- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Pound Looking To Test 1.69 Psychological Level

The British Pound has, as of late, been a stellar performer in the FX world, climbing the charts consistently as the economy goes from strength to strength. The question is, how high can it go? I believe there is plenty of room to go higher, but I’m not going to argue that I have a crystal ball and I expect it to touch the sky anytime soon. My main focus is on the 1.69 level, which looks like a very easy play for a lot of the traders out there.

Let’s start out by explaining why I am looking at this 1.69 level.

-

Economic news out this week is expected to be very strong. CPI data, if it’s stronger than expected at 1.7%, will lead to a very strong boost for the economy (as it closes in on the 2% target inflation rate). Retail spending is also due out and should easily beat last month’s abysmal reading.

-

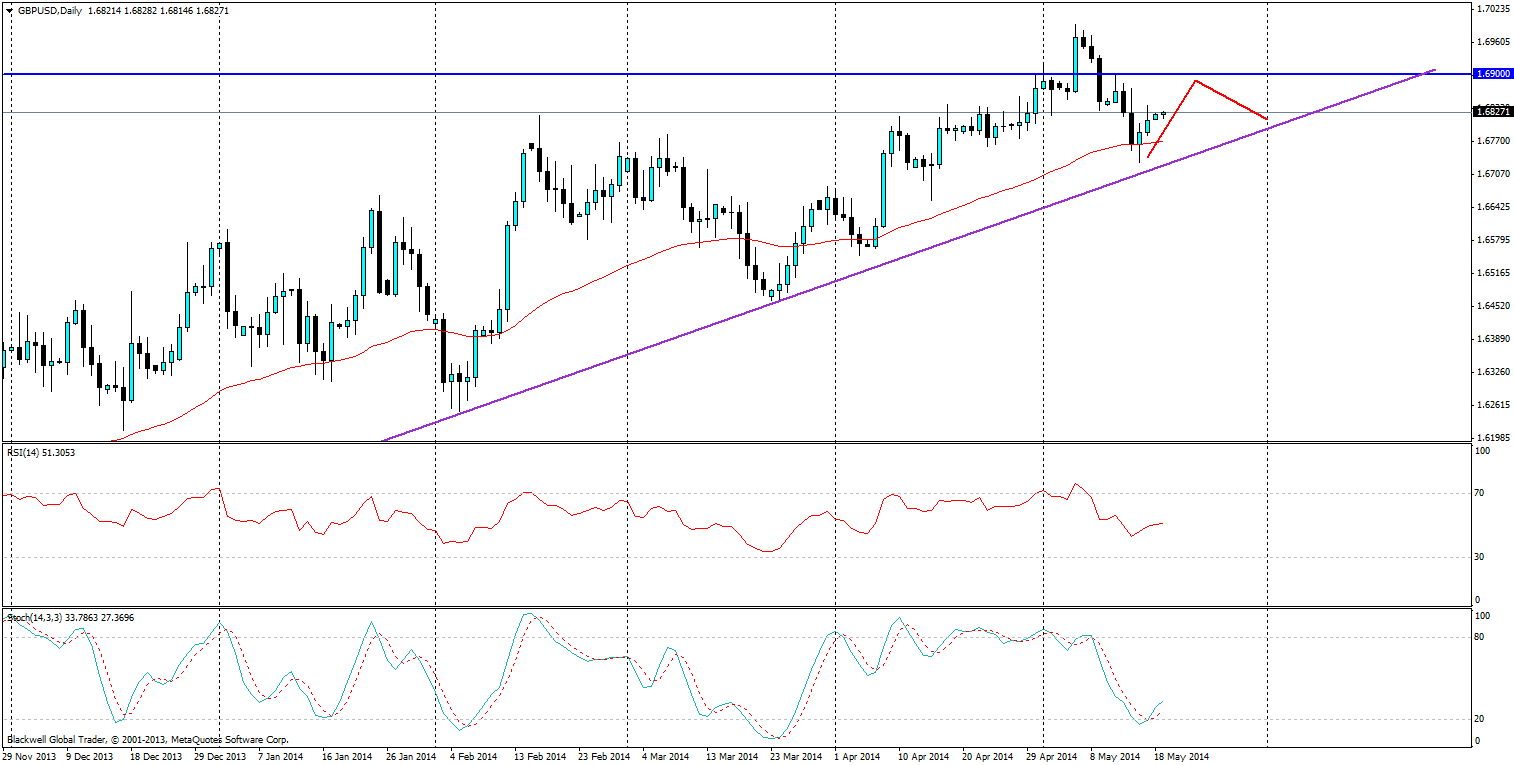

Current indicators look to be very strong in support of further climbs higher. I argue this, just looking at the Stoch, RSI and a 50 day moving average. In the chart below, the Stoch has clearly shifted momentum towards the buy side and looks to be picking up pace as it climbs higher. The RSI also shows that buying pressure is starting to come back into the market, while the 50 day moving average shows a great trending upward line.

-

A strong bullish trend line – they don’t come much stronger than this one, and it looks likely to stay in play, as it has been tested numerous times in the last few months.

-

Higher highs and higher lows. Each wave upwards so far has been getting higher highs and higher lows, all the hallmarks of a trending market and certainly something that many traders like to see.

Only a few things left to mention, but important nonetheless.

Source: Blackwell Trader (GBP/USD, D1)

A quick look at the chart confirms all of the above and my reasoning for the targeting of the 1.6900 level I have outlined, but what I expect after that is a slight pullback. I say this because markets are still worried about higher levels and will most likely act cautiously as it lifts higher, especially with the 1.700 level.

Why is a 1.70 level a worry? It reduces competitiveness for the British Pound when competing in international markets, and the Bank of England could start to voice some concern, especially when they are still doing an asset purchase program and keeping rates at record lows. Obviously, it's not going to actually damage the economy in 1.70 but markets might be a bit cautious before breaking into new territory.

Overall, the Pound is certainly looking to be a winner as of late and I expect that the 1.69 level is one to target in your next trade. I say this based on the fact that recent data has shown the UK economy to be growing and recovering strongly (especially when compared to the OECD), as well as the technical reasons I have outlined.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Swiss franc is down for a second straight trading day. In the European session, USD/CHF is trading at 0.8980, up 0.38% on the day. Switzerland’s GDP Eases to 0.2% The Swiss...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.