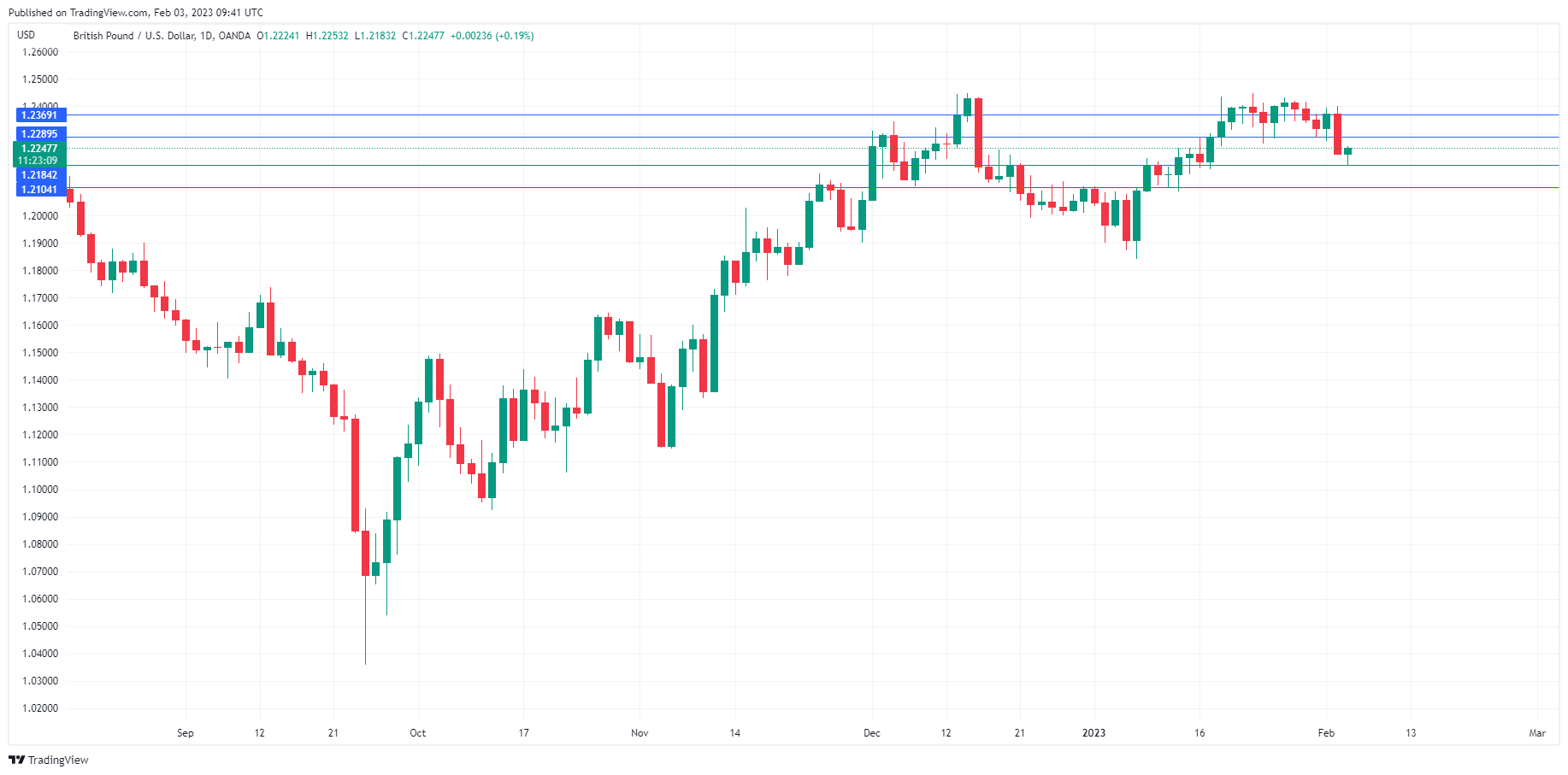

GBP/USD Technical

- 1.2184 and 1.2104 are providing support

- There is resistance at 1.2289 and 1.2369