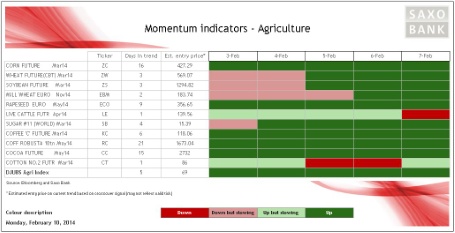

The agriculture sector, which was in a month-long downtrend up until the end of January, has seen a dramatic turnaround lately. The DJ-UBS agriculture index has rallied by 5.5 percent since the January 30 low, with gains seen across all the three sub sectors of grains, softs and livestock.

As a result, we have seen short-term momentum turning positive across the 11 major commodities covered in this, not least due to the recent weather developments in the US and especially Brazil, which has lent a helping hand to commodities such as soybeans, wheat, and especially coffee.

US government report on Monday may determine near-term outlook for key crops.

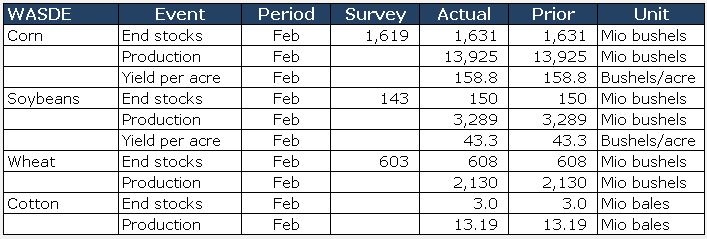

A supply and demand report from the US Department of Agriculture on Monday, February 10 at 17.00 GMT could help determine the near-term global outlook for the key crops of soybeans, corn and wheat. Some profit-taking has been seen in wheat over the past three sessions on the expectation that the report will raise global production even further on the back of bigger-than-expected harvests in Canada and Russia.

The soybeans sector, on the other hand, has been finding support and touched a seven-week high ahead of the report, in anticipation that the report will reduce the previous supply estimate from 150 million to 143 million bushels. Adding additional support is the continual worry about the Brazil soy crop for which rain is needed very soon to avoid a reduction in output.

Corn inventories are also expected to be lower from 1631 million bushels to 1619 million as exports has been running at healthy levels. Both crops could be exposed to some profit-taking if the report fails to live up to expectations, not least corn where the net-short for the past six months has almost been removed after strong buying over the past couple of weeks.