The pound has a big night ahead as inflation figures are due out. The market predicts the 1-3% target range to be breached which will likely impact the Bank of England’s decision making over the medium term.

(Source: Blackwell Trader)

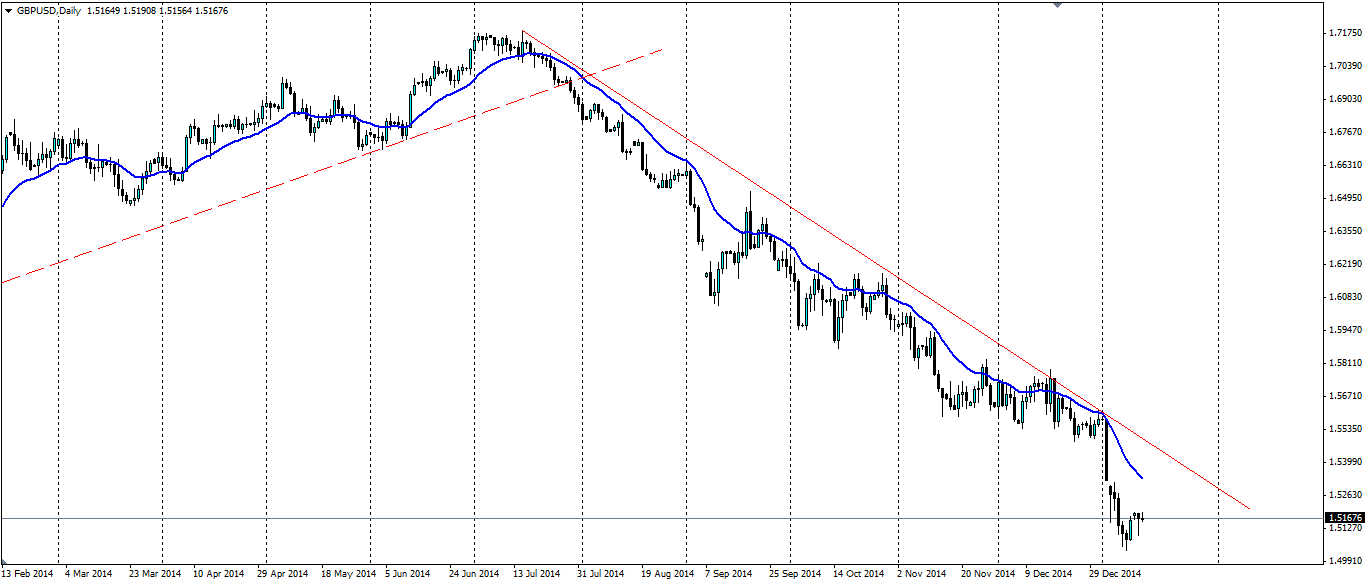

The pound ended 2014 in the worst possible way and the beginning of a new year has seen that trend continue. The economic indicators point to a relatively strong UK economy; GDP is steady at 0.7% and unemployment has fallen to a respectable 6.0%. But there is one indicator that is dictating proceedings: inflation.

The CPI has fallen to 1.0% y/y, at the bottom of the BoE’s target 1-3% range and interest rates are unlikely to budge while inflation is unthreatening. There had been speculation of a rise in interest rates by mid-2015. This is all but out of the question and the prospects could become even bleaker if the market predicts correctly with its estimation of 0.7%.

This now begs the question: if inflation continues to fall, will the Bank of England step in to contain it? One effect of the inflation rate falling out of the target range is that BoE Governor Mark Carney must write an open letter to the Chancellor of the Exchequer George Osborne explaining why inflation has strayed out of the target band and what the Bank intends to do about it. This could prove telling as we may see the first talk of stimulus. Certainly an interest rate hike will be out of the question.

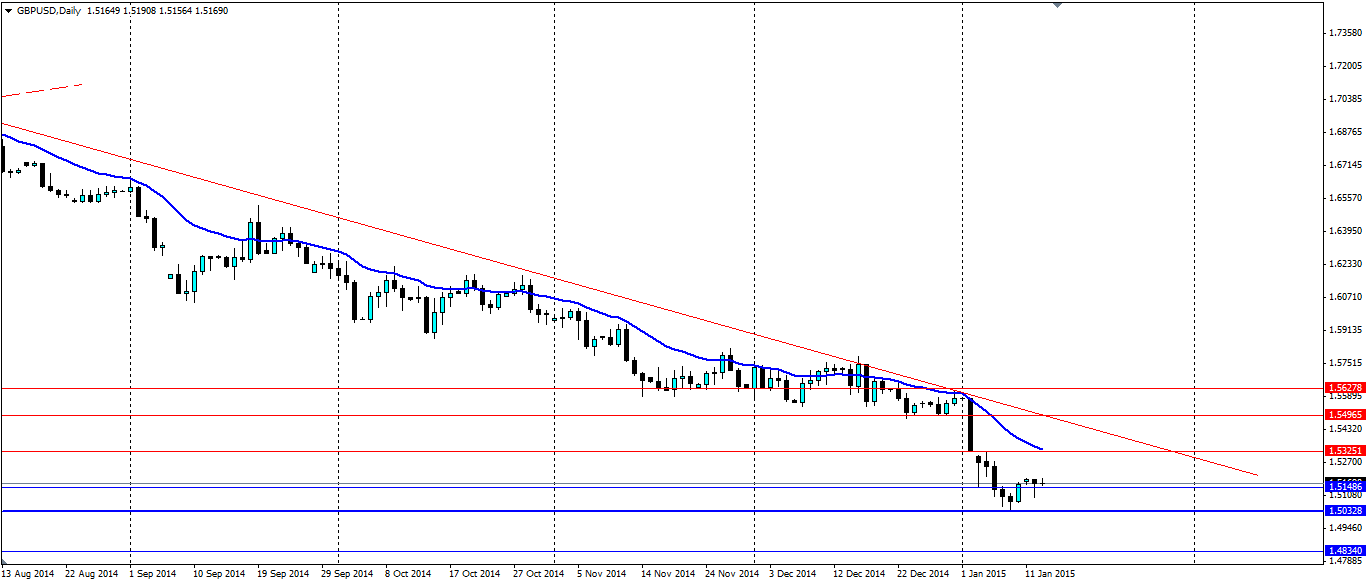

The pound has found a bit of support on the charts over the last few days and this could be a signal that the market believes inflation will not fall as far as the 0.7% expected. If it does not we may see a bullish push up towards the bearish trend line. If it falls more it will likely see the recent 18 month lows pushed out further.

(Source: Blackwell Trader)

The pound will look for support at 1.5148 with the recent low looking relatively solid at 1.5032 with the next level of support at 1.4834. Resistance will be found at 1.5325, 1.4596 and 1.5627 with the trend line acting as dynamic support.