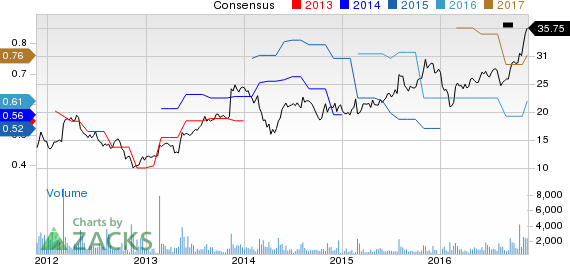

Share price of Pegasystems Inc. (NASDAQ:PEGA) rallied to a new 52-week high of $35.85, eventually closing a tad bit lower at $35.75 on Nov 18. This represents a strong year-to-date return of approximately 30%, better than the S&P 500’s 6.8% in the same period.

Currently, Pegasystems carries a Zacks Rank #2 (Buy). Notably, the stock has a market cap of $2.67 billion.

Key Factors

Pegasystems reported third-quarter 2016 earnings of 7 cents per share and revenues of $183 million, which were in line with the Zacks Consensus Estimates. We note that the company has beaten the Zacks Consensus Estimates in all the four trailing quarters, with an average surprise of 20.93%.

Revenues increased 13% year over year, driven by expanding customer base. Moreover, license and cloud revenues jumped 17% and 32%, respectively. Recurring revenues grew 19% from the year-ago quarter.

Pegasystems continue to anticipate that its business will shift away from perpetual license toward recurring license revenue streams. Although this transition will impact license mix, it will improve visibility and generate higher recurring cash flow. Further, the company expects consulting business to grow at high-single to low-double digits going ahead.

Pegasystems exited the third-quarter with $420 million of total license and cloud backlog, which grew $27 million sequentially and $40 million on a year-over-year basis.

Estimate Revisions

The Zacks Consensus Estimate for full-year 2016 has increased by a nickel to 61 cents in the last 30 days. Over the same time frame, full-year 2017 earnings estimate has increased 3 cents to 76 cents per share.

Key Sector Picks

Better-ranked stocks in the broader technology sector include Konami Holdings (OTC:KNMCY) , Rosetta Stone (NYSE:RST) and Stamps.com (NASDAQ:STMP) . All the three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Current year earnings estimate for Konami have increased 14.4% (20 cents) to $1.59 in the last 30 days.

Similarly, Stamps.com estimate have surged a massive 19.8% ($1.08) to $6.53 in the same time frame.

Rosetta Stone’s loss estimate has narrowed down by 32 cents to $1.62 per share at the same time.

Zacks’ Best Private Investment Ideas

In addition to the recommendations that are available to the public on our website, how would you like to follow all Zacks' private buys and sells in real time?

Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors. Starting today, for the next month, you can have unrestricted access. Click here for Zacks' private trades >>

STAMPS.COM INC (STMP): Free Stock Analysis Report

PEGASYSTEMS INC (PEGA): Free Stock Analysis Report

ROSETTA STONE (RST): Free Stock Analysis Report

KONAMI CORP-ADR (KNMCY): Free Stock Analysis Report

Original post

Zacks Investment Research