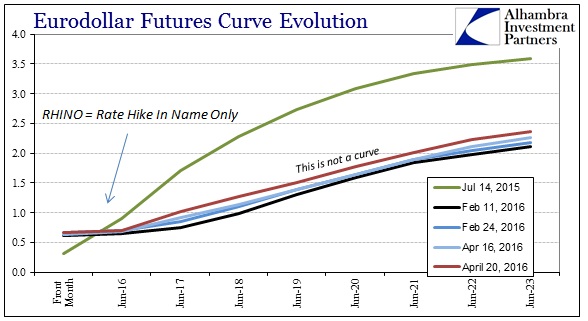

Today was the third consecutive down day of selling in eurodollar futures. The June 2018 contract settled below 98.80 for the first time in April, almost unwinding the move higher at the start of this month. Even after the selling, the eurodollar curve remains as depressed as ever, discounting an entirely different set of future circumstances than stocks or junk bonds.

It is that move after March 16 and really starting around March 29 that is more interesting. At the time, it looked very much like the expected (by me, anyway) revisit of broad eurodollar trouble or the approaching countdown of the “ticking clock.” There was an enormous repo warning just prior to all this, of course, but it hasn’t so far proven (yet) to be the same kind of disruption as we have seen before.

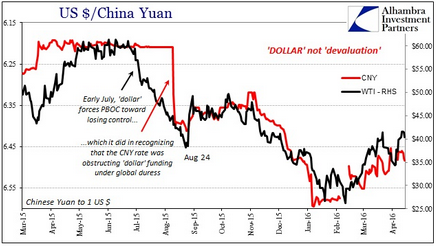

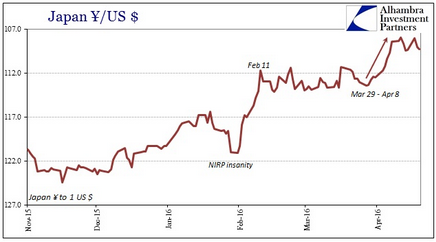

That much was obvious by the lack of participation via the Chinese, at least so far as indicated by the eurodollar world’s central correlation of CNY (against whatever). It may indicate (and indicate still) something about the “dollar” or perhaps continued PBOC influence, but what was distinct was instead the forward nature of JPY. You can see the eurodollar move at the end of March/start of April matched perfectly with this last part of yen appreciation that had already caused a lot of stress and headache in Tokyo, for the Bank of Japan in particular.

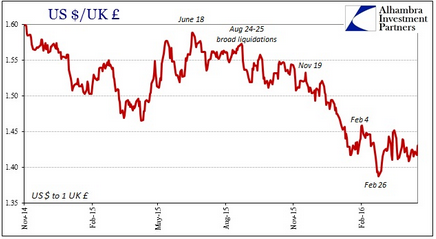

It wasn’t matched by anything else, at least nothing that stands out to me. Sterling, for example, followed CNY much more closely than JPY, which is significant because pound and yen are very often a mirror image of each other under just these sorts of conditions. I have suggested before that this proposes a specific Japanese “dollar” issue which was certainly indicated by hugely negative basis swaps, and without seeing it continue or reflected elsewhere it does seem like an isolated and specific disturbance.

I would not rule out general “dollar” problems just yet, but there might be significance in this development. The world may be mostly correlated with CNY for now, but JPY can still be a central agent. It may sound too nonspecific to be serious until you realize just how badly the Bank of Japan has messed up Japanese banks and money markets there.