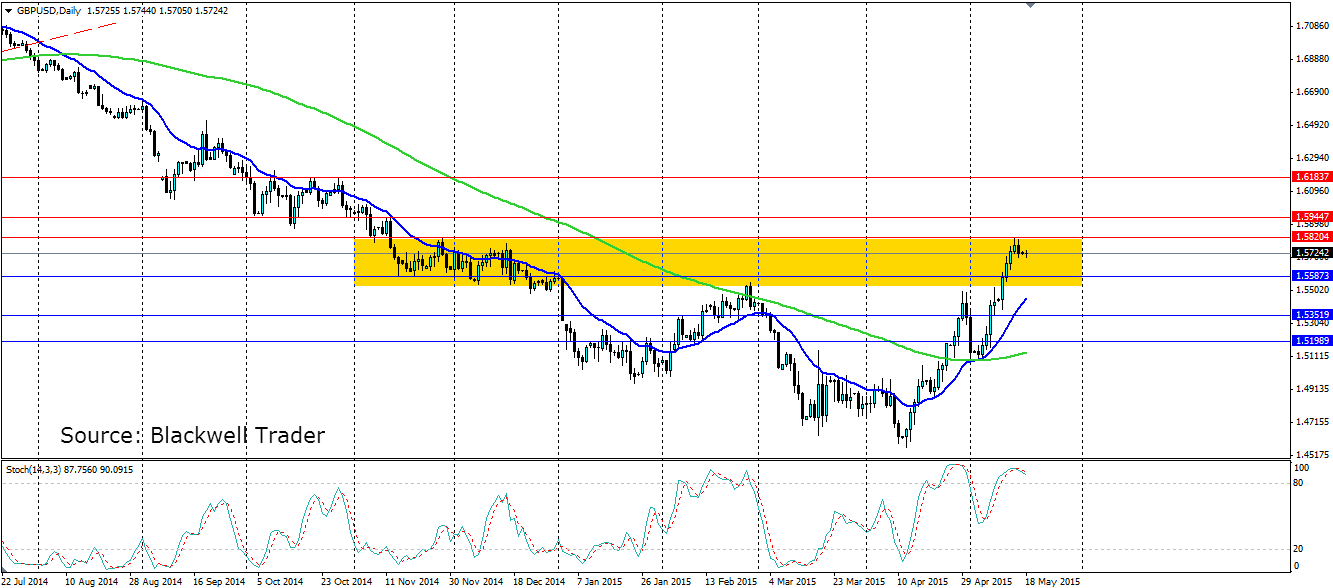

The pound has been simply relentless on its charge up the charts thanks to US dollar weakness, and the continued optimism after the shock election result. The pair has now run into a strong liquidity zone that has seen plenty of reversals in the past, so we can expect some action to come this week. Already we are seeing a double top form on the shorter time frames which could indicate a reversal.

The pound was a sight to behold during the week as it took no prisoners and pushed to fresh highs for the year. The move was not fundamentally driven from the UK side as the news was a little lacklustre. The Bank of England downgraded their 2015 growth forecast from 2.9% to 2.6% but the market shook this off.

The Unemployment rate did drift lower, from 5.6% to 5.5%, but the NEISR GDP estimate also fell from 0.6% to 0.4%. US dollar weakness was the driving force behind the surge in the pound as weak jobs openings, retail sales, PPI and consumer sentiment all contributed to the USD sell off.

The market will be watching the CPI figures due out tomorrow to see if last week's BoE assessment of inflation holds any merit. Retail sales figures are the other big news event to watch.

Technicals show just how aggressive the last two week's moves have been. The pair has now hit a strong liquidity zone that could see it trapped in a range, or reverse. A double top pattern has formed on the short time frame, with it showing as a set of pin bars on the daily chart. The Stoch is forming a lower high indicating divergence and a possible reversal. Look for resistance at 1.5820, 1.5944 and 1.6183 with support at 1.5587, 1.5351 and 1.5198.