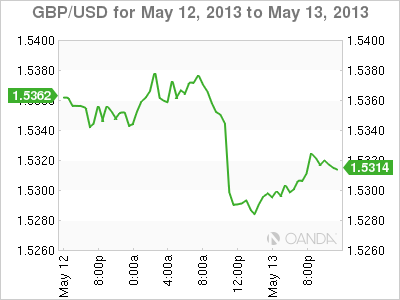

GBP/USD moved higher in Thursday trading, as the dollar lost ground after disappointing US releases. The pair was testing the 1.53 line in the North American session. In the US, Building Permits beat the estimate, but Core CPI was slightly below the forecast. Unemployment Claims was a major disappointment, climbing to a six-month high. Philly Fed Manufacturing Index also was well off expectations. It’s a much quieter day in the UK, with 30-year bonds the only release.

There was a host of key US releases on Thursday, and the numbers left the markets disappointed. Building Permits climbed nicely, up to 1.02 million. This beat the estimate of 0.94 million. However, that news was all downhill afterwards. Core CPI posted a weak gain of 0.1%, just shy of the estimate of a 0.2% gain. Unemployment Claims had reeled off three strong readings, but this time the key indicator jumped to 360 thousand, blowing past the estimate of 332 thousand. The Philly Fed Manufacturing Index dropped into negative territory, posting a reading of -5.2 points. This was well off the estimate of 2.5 points. Housing numbers also joined the parade, as Housing Starts came in at 0.85 million, nowhere near the estimate of 0.98 million.

The US dollar has shown some broad strength against the major currencies, in part due to speculation that the Federal Reserve might terminate its current round of quantitative easing, thanks to an improving employment picture in the US. The Fed has not given any clues that it might scale back QE, which involves asset purchases of $85 billion every month. However, if the US recovery shows stronger signs of recovery, pressure will increase on the Fed to ease up on the QE, which would be dollar-positive. Any statements from the Fed regarding QE could affect the currency markets, so the markets will be keeping an eye on Bernard Bernanke and his colleagues at the Federal Reserve.

In Europe, we’ve seen a lot of volatility from the euro recently, and one of the reasons has been statements from the ECB regarding negative deposit rates. Essentially, this means that depositors would be charged a fee for cash deposits held in European banks. ECB head Mario Draghi broached the idea earlier this month, and the euro dropped almost immediately. The reason? Negative deposit rates would lead to the flow of funds out of the Eurozone, as deposit holders seek better returns on their money. Earlier in the week, ECB member Ignazio Visco said that the ECB was open to the idea of negative deposits. Proponents of the idea argue that it would increase lending to businesses and help boost economic activity in the sluggish Eurozone. The ECB would be the first major central bank to adopt negative deposit rates, and if the ECB does take steps to adopt this measure, we can expect the euro to react.

GBP/USD May 16 at 14:45 GMT

GBP/USD 1.5306 H: 1.5313 L: 1.5197 GBP/USD Technical" title="GBP/USD Technical" width="595" height="76">

GBP/USD Technical" title="GBP/USD Technical" width="595" height="76">

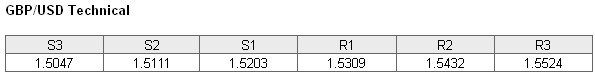

GBP/USD has moved higher in Thursday trading and has pushed above the 1.53 line. The pair is testing resistance at 1.5309. This line could fall if the pound continues to flex some muscle. This is a followed by resistance at 1.5432. On the downside, the pair is putting pressure on 1.5203, which is protecting the 1.52 level. This line has strengthened as the pair trades at higher levels. This is followed by a support level at 1.5111.

- Current range: 1.5203 to 1.5309

- Below: 1.5203, 1.5111, 1.5047 and 1.5000

- Above: 1.5309, 1.5432, 1.5524, 1.5630 and 1.5695

GBP/USD ratio has been pointing to movement towards long positions. This is reflected in the current movement of the pair, as the pound has moved upwards, taking advantage of weak US numbers. While the pound continues to flex its muscle, we can expect the ratio to continue this movement.

The pound has been on a downward slide for more than a week, but has finally turned around and made some gains against the US dollar, thanks to some weak US data earlier on Thursday. We could see the pair settle down and stay close to the 1.53 line, as the markets await key consumer confidence out of the US on Friday.

GBP/USD Fundamentals

- 9:39 British 30-y Bond Auction. Actual 3.29%.

- 12:30 US Building Permits. Estimate 0.94M. Actual 1.02M.

- 12:30 US Core CPI. Estimate 0.2%. Actual 0.1%.

- 12:30 US Unemployment Claims. Estimate 332K. Actual 360K.

- 12:30 US CPI. Estimate -0.3%. Actual -0.4%.

- 12:30 US Housing Starts. Estimate 0.98M. Actual 0.85M.

- 14:00 US Philly Fed Manufacturing Index. Estimate 2.5 points. Actual -5.2 points.

- 14:30 US Natural Gas Storage. Estimate 96B. Actual 99B.

- 16:30 US FOMC Member Sarah Bloom Rosengren Speaks.