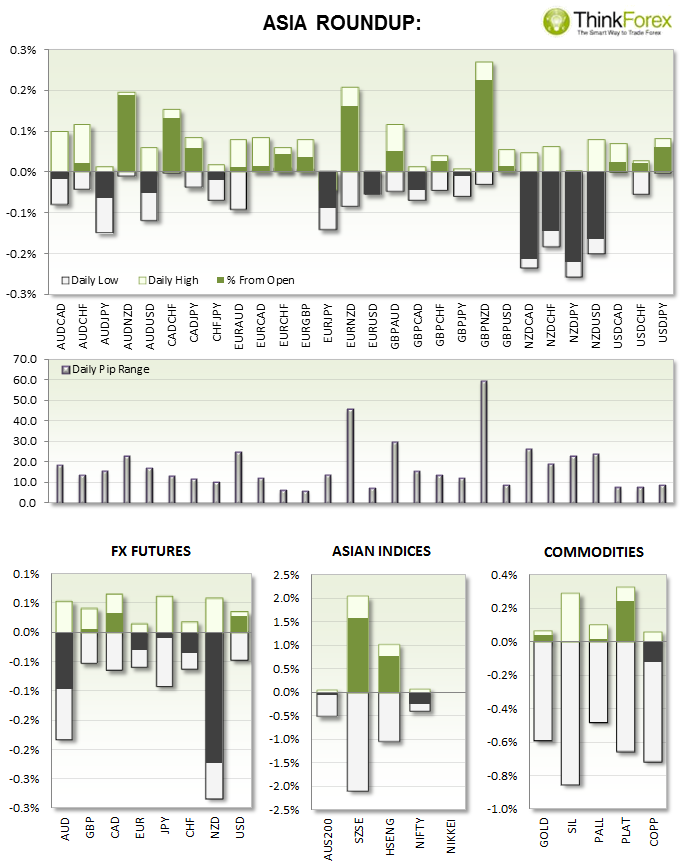

No red news tonight could see tighter trading ranges following on from today's quiet Asia session.

The Services PMI is more of a 'nice to know' number over a tradable release, which should see the market focus on US Pending Home Sales. It is the first negative forecast since the -0.8% seen in March, so any reading above 0 should continue to support the stronger looking Greenback.

At the end of the US session (early Asia) it is over to Japan data, with any strength here putting additional pressure on NZD/JPY.

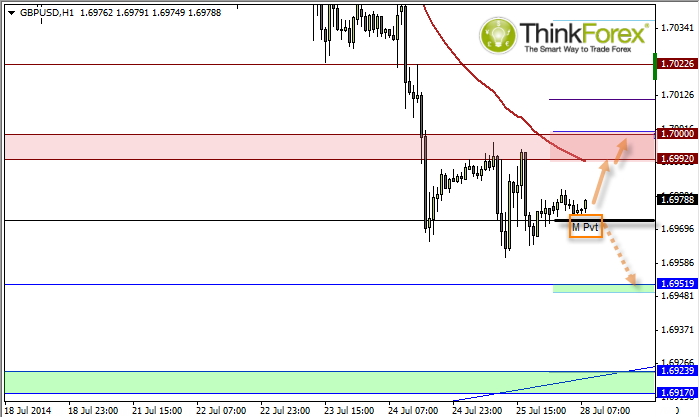

GBP/USD: Sits quietly near the lows

I found it difficult to find anything of particular interest - which in itself is a great description of market conditions today during Asia trading. We had an eventful Friday which tends to leave Asia 'sheepish' on the following Monday as it awaits further data from Europe and or US. Unfortunately as we seem relatively light today then I suspect we could see tight trading ranges during London and US sessions.

However Cable is currently sitting above the Monthly pivot and below the daily (which is also by the 1.7 barrier).

We can use the Monthly pivot as the bullish/bearish line in the sand for today’s session and look to trade the range, either targeting 1.699-70 on the bullish side to 1.695 for the bears (below the Monthly Pivot).

NZD/USD: Suspect a bullish bounce may be on the cards

The bearish momentum is beginning to wane, and in the event we have poor US data tonight then this will help support NZD/USD tonight. Technically, I suspect we'll test 0.8524 before the releases later, but a break below here could see MS1 acting as support.

Either way I suspect we are due a pullback from last week’s losses with the first bullish target being around 0.856 resistance.