“Go where there’s growth.”

It’s a mantra so simple that even novice investors immediately understand it.

Why? Because it makes perfect sense that companies operating in growing markets and increasing sales and profits can’t help but see their share prices rise.

I mean, why else does a company go into business? To grow, grow and grow some more!

So where’s the growth today? The answer might surprise you. But don’t let that keep you from scooping up the profits…

No One Will Believe It…

We’ve been told time and time again that emerging markets are home to the fastest growth rates in the world.

What people say doesn’t always jive with reality, however.

“Although it might be hard to believe, the U.S. and the developed markets are where the growth is,” according to Richard Bernstein of Richard Bernstein Advisors.

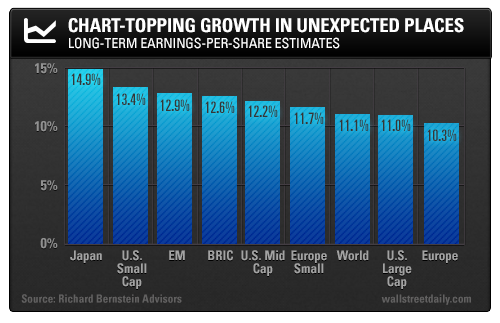

Sure enough, if we dig into the data, long-term earnings growth projections for Japanese stocks and U.S. small caps top the list.

Shocking, I know. But it’s nonetheless true.

Even if we evaluate growth prospects over the short run (i.e., the next 12 months), Japan and U.S. small caps still come in first and second place, respectively.

Now you understand why we’ve been banging the drum for so long on Japan and U.S. small caps.

Along the way, we’ve shared numerous specific investment opportunities.

In Japan, for instance, we offered up the WisdomTree Japan Hedged Equity Fund (DXJ). You’ll recall, it provides a hedge against currency valuations, while investing in some of the largest dividend-paying Japanese stocks. It’s up 20% over the last year and remains an attractive, low-cost and safe way to bet on a resurgent Japan.

My favorite play in Japan, however, remains the Japan Smaller Capitalization Fund (JOF). The closed-end fund invests in 146 small-cap Japanese companies. They represent the cheapest stocks in the country, as well as the ones with the most growth potential. Best of all, the fund currently trades at a 10% discount to NAV, which makes it an even more compelling bargain.

On the Domestic Front

When it comes to U.S. small-cap opportunities, a bevy of factors contribute to the rosy expectations. Like lower energy costs, increasing productivity, superior quality control and political stability, according to Bernstein.

He’s particularly fond of U.S. small-cap banks, thanks to much stronger balance sheets than their larger-cap brethren. While I don’t disagree with his assessment, I’m most optimistic about technology stocks. (For a quick refresher explaining why, go here.)

With that in mind, in November I brought 3-D scanning leader, FARO Technologies, Inc. (FARO), to your attention. And the company definitely fits the “growth” bill.

Sales and new order bookings increased 11% and 20%, respectively, in the most recent quarter. That figure is more than double the sector’s average growth rate of 4.9% – and it stands head and shoulders above the S&P 500 Index average sales growth of 0.8%.

Not long ago, I also shared a compelling small-cap, cyber-security play with you – The KEYW Holding Corporation (KEYW).

It’s up a solid 12% since then, on heavier than average volume, too.

Could a takeover be in the works, like I predicted? Time will tell. Regardless, the stock possesses significant growth opportunities – and, most importantly, it remains grossly undervalued.

Of course, our WSD Insider portfolios are chock-full of other, equally compelling, small-cap opportunities. I’m getting ready to add another fast grower to this exclusive list, which is levered to one of the hottest trends in the market right now.

And it’s completely off Wall Street’s radar, which sets the stage for dramatic gains. If you’re already a WSD Insider, stay tuned. The issue should hit your inbox early next week.