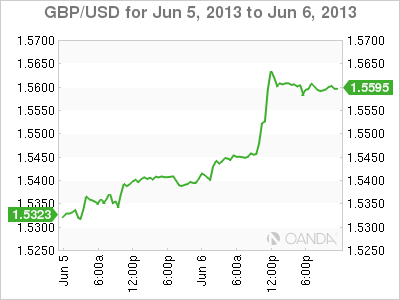

The British pound continues to fire on all four cylinders, and has posted sharp gains on Thursday. The pair has gained over one cent on the day, and has barreled past the 1.55 line. GBP/USD is at its highest level since early May. As widely expected, the Bank of England did not adjust the Asset Purchase Facility or its key interest rate. There was good news from the UK housing sector, as Halifax HPI beat the forecast. In the US, Unemployment Claims bounced back and was very close to the estimate.

The BOE was in the spotlight on Thursday, but there were no surprises as Governor Mervyn King chaired his last policy meeting. He will be replaced by Mark Carney, who is leaving the top post at the Bank of Canada. As expected, the BOE maintained QE at 375 billion pounds, and the key interest rate at 0.50%. There have been signs of improvement in the British economy, such as solid PMIs, and if this continues, the central bank will be able to contemplate reducing QE.

It was a clean sweep for British PMIs this week, as Services PMI looked sharp on Wednesday. The PMI has been above the 50-point level throughout 2013, marking ongoing expansion in the services sector. The index has been moving upwards, and continued the trend in May, climbing from 52.9 to 54.9 points. This easily beat the estimate of 53.1 points. Earlier in the week, the Manufacturing and Construction PMIs for May showed improvement as both indexes climbed above the 50 line. The solid PMI releases have raised hopes that the underperforming British economy is finally headed in the right direction.

The US continues to post some weak numbers, and on Wednesday it was the turn of ADP Non-Farm Payrolls. The key indicator has struggled, and has now missed the estimate for three consecutive releases. The indicator came in at 135 thousand, well off the forecast of 171 thousand. However, Unemployment Claims bounced back, posting a reading of 346 thousand, very close to the estimate of 345 thousand. We’ll see some more key employment numbers on Friday, as the US releases the Unemployment Rate and Non-Farm Payrolls.

Will the US Federal Reserve scale back its current QE program? This question has been preoccupying the markets for some time now. Although the Fed hasn’t made any changes so far, Fed policymakers, including Fed Chair Bernanke, continue to hint that QE could be scaled back in the next few months. With the US continuing to alternate between good and bad economic releases, the Fed may continue to hold off on any changes to QE before it is convinced that the US economy is improving. The currency markets have reacted sharply to talk about terminating QE, and any moves related to QE will likely impact on the US dollar.

GBP/USD June 6 at 15:20 GMT

GBP/USD 1.5525 H: 1.5529 L: 1.5381

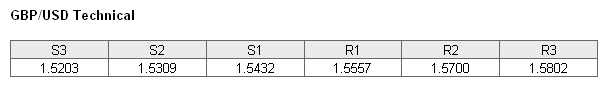

GBP/USD continues to rally, and broke through the 1.55 line in the European session. The pair is testing resistance at 1.5555. This line could be tested if the pound’s strong upward momentum continues. This is followed by resistance at the round number of 1.5557. On the downside, GBP/USD is receiving support at 1.5432. This line has strengthened as the pair trades at higher levels. The next support level is at 1.5309, protecting the 1.53 line.

Current range: 1.5432 to 1.5557

Further levels in both directions:

- Below: 1.5432, 1.5309, 1.5203, 1.5111, 1.5047 and 1.5000

- Above: 1.5577, 1.5700, 1.5800 and 1.5869

GBP/USD has been marked by strong movement towards short positions. With the pound posting sharp gains against the US dollar, this is likely to do a large number of long positions being covered, resulting in a larger percentage of open short positions. For the first time since early May, short positions now make up a majority of the positions in the ratio.

GBP/USD Fundamentals

- 7:00 British Halifax HPI. Estimate 0.2%. Actual 0.4%.

- 11:00 Bank of England Asset Purchase Facility. Estimate 375B. Actual 375B.

- 11:00 Bank of England Official Bank Rate. Estimate 0.50%. Actual 0.50%.

- 11:30 US Challenger Job Cuts. -41.2%.

- 12:30 US Unemployment Claims. Exp. 345K. Actual 346K.

- 14:30 US Natural Gas Storage. Exp. 101B. Actual 111B.