Good day traders!

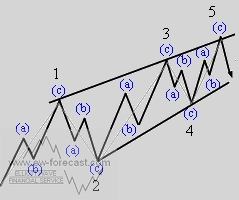

Gold still looking for a top and a possible sharp three-wave corrective retracement, as we are observing an Elliott wave ending diagonal pattern within sub-wave v) of five. Upside for gold can be seen around the 1270 region, where Fibonacci projection projects a temporary top. A reversal and later break below the 1263 level would suggest a three-wave retracement towards the 1252 level.

Gold, 1h

An ending diagonal is a special type of pattern that occurs at times when the preceding move has gone too far too fast, as Elliott put it. A very small percentage of ending diagonals appear in the C wave position of A-B- C formations. In double or triple threes, they appear only as the final “C” wave. In all cases, they are found at the termination points of larger patterns, indicating exhaustion of the larger movement.

- structure is 3-3-3-3-3

- a wedge shape within two converging lines

- wave 4 must trade into a territory of a wave 1

- appears primarily in the fifth wave position, in the C wave position of A-B- C and in double or triple threes as the final “C” wave

Elliott wave ending diagonal:

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All our work is for educational purposes only.