Lately, I’ve been fielding a great many questions related to automobile companies. Had I seen the 5-year highs on car purchases? Am I aware that autos were the strongest segment in 2012 retail? And what’s the best ETF for capturing the inevitable growth?

In truth, I’m not necessarily convinced that the U.S. auto sector will continue along the same robust path. Government backing and a commitment to fuel efficiency may have brought Ford and GM back into play. Yet it is the inexpensive financing that deserves the lion’s share of credit in an auto recovery.

Keep in mind, as early as the 2nd half of 2013, the Federal Reserve may outline its exit plans from unconventional easing. Even if the Fed does not begin to raise rates — even if the cessation of bond-buying is a year or more away, markets may begin to factor in a slowdown in consumer activity.

Perhaps fortunately, the First Trust’s Global Auto Index Fund (CARZ) is truly global. The fund tracks an index of 35 manufacturers, with 37% exposure to Japanese corporations, 17% to U.S. companies and to 16% German manufacturers.

At present, this exchange-traded vehicle is severely overbought and ripe for a pullback. It is 20% above its 200-day moving average. (Double-digit percentages are bad enough.) Meanwhile, the Relative Strength Index (RSI) readings on the current CARZ price is also flashing high beam warnings.

The 0.70% expense ratio on CARZ also makes me cringe. I rarely consider ETF investments that grab more than 0.5%, and there are times when I am reluctant about anything above the iShares/Vanguard/State Street norms. On the other hand, CARZ sports a price-to-book of 1.16 and a price-to-sales of 0.35. There’s nothing particularly expensive about that.

At the very least, I would wait for a pullback to the 50-day moving average before committing new money. Believe me, a patient investor will wait for an 8%-10% sell-off.

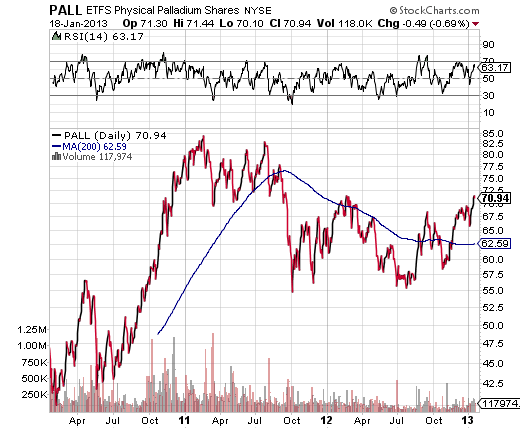

Additionally, one may wish to play autos from an entirely different angle. One might consider ETFS Physical Palladium (PALL).

Autos require palladium for catalytic converters. Many analysts maintain that palladium demand is so strongly related to the cyclical nature of auto sales, one cannot even separate the two.

In reality, palladium is in a wide variety of consumer products, including computers, cell phones and jewelry. It follows that PALL may be a means by which one invests in increasing materials demand for improvements in the global economy at large.

It may be interesting for folks to note, PALL would have to rise 20% to revisit its 2011 highs. In many ways, the multi-faceted industrial metal is in a similar situation to some emerging market investments.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Potential Increases In Demand For Cars And Cell Phones? ETFs To Watch

Published 01/20/2013, 12:45 AM

Updated 03/09/2019, 08:30 AM

Potential Increases In Demand For Cars And Cell Phones? ETFs To Watch

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.