- BoE Gov. Bailey rules out extending bond-buying support

- Intervention warnings resume as yen tumbles to fresh lows

- Dollar eases ahead of US inflation data

- IMF downgrades world growth forecasts, warns of recession

Pound falls as Bailey says BoE support program to end Friday

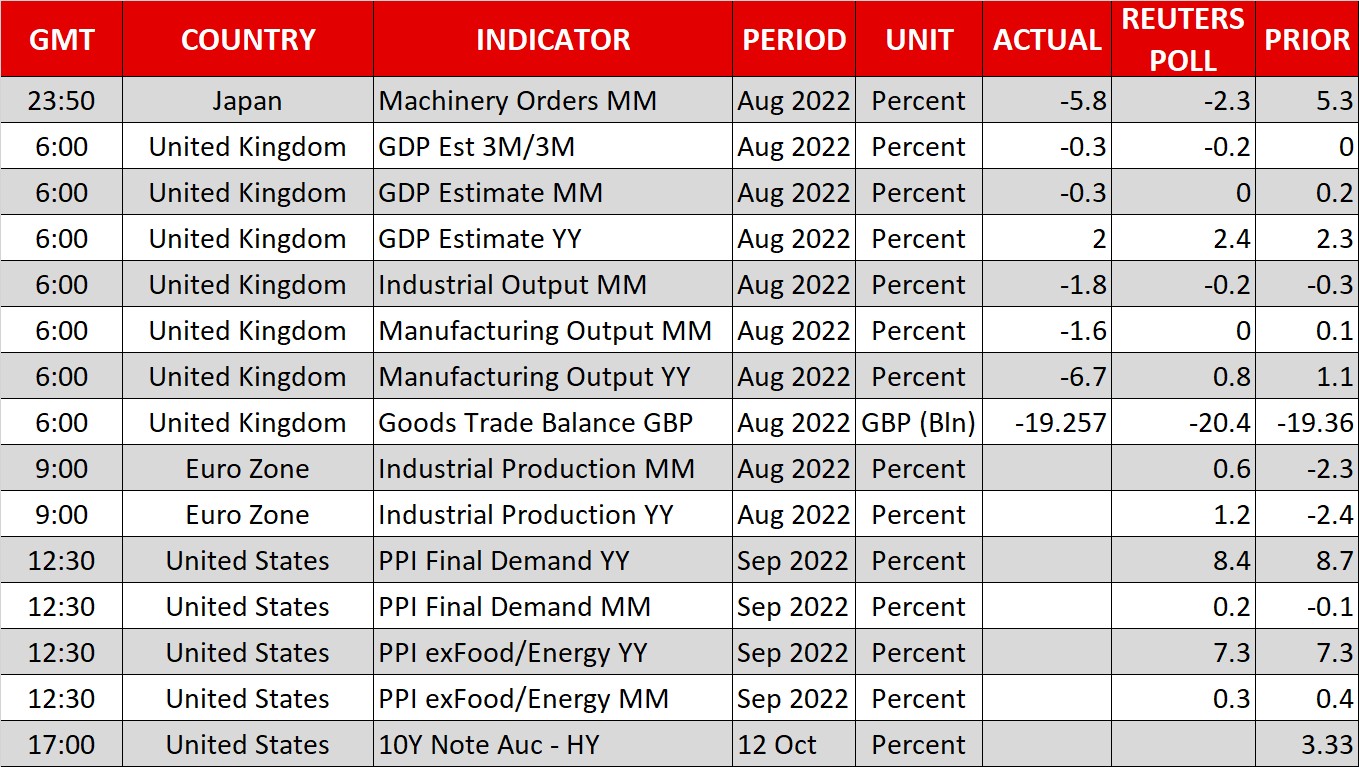

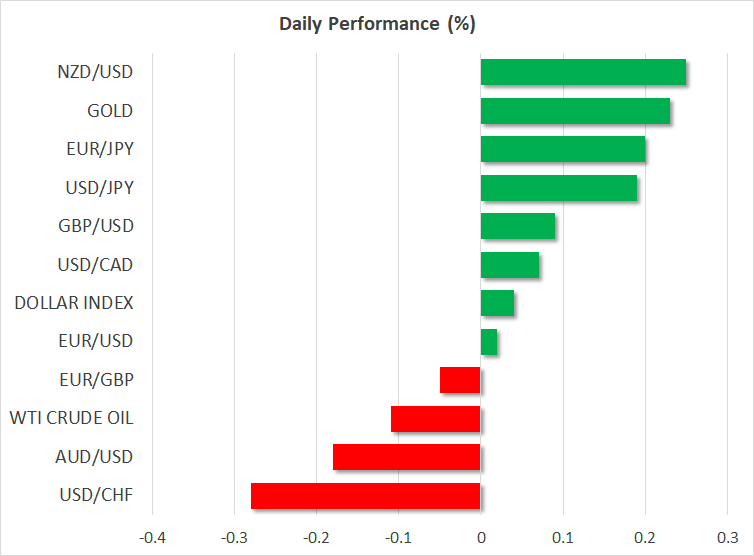

The pound was the main loser among the major currencies yesterday, coming under strong selling interest after Bank of England Governor Andrew Bailey warned pension fund managers to end their rebalancing process by the end of the week as the central bank is sticking to its initial plan of ending its recently enacted emergency bond-buying support program on Friday.

Earlier in the day, the Pensions and Lifetime Savings Association requested an extension of the program until Oct 31, and even beyond if possible, and that’s maybe why Bailey’s refusal came as a disappointment.

At first glance, a slide in a currency when its central bank stops buying bonds appears very odd but combined with the fact that the pound rallied notably on the announcement of the emergency plan, it suggests that traders’ trust in the new government is still not-existent. They may still hold the view that without the help of the BoE, the government’s plans will serve in further fueling sky-high inflation and the ballooning budget deficit.

This is evident by the fact that they are pricing in a full percentage point worth of rate increase at the BoE’s upcoming gathering in November. Recent history has shown that pound traders may not be confident enough that the Bank’s actions could relieve them from the pain of biting consumer prices, but rather fearful of more aggressive tightening that would deepen the wounds of the UK economy. Ergo, combined with the risk-linked characteristics the pound has developed due to its widening twin deficit, this could keep the British currency under pressure.

Dollar/yen rise triggers fresh intervention warnings

The yen was the second loser in line, with dollar/yen breaking above 146.00 for the first time since 1998, prompting Japanese authorities to warn again for necessary action if deemed necessary. The pair is now trading slightly higher than the prior 24-year peak of 145.90 hit just before the government intervened to rescue its currency, meaning that the likelihood of another intervention episode soon may be very high.

Nonetheless, taking as a paradigm the failure of the first intervention episode, the chances of success this time may again be very small. The biggest game in town for the currency market nowadays has been monetary policy and thus, widening rate differentials between Japan and the rest of the world are likely to keep the yen under pressure. Yes, interventions could support it instantly, but any rallies are likely to constitute strong upside corrections rather than a reversal in the yen’s steep longer-term downtrend.

Dollar traders await US inflation numbers

The US dollar outperformed most of its major peers yesterday but pulled back today against all but the yen. With the US inflation numbers scheduled to be released tomorrow, traders may have preferred to lock some profits on existing long positions, perhaps to eliminate the risk of a downside surprise.

The forecast for the headline CPI points to further slowdown, but the core rate is expected to have risen, underscoring the view that inflation has become stickier compared to a few months ago. Therefore, with market participants assigning around a 90% chance for a fourth consecutive 75-bps hike at the Fed’s upcoming gathering, accelerating underlying inflation could seal the deal, while a big upside surprise could force those expecting rates to be cut towards the end 2023 to scale back their bets.

Although many argue that the long-dollar trade is crowded, the fact that investors have room to raise their implied rate path to match the Fed’s projections suggests that there is more upside potential, especially without any concrete evidence that the Fed could slow down soon.

Equities keep suffering as IMF warns of global recession

Equities continued to trade lower yesterday and today during the Asian session, as the International Monetary Fund cut its 2023 global growth forecasts, ringing alarm bells that very high inflation, war-driven crises, and tighter financial conditions due to higher interest rates could drag the globe into recession and financial instability. BoE Gov. Bailey’s remarks didn’t bode well for investors either as they fueled fears that the BoE’s withdrawal could reignite volatility in bond markets and add to instability.

With US inflation data expected to only add to the narrative of an ultra-hawkish Fed, equities may be destined to drift further south, especially high-growth stocks that are more sensitive to interest-rate changes. That conclusion is supported by the fact that once again, the tech-heavy Nasdaq was Wall Street’s main loser yesterday.

Tonight, we get the minutes from the latest FOMC gathering, but given that several policymakers have been singing the same hawkish song in the aftermath of the meeting, the minutes may be treated as outdated and have little market impact.