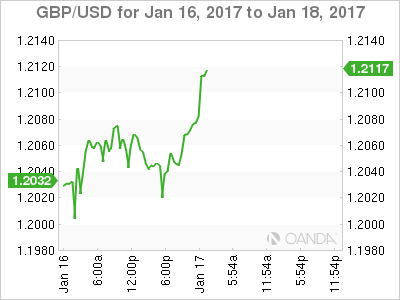

The British Pound

The pound remains center stage, but after yesterday’s early APAC mayhem, predictably the remainder of Monday ‘s trading session was subdued. Moreover, outside of a quick look below 1.2000 at the London open, trader’s were content to peruse the UK print editorials that were full of so-called leaks of what the UK prime minister will be saying in her Brexit speech tonight. Cable upside was capped at 1.2080 overnight as the overriding theme remained that UK PM Theresa May would push for a “hard Brexit”,

The pound is facing an uphill battle. However, PM May’s speech may keep the Equity Bears at bay if she can deliver a clear and decisive post-Brexit roadmap in a forthright manner, as for the Forex markets, May’s focus on immigration while giving up single market access could be the dagger and harbinger for a move to 1.1800.

In the absence of US fixed income due to the US holiday, other currency pairs were relatively quiet while contending with a touch of predictable risk aversion due to the weekend UK headlines.

Despite the muted start, we could be in for ruckus of a week for the big dollar. In addition to May’s speech, investors will need to navigate a plethora of Fed speaks before the highly anticipated President-elect Trump’s inauguration. Also, Davos will provide ample headlines and let’s not forget the ECB which could surprise.

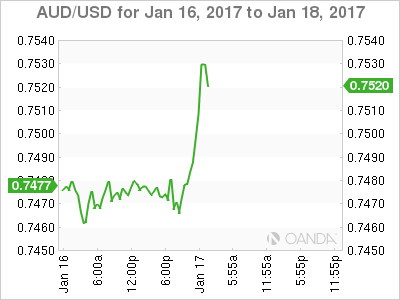

The Australian Dollar

It was a relatively quiet session as the Aussie was weighted down by a minor bout of risk aversion. However, the Aussie has remained well supported on dips near .7460 so far. However, the technical resistance .7525 nemesis level continues to rebuff, suggesting that it will take a bit more than rallying iron ore prices to crack that nut. While I suspect we are topping out at levels above .7500, the constructive price action on the back of iron ore prices should suggest that perhaps the Aussie short trade is not the best currency to express a supportive USD bias.

Positioning feels very neutral, and I suspect dealers will continue to trade the fringes of the technical support levels until clearer USD signals emerge.

On the commodity front, and while getting a bit ahead on the calendar, Friday China’s Q4 GDP should offer some insight into Mainland economic activity and could either validate or contradict the current commodity price action.

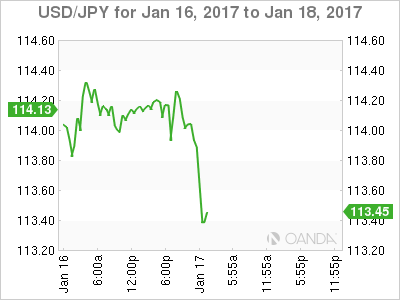

The Japanese Yen

USDJPY continues to trade with a “ heavy” bias, and in the absence of USD Fixed Income overnight, the JPY was driven on the back of risk aversion as outsized movement on GBPJPY was the primary driver. There has been less focus on the USDJPY pair after last week's hefty position clear out; nonetheless USDJPY remains strongly correlated to US fixed income.

I suspect we are at a bit of an inflection point on USDJPY, as the market is starved for definitive signals to emerge on the reflationary trade.

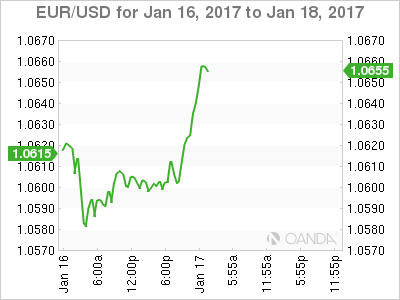

Euro and the ECB

The euro is feeling the weight of the yesterday’s sterling crunch.

However, like JPY, EUR moves are very correlated to US interest rate curve. However, until a clearer snapshot emerges on US fixed income we are likely to remain in tight ranges.

This week’s ECB will be the primary focus for euro traders.I am always in expecting the unexpected mode when it comes to the ECB decisions. However, there’s unlikely to be any significant policy change that will cause investor panic nor the euro to rocket higher.

Keep in mind the recent EUR strength is more about the broader USD correction rather than any positivity in Europe. While there’s evidence of an improving macro environment, I suspect Draghi will emphasise high levels of Global uncertainty. Also, Draghi will likely downplay the oil-induced inflationary uptick and focus on political risks in 2017. IN my view, the ECB decision will be uneventful and expect the longer-term euro shorts to remain intact but we may see some of the weaker short term specs trim ahead of the announcement. Overall there’s a strong political argument to maintain easy monetary policy in Europe

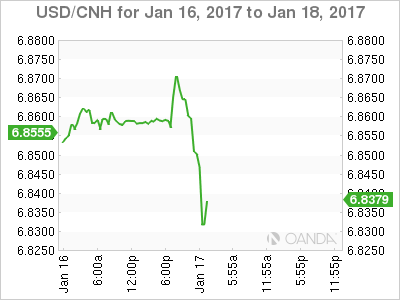

The Offshore Yuan

The Mainland economic woes argument remains a convincing factor which points to further yuan depreciation. However, the PBOC’s iron-fisted control and manipulation of offshore CNH funding conditions, and the grip likely to become unyielding to control capital outflows might keep any slips in check. Traders unsure of either the carry or funding cost continue to add an unwanted level of confusion as well. While the PBOC are expected to add cash ahead of the anticipated Lunar New cash crunch, dealers are still cautious about the PBOC overall offshore FX policy.

The Malaysian Ringgit

The air of caution is permeating in the region as President-elect Donald Trump’s inauguration nears. Also, local currency dealers are paying careful attention to Fed-speak this week for any policy hints as rising US interest rates, and a stronger dollar will counter any positivity from firming oil prices.

I maintain we are in a cooling-off period in the global market as the USD consolidates on the back of a USD fixed income reprieve. However, the Macro conditions remain intact. While I expect USD strength to re-emerge, it could be more gradual vs.regional EM markets that we saw post-election tantrum. However, I remain very cautious about the Local EM trade as I expect to see further interest divergence across EM as re-pricing resumes.