Shares of Celgene Corporation (NASDAQ:CELG) declined after the company announced that a phase III trial, REVOLVE, (CD-002) on pipeline candidate GED-0301 in Crohn’s disease and the extension trial, SUSTAIN (CD-004) will be discontinued.

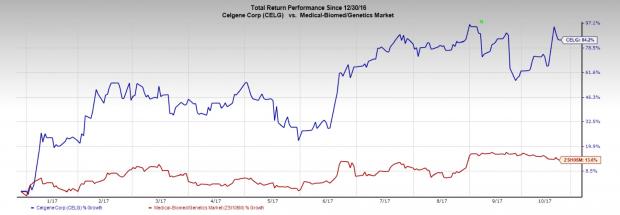

Celgene’s stock has moved up 84.2% year to date compared with the industry’s gain of 13.6%.

The decision to discontinue the trial comes following a recommendation from the Data Monitoring Committee, which assessed overall benefit/risk during a recent interim futility analysis.

Consequently, the phase III trial, DEFINE (CD-003) for Crohn’s Disease will not be initiated. Meanwhile, Celgene is waiting to review the full dataset from the phase II trial in ulcerative colitis to determine next steps.

The news comes as a disappointment as the candidate was in late stage of development. Celgene’s Inflammatory Bowel Disease Portfolio currently consists of ozanimod (phase III) and Otezla (phase II ongoing for UC; pending positive results, a phase III trial will be initiated in 2018).

Otezla is approved for patients suffering from moderate to severe plaque psoriasis who are candidates for phototherapy or systemic therapy. The drug is also approved for the treatment of adult patients with active psoriatic arthritis.

Celgene is currently working on label expansion of drugs like Pomalyst/Imnovid, Abraxane and Otezla, among others. Meanwhile, Celgene’s Revlimid continued to outperform driven by further market share increases in newly diagnosed myeloma and the continued increase in treatment duration. The recent approval of Idhifa in the United States for relapsed and/or refractory acute myeloid leukemia has further boosted the company’s portfolio.

However, Celgene is highly dependent on Revlimid, while foreign exchange headwinds are expected to continue while Abraxane sales are under competitive pressure.

Last month, Celgene aannounced that the FDA put a hold on several trials in the FUSION program. Partial clinical hold has been put on five trials and a full clinical hold on one trial.

The trials are evaluating Imfinzi, an anti-PD-L1 antibody, in combination with immunomodulatory and chemotherapy agents in blood cancers such as multiple myeloma, chronic lymphocytic leukemia and lymphoma. Celgene entered into a strategic collaboration with AstraZeneca PLC's (NYSE:AZN) MedImmune in April 2015 to develop and commercialize Imfinzi for hematologic malignancies in combination with Revlimid, Pomalyst, Vidaza and others.

The FDA had placed a hold on these trials due to risks identified in other trials for an anti-PD-1 antibody, Merck & Co.’s (NYSE:MRK) Keytruda, in patients with multiple myeloma in combination with immunomodulatory agents.

Zacks Rank & Key Pick

Celgene currently carries a Zacks Rank #3 (Hold).

A better-ranked stock in the healthcare sector is Aduro Biotech, Inc. (NASDAQ:ADRO) which currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Aduro Biotech’s loss per share estimates narrowed from $1.44 to $1.32 for 2017 and from $1.33 to $1.24 for 2018 over the last 30 days. The company has topped estimates in two of the trailing four quarters with an average of 2.53%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius. Click for details >>

Astrazeneca PLC (LON:AZN): Free Stock Analysis Report

Merck & Company, Inc. (MRK): Free Stock Analysis Report

Celgene Corporation (CELG): Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

Original post

Zacks Investment Research