The Dow Jones Transportation was a drag on the broader market for all of 2015. And most of 2016 was only slightly better as it moved sideways after an early bounce. It was not until November 2016 that the transports started to move higher and fly out of a two year hole. They reached the 2014 highs in December and as the calendar turned to 2017 have been stuck there. Will this turn into a double top, and Transports fall back? Or is this just a digestive pause before thrusting on to new all-time highs?

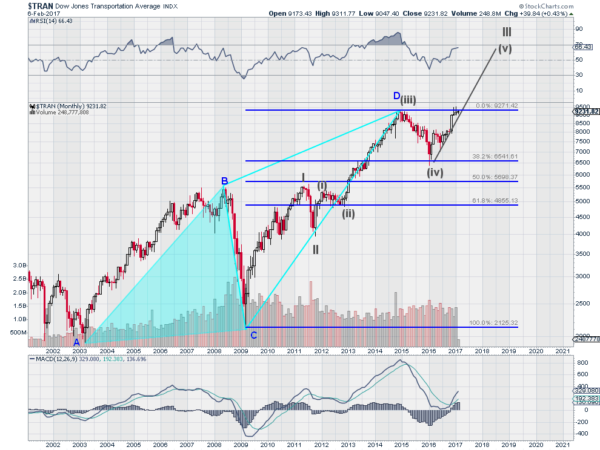

The chart below gives some clues. The Transports went through an AB=CD pattern over the 11 year period that led to the 2014 high. The CD leg ended with a 200% extension of the AB leg, before correction 38.2% of the move. Now with a bounce to the 2014 high several methods of technical analysis offer some upside targets.

There has been building an Elliott Wave Count that suggests continuation higher. Since the 2009 low the Transports have printed the first wave higher and the corrective second wave and are now working on the third wave up. Digging into the structure the Transports are now in Wave (v) within Wave III. Projecting from the minor wave positive moves gives a range of 9,990 to 10,960 for the top of minor wave (v). The latter seconded by an AB=CD from the bottom at (ii) to the top at (iii) then back to (iv) continuing. The larger AB=CD pattern also gives rise to a harmonic pattern, a 3 Drives, that would look for a large move higher. This would give a target range of 10,140 to 13,640.

This is a very large range but they are all pointing higher. Additionally momentum supports continued upside. The RSI is in the bullish zone and rising, while the MACD crossed up late in 2016 and has a lot more room to move higher. No one can predict where the Transports will stop. As I started with earlier, this could be the top right now. But the price action suggests there is a lot more upside in this sector.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.