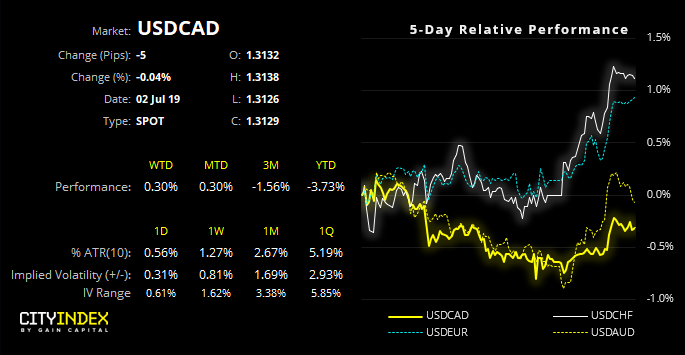

Whilst we retain our core bearish view, a few indications point towards a corrective bounce before the dominant trend resumes.

As we noted in our weekly COT report, net-short exposure on CAD futures was reduced by -23.3k contracts and gross shorts were closed at their fastest rate since July 2017. And this is after traders spent most of the year so far subtly reducing short exposure. As the USD is retreating from highs after net-long exposure hit relatively high levels which, we retain our core view that the tide on USD/CAD is indeed turning in favour of the bear-camp. However, over the near-term the technicals favour a corrective bounce before losses resume.