Shares of pharmaceutical giant Johnson & Johnson (NYSE:JNJ) are slightly higher, last seen up 0.1% at $136.16. Traders are gearing up for first-quarter earnings, which are slated for before the market opens, tomorrow, April 16. Below we will take a look at how JNJ has been faring on the charts, and see what the options market is pricing in for its post-earnings moves.

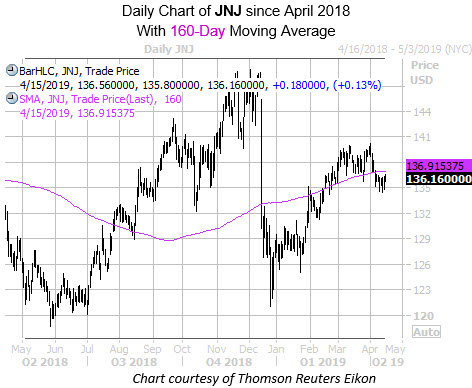

Johnson & Johnson stock has been moving higher his calendar year, and despite its late-December pullback, has rallied to or above the historically support $135 mark. While the 160-day moving average has been a line of resistance for the shares since its late-2018 dip, it also has performed as support in the past -- as recently as mid-August. Year-to-date, JNJ is up 5%.

Moving onto JNJ's earnings history, the blue-chip has closed higher the day after reporting in half of its past eight earnings, including a 3.5% surge last July. Over the past two years, the shares have swung an average of 2.6% the day after earnings, regardless of direction. This time around, the options market is pricing in a nearly double, 4.6% swing for tomorrow's trading.

Digging deeper, the security's Schaeffer’s put/call open interest ratio (SOIR) of 1.20 sits in the 89th percentile of its annual range. In other words, this suggests a larger-than-usual put-skew among near-term options traders. Analyst attention also remains bearish, setting up potential post-earnings bull notes.