Free trade agreements keep the world competitive.

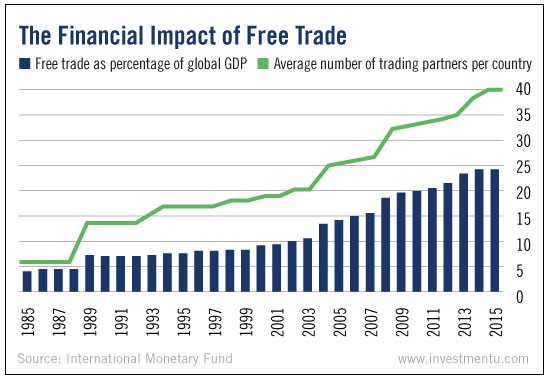

A level playing field increases economic growth. That’s a big reason why more and more countries have entered into these kinds of deals, as shown in today’s chart.

But the soon-to-be new leadership might threaten this trend. Trump wants to place tariffs on foreign-made goods. He’s even called NAFTA the worst trade deal ever approved.

With Inauguration Day getting closer, it’s important to prepare your portfolio.

Now, there’s no doubt that Trump’s tariffs will keep jobs here. But they’ll also put pressure on U.S. companies that manufacture abroad. And global companies will struggle even more if the tariffs spark trade wars.

That’s why we’re turning to companies that produce the majority of their goods in the U.S. They’ll continue operating unscathed. And they might even become more competitive. (After all, companies that outsource will need to raise their prices to cover the new tariff costs.)

Finding U.S. manufacturers that produce the majority of their goods in America is no easy task. But we’ve managed to uncover two great American stocks that fit the bill...

Two Made-in-America Stocks

The first made-in-America company is Whirlpool (NYSE: NYSE:WHR). Whirlpool is a leading producer of home appliances. Some of its brands include Maytag, Amana, Jenn-Air and KitchenAid.

Whirlpool has said about 80% of its appliances sold in the U.S. are made here. That’s a huge portion compared to its competitors.

It is worth noting that Whirlpool does generate a large portion of sales overseas. But the company has stayed committed to producing its U.S.-sold goods in America. New tariffs shouldn’t impact Whirlpool as much as its competitors.

Our second company is even larger than Whirlpool, but it’s less of a household name.

Nucor (NYSE: NYSE:NUE) operates and sells steel products in North America. It builds reinforcing steel for cement and other materials. The business sells steel mesh, grating, fasteners and many other products.

Nucor is a U.S. company that will benefit if Trump’s trade deals come to fruition. The talk of increased infrastructure spending is also a plus.

These two companies should prosper under the new regime. Ending or changing the free trade agreement will benefit made-in-America companies in the short term.

So take a look at your portfolio today. How vulnerable are your holdings to Trump’s trade tariffs?