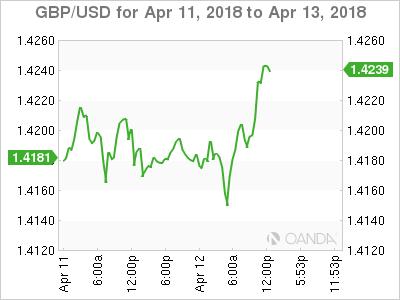

The British pound is on a roll and has recorded gains for a fifth straight day. In the Thursday session, GBP/USD is trading at 1.4243, up 0.45% on the day. The pound has enjoyed a strong week, gaining 1 percent. On the release front, the Bank of England released its quarterly credit conditions survey. In the US, unemployment claims dropped to 233 thousand, very close to the estimate of 231 thousand. On Friday, the US releases the UoM Consumer Sentiment report.

The Federal Reserve minutes had a generally hawkish tone, reflective of a solid US economy. All of the Fed policymakers indicated that the US economy would continue to improve and that inflation would rise in the next few months. At the March meeting, the Fed unanimously voted to raise rates by a quarter-point, bringing the benchmark rate to a range between 1.50% and 1.75%. The Fed projection for rate policy in 2018 remains at three hikes, although there is speculation that the Fed could revise the forecast to four rate hikes. Last week, Fed Chair Jerome Powell said that the Fed would likely continue to raise rates in order to keep a lid on inflation, but added that the rate moves would be gradual. A new headache for the Fed is the escalating trade battle between the US and China, which could hurt the economy and raise consumer prices. As for the next two rate meetings, the markets expect Powell & Co. to sit tight in May and raise rates at the June meeting.

The plucky pound continues to head higher and has surged a sizzling 5.4% since the start of the year. The stronger currency has helped ease inflation concerns to a degree, although the inflation rate is still close to 3%, well above the BoE target of 2%. As for rate policy, bank policymakers do not meet for a rate meeting until May, but there appears to be strong support for a quarter-point rate increase. On Tuesday, a key BoE member, Ian McCafferty, urged the bank not to delay in raising rates, and other policymakers support this view. One strong reason in favor of a rate hike is that inflation remains around 3%, well above the 2% target. However, the lukewarm British economy and the dark cloud of Brexit are key reasons why Governor Mark Carney has not been enthusiastic about raising rates. As things currently stand, a quarter-point rate hike seems likely at the May meeting.

GBP/USD Fundamentals

Thursday (April 12)

- 2:30 MPC Member Ben Broadbent Speaks

- 4:30 BoE Credit Conditions Survey

- 8:30 US Unemployment Claims. Estimate 231K. Actual 233K

- 8:30 US Import Prices. Estimate 0.2%. Actual 0.0%

- 10:30 US Natural Gas Storage. Estimate -11B. Actual -19B

- 13:01 US 30-year Bond Auction

- 15:00 BoE Governor Mark Carney Speaks

Friday (April 13)

- 10:00 US Preliminary UoM Consumer Sentiment. Estimate 100.6

*All release times are GMT

*Key events are in bold

GBP/USD for Thursday, April 12, 2018

GBP/USD April 12 at 11:45 EDT

Open: 1.4179 High: 1.4247 Low: 1.4146 Close: 1.4244

GBP/USD Technicals

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.4010 | 1.4128 | 1.4227 | 1.4345 | 1.4452 | 1.4565 |

GBP/USD inched higher in the Asian session and has been choppy in the European and North American session

- 1.4227 has switched to a support level after gains by GBP/USD on Thursday. It is a weak line

- 1.4345 is the next resistance line

- Current range: 1.4227 to 1.4345

Further levels in both directions:

- Below: 1.4227, 1.4128, 1.4010, 1.3901

- Above: 1.4345, 1.4452 and 1.4565

OANDA’s Open Positions Ratio

GBP/USD ratio continues to show gains in short positions. Currently, short positions have a majority (61%), indicative of trader bias towards GBP/USD reversing directions and moving lower.