Forex News and Events:

No surprise: the peripheral risks are nothing new. The recent rush into Euro-zone’s peripheral stocks and bonds went well beyond the rational. The significant narrowing in yield spreads between core and periphery bonds was alarming, yet the additional ECB stimulus successfully distorted the risk sentiment in EZ bond markets. Over the past months, the 10-year yield spreads between Spanish/Portugal 10 vs. Germany fell to their lowest levels in more than four years, the Italian 10-year-Germany spread hit three-year lows. The risk premiums were and are still mispriced; besides the ECB stimulus we see no meaningful reason to favor peripheral debt over the core. The yield spreads are not proportionate to relative sovereign risks, any negative news thus generates panic across the entire Euro-zone due to fragility of the financial situation. Unfortunately for Portugal, the Espirito Santo Bank has been the first to come under the spotlight, yet the majority of peripheral countries face similar concerns vis-à-vis their banks.

Today, investors’ cheap-liquidity appetite curb as these insolvency risks materialize. This is bad news for victims of their appetite, yet good news for rationality. Interestingly, the Fed minutes released on Wednesday highlighted US policy makers’ concerns about the inconsistent risk appetite and they were right. However we do not think that this situation is ready to change yet.

Portugal situation: a game changer for the ECB?

Now we are at a critical point. There are two possible scenarios ahead of us: 1. The Portugal situation will either gain traction to increase the contagion risk across the periphery or, 2. this whole story will end up in a non-event and the core-periphery spreads will continue underpinning liquidity in the EZ. In this respect, we highlight that Espirito Santo Bank is not big enough to generate a systemic risk, yet large enough to trigger a contagion. At the time we write these lines, the European sentiment seems under control signaling that the Portugal situation will perhaps have limited overall impact on markets. Why would investors turn their back to the ongoing profitable cheap liquidity situation.

There is no doubt, the easy money is not only good for investors. The narrowing spreads in the Euro-area has also been encouraging in the sense that the peripheral countries could also benefit from cheap financing to fuel their economic recovery. This is the only way to reduce fragmentation in the heart of the EZ and the ECB has no choice but to make this happen. If the Portugal situation becomes contagious, the ECB will be brought to reconsider a broad based asset purchases program to ease the tensions.

EUR remains range-bound

The sell-off in European bonds pulled EUR/USD down to 1.3589 as soon as Portugal news spilled over the markets, yet the price action has not been dramatic. Technically, June-July uptrend channel rotated down, EUR/USD nears 1.3595/1.3734 range bottom, technical indicators wait for fresh direction. We see limited upside today given the uncertainties will continue weighing on the entire EUR-complex. A week close below 1.3576/80 (Jul 7 low / MACD pivot) should further decrease the short-term appetite in EUR/USD, otherwise the bias in EUR/USD will remain on the topside.

EUR/GBP consolidates losses below the 21-dma (0.79756). The corrective phase will come at risk for a close below 0.79375 (intraday low). Large option expiries should keep the upside limited at 0.79500/0.80000.

EUR/CHF will most probably close the week with failed attempt to reverse the short-term dynamics to positive. Offers at 21-dma (today at 1.21607) capped the upside solidly. Technicals are flat; the MACD will remain positively biased for a daily close above 1.21415. At this stage, EUR/CHF direction is contingent on global EUR sentiment. The negative correlation between EUR/USD and EUR/CHF intensifies (40-day correlation shifts to -25/30%), a EUR recovery versus USD rises the downside risk against the franc.

Today's Key Issues (time in GMT):

2014-07-11T12:30:00 CAD Jun Unemployment Rate, exp 7.00%, last 7.00%2014-07-11T12:30:00 CAD Jun Net Change in Employment, exp 20.0K, last 25.8K

2014-07-11T12:30:00 CAD Jun Full Time Employment Change, last -29.1

2014-07-11T12:30:00 CAD Jun Part Time Employment Change, last 54.9

2014-07-11T12:30:00 CAD Jun Participation Rate, last 66.1

2014-07-11T18:00:00 USD Jun Monthly Budget Statement, exp $79.5B

The Risk Today:

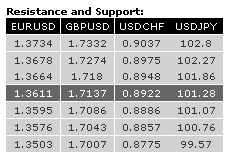

EUR/USD

EUR/USD declined sharply yesterday, completely erasing Wednesday's gains. A further decline towards the support at 1.3503 is favoured as long as prices remain below the resistance at 1.3664 (03/07/2014 high). An hourly support stands at 1.3576. In the longer term, the break of the long-term rising wedge (see also the support at 1.3673) indicates a clear deterioration of the technical structure. A long-term downside risk at 1.3379 (implied by the double-top formation) is favoured as long as prices remain below the resistance at 1.3775. Key supports can be found at 1.3477 (03/02/2014 low) and 1.3296 (07/11/2013 low).

GBP/USD

GBP/USD is consolidating near the top of its rising channel. The mild price correction thus far suggests persistent buying interest. Monitor the hourly support at 1.7086 and the hourly resistance at 1.7180 (04/07/2014 high). Another support can be found at 1.7007 (27/06/2014 low). In the longer term, the break of the major resistance at 1.7043 (05/08/2009 high) calls for further strength. Resistances can be found at 1.7332 (see the 50% retracement of the 2008 decline) and 1.7447 (11/09/2008 low). A support lies at 1.6923 (18/06/2014 low).

USD/JPY

USD/JPY has broken the support at 101.24, confirming a short-term weak technical structure. However, a key support stands at 100.76. Hourly resistances can now be found at 101.45 (09/07/2014 low) and 101.86 (09/07/2014 high). A long-term bullish bias is favoured as long as the key support 99.57 (19/11/2013 low) holds. However, a break to the upside out of the current consolidation phase between 100.76 (04/02/2014 low) and 103.02 is needed to resume the underlying bullish trend. A major resistance stands at 110.66 (15/08/2008 high).

USD/CHF

USD/CHF continues to move within its declining channel. An hourly support lies at 0.8886 (intraday low). Hourly resistances are given by the declining channel (around 0.8948) and 0.8975. Another support stands at 0.8857. From a longer term perspective, the bullish breakout of the key resistance at 0.8953 suggests the end of the large corrective phase that started in July 2012. The long-term upside potential implied by the double-bottom formation is 0.9207. A key resistance stands at 0.9156 (21/01/2014 high).