Overall, the US economy is in strong shape. Unemployment is low, growth is positive (but moderate) and inflation is under control. But the expansion is also getting old; the possibility of a negative event hurting growth is increasing. Looking at the economic landscape, these are the risks that I think could potentially derail the economy -- or at least deliver negative shocks in 2017.

Oil Prices

Because of oil’s centrality to the US economy, major oil-price spikes usually lead to an economic slowdown. James Hamilton (who writes at Econbrowser.com) documented this in the paper Historical Oil Shocks, which not only describes the major post-WW II oil events, but also documents the “economic downturns that followed each of the major postwar oil shocks.”

Currently, oil is cheap, thanks to Saudi Arabia, which increased production in 2014 to harm its then newest competitor, the US fracking industry. This started a large selloff in the oil market: the West Texas Intermediate Contract fell from a little over 100/bbl. in 2014 to 26/bbl. in early 2016. Prices rose since then, eventually moving just about $50/bbl. in early summer, where they currently sit. The drop in oil led to a decline in gas prices: the price of a gallon of conventional gasoline fell from over $3.50/gallon in late 2014 to its current level of just over $2/gallon. But in December, Saudi Arabia and Russia agreed to a production cut that, according to the IEA, would bring the oil market back into supply/demand equilibrium by the second half of 2017. Assuming IEA’s prediction is correct and there is no cheating (which usually happens with OPEC production quotas), oil prices should rise. This will naturally translate into higher prices at the pump. The current national average of $2/gallon is very low; it means there’s a fair amount of room for prices to move before they start to crimp consumer spending.

Inflation

In a recent bond-market review, I noted that a combination of rising oil prices, increased housing costs and higher shipping rates could lead to increases.

Trump

The general consensus is that Trump will be very pro-business. After the election, the financial sector’s ETF XLF rallied on the hopes of a greatly trimmed Dodd-Frank. But that’s not all. Trump has publicly stated he would cut regulation, reform the corporate tax code and lower the personal rate. But there are potential problems as well, with the greatest being the possibility of a trade war as explained by Paul Krugman:

Post-election, Trump has also taken to Twitter and specifically targeted several companies, which sent their respective stock prices lower, albeit briefly. Clearly, there are good and bad issues associated with the new administration.

Health Care

One of the GOP's first legislative goals is to repeal the ACA. However, as of this writing, the Republicans have not decided on a replacement plan, instead opting for a “repeal and delay” strategy. But the market may force their hand. Once the ACA is repealed, health insurers will be playing a game of chicken, each waiting for the first major insurer to either greatly scale back their participation in the marketplace or to withdraw completely. And once this happens, a stampede for the exit will probably start. Congress has also floated the idea of greatly changing Medicare and Medicaid. Should all three events occur next year, the U.S. could experience one of the most radical changes to health-care policy since LBJ's passage of the Great Society in the 1960s. The combination of these potential changes explains why health care ETF XLV is one of the worst-performing ETFs post-election.

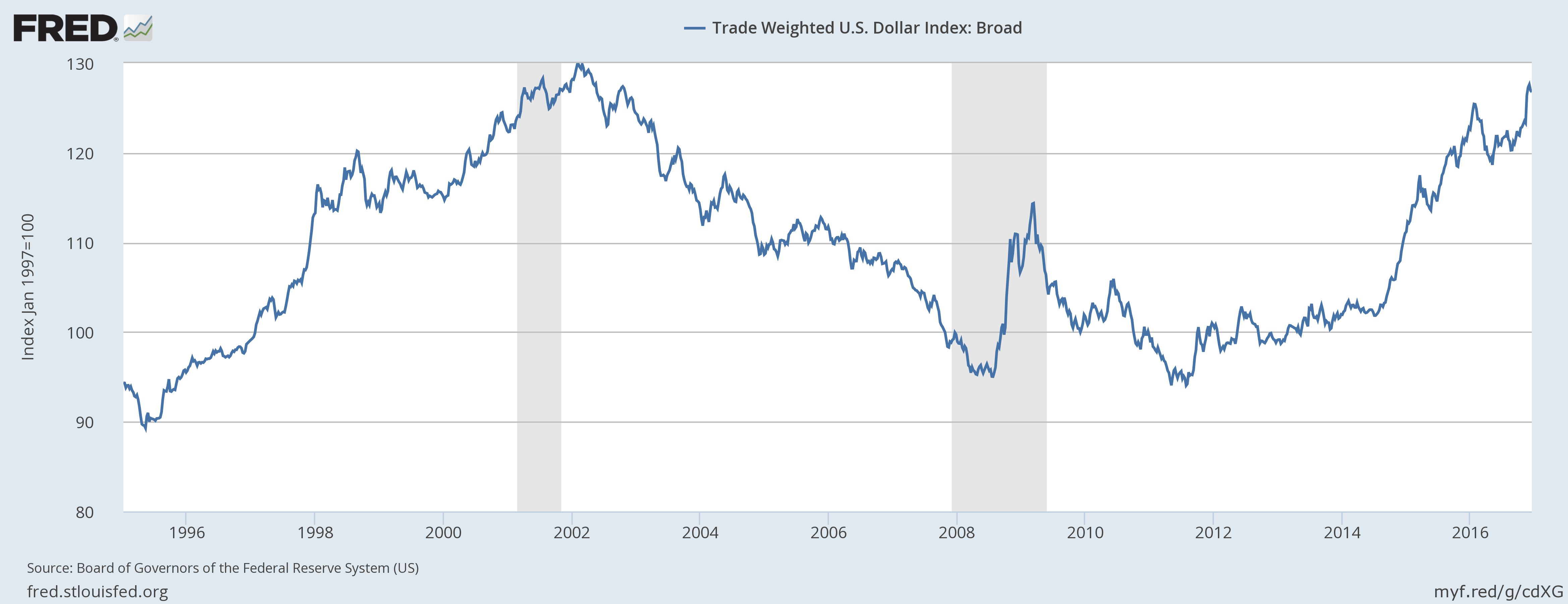

The Dollar

The trade-weighted dollar is currently trading near 20-year highs.

The Fed is the most aggressive developed world central bank regarding interest rate policy and the US economy is currently the best-performing developed market economy. Both facts support the dollar's current level. Should the dollar remain strong, large multi-national companies will face international headwinds that will slow revenue growth. Additionally, exports will also face a challenging environment, potentially slowing GDP growth.

Rising Interest Rates Lead To Housing Slowdown

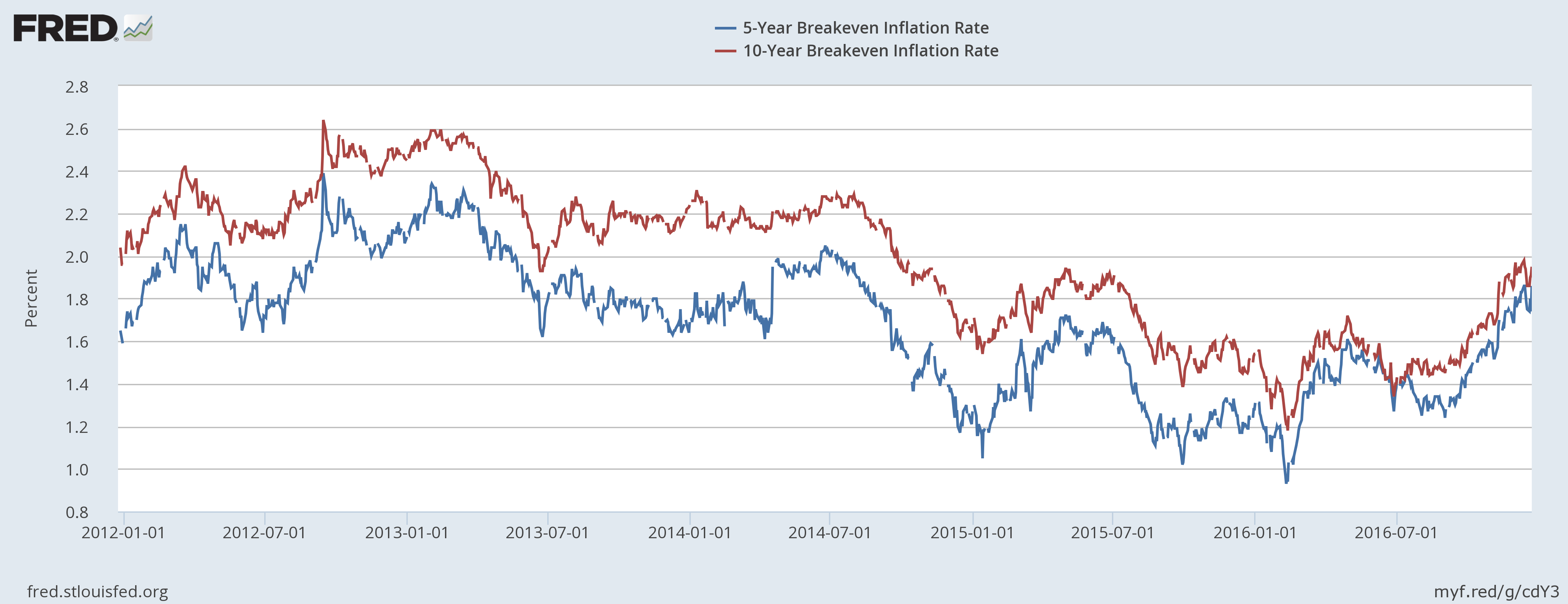

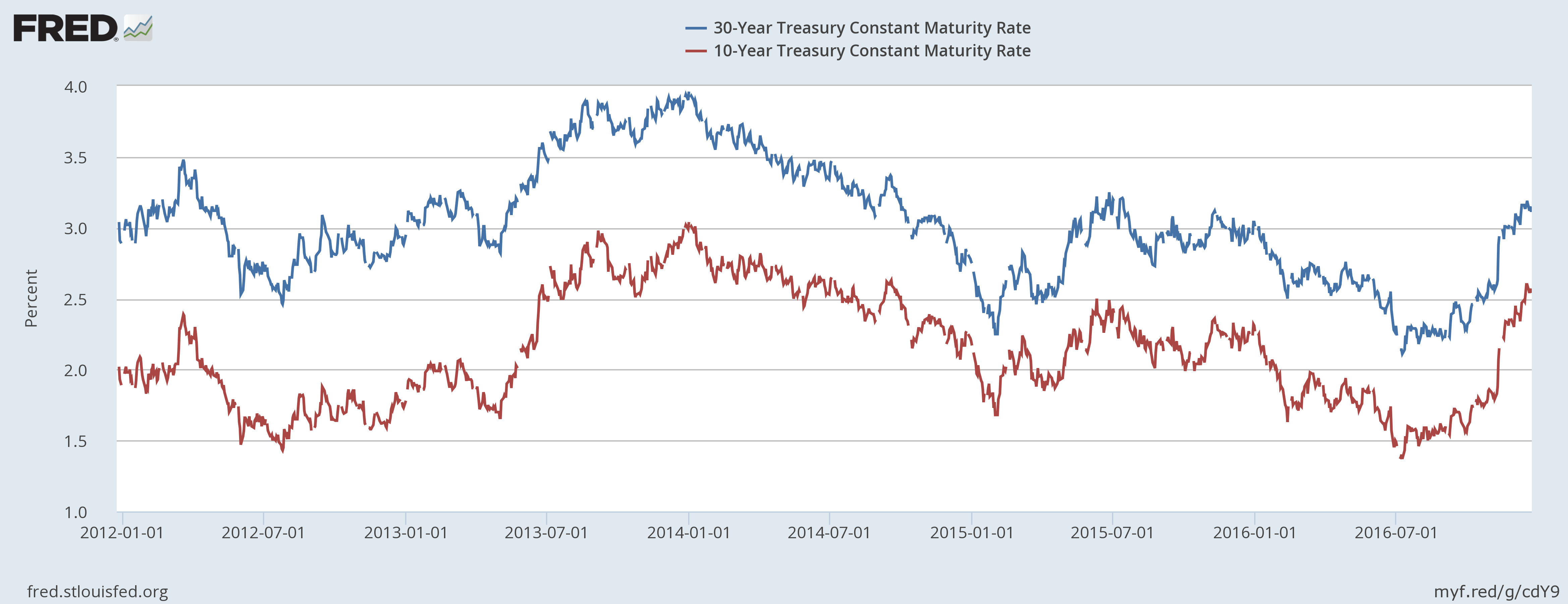

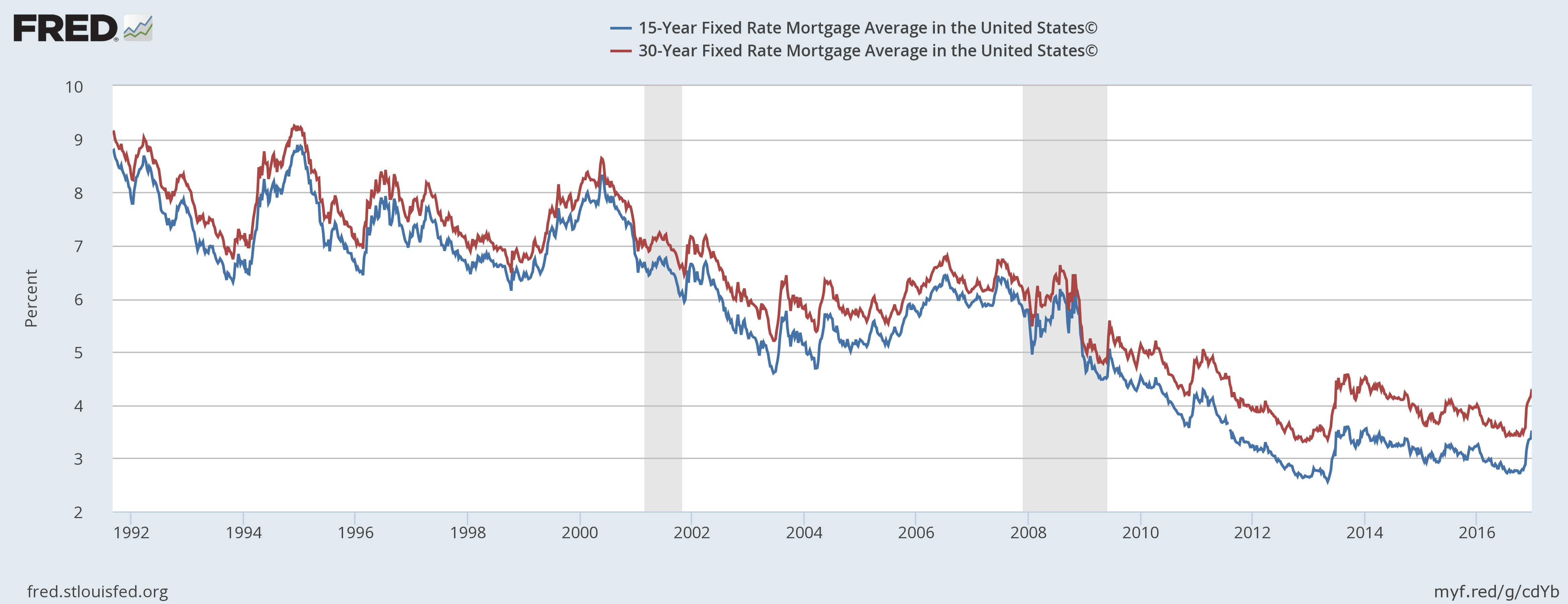

Housing has been one of the least-reported economic bright spots since the recession ended. But Trump’s victory has increased inflation expectations as investors see the combination of increased infrastructure spending and tax cuts as inflationary. This has increased Treasury rates, which in turn has increased 15-20-year mortgage rates. The following charts illustrate:

The top chart shows the 5- and 10-year breakeven inflation rate. Both increased over 40 basis points since the end of the summer. As a result, interest rates increased, leading to higher 10- and 30-year CMT treasury rates (middle chart). This has translated into large jumps in the 15- and 30-year mortgage rates (bottom chart). Unfortunately, there is no economic rule of thumb that says, “For every...increase in mortgage rates, housing sales will fall ...” However, basic supply and demand states that an increase in cost will lower demand.

There is no guarantee any of this will happen. However, I think the most likely event occurring is the impact of rising rates on the housing market; indeed, it's already happening. And the negative shocks to the health-care sector are more or less a foregone conclusion as well. The other risks are less likely.