Michael Barnier, the EU’s top negotiator on Brexit, called a reaching of the agreement on the deal within next 6-8 weeks realistic. This news supported the growth of the British currency, returning the sterling above 1.3040 of the dollar, to the highs since the beginning of August. The reaching of the agreement will reduce uncertainty around the British currency and cause a collapse of pessimistic positions that were betting on the development of the worst-case scenario.

Later in the day, traders with the British currency will also evaluate new employment and salary data. The proximity of Brexit begins to bite economic indicators, as we see a slowdown in the earnings growth, and the claimant count had increased by 108K or by 13.5% over the past 12 months by July. Thus, weak macroeconomics can quickly neutralize the positive impact of the news on the negotiations.

Asian bourses have been declining for the 9th trading session in a row, despite the fact that Trump has not announced new measures against the imports from China. MSCI for the Asia-Pacific region without Japan loses 1% this morning and has been trading at the lowest levels since last July. The Hong Kong index also loses in the morning, fixing a decline by 21% of the January’s peak levels. The bear market (a fall of more than 20% from the peak) is capturing more and more countries. In these conditions, the funds tend to further reduce positions in these markets, avoiding further losses, as the offensive phase of the bear market often follows a sequent long decline in quotations, often by 10-20%.

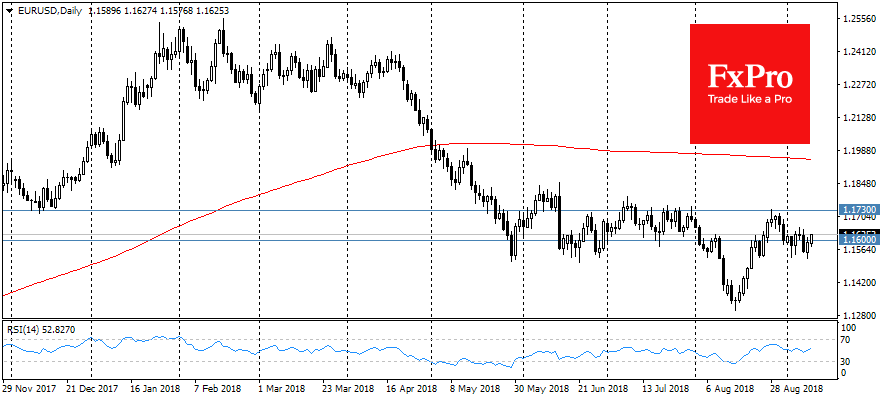

At the same time, the dollar index recedes under the pressure as the pound and the euro gains. The demand for European currencies has returned against the background of positive news about the negotiations on Brexit. As a result, EUR/USD tries to gain a foothold above 1.16, and GBP/USD is above 1.3040. The Japanese yen weakens to the dollar following the growth of the demand for risky assets in developed markets, where futures on S&P500 add the second day in a row.

Alexander Kuptsikevich, the FxPro analyst