The swimming pool and lifestyle product maker, Pool Corporation (NASDAQ:POOL) , posted mixed second-quarter 2017 results, wherein the top line surpassed the Zacks Consensus Estimate while the bottom line lagged the same.

Notably, share price of the company plunged 9.4% in yesterday’s trading session following the release.

Quarter Discussion

Pool’s second-quarter earnings of $2.21 per share missed the Zacks Consensus Estimate of $2.24 by 1.3%. However, the figure rose 11.6% on a year-over-year basis.

Net sales came in at $988.2 million, marking an increase of 8% year over year. Sales growth in certain product categories reflects the ongoing recovery in the remodel and replacement sectors of its business as well as its consistent market share gains.

Continued growth in consumer discretionary spending also acted as a tailwind to the company’s top line. As a result, sales outpaced the Zacks Consensus Estimate of $982.7 million by 0.6%.

Behind the Headline Numbers

Pool reports operations under two segments – the Base Business segment (constituting majority portion of the business) and the Excluded segment (sale centers excluded from base business).

The Base business segment witnessed sales growth of 7% year over year on the back of increases in swimming pool repair and remodel activities, including major pool refurbishment and replacement of key pool equipment.

Meanwhile, the company’s gross margin in the second quarter was 29.3%, down 20 basis points (bps) year over year due to changes in customer and product mix. However, gross profit increased 7% year over year to a record $289.7 million, with base business gross profit increasing 6%.

Additionally, selling and administrative expenses (operating expenses) increased approximately 6% year over year to $135.5 million in the reported quarter, with base business operating expenses increasing 5%. The upside was primarily driven by seasonally higher growth-driven labor and freight expenses as well as higher employee-related insurance costs.

While the operating margin increased 10 bps year over year to 15.6%, operating income jumped $154.2 million, up 8% from the year-ago quarter.

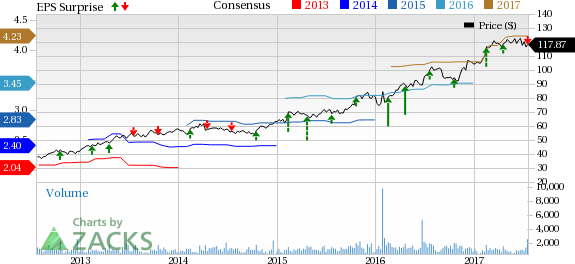

Pool Corporation Price, Consensus and EPS Surprise

Earnings Guidance for 2017

Pool reiterated its previously issued guidance for 2017 of earnings within the range of $4.12–$4.32 per share.

Zacks Rank & Peer Releases

Pool currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other stocks in the same industry, Polaris Industries Inc. (NYSE:PII) recently reported strong second-quarter 2017 results with both the bottom and the top line beating the Zacks Consensus Estimate.

Meanwhile, Brunswick Corporation (NYSE:BC) and West Marine, Inc. (NASDAQ:WMAR) are expected to release the quarterly numbers on Jul 27. The Zacks Consensus Estimate for the quarter’s EPS is pegged at $1.34 for Burnswick, and 89 cents for West Marine.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Pool Corporation (POOL): Free Stock Analysis Report

Brunswick Corporation (BC): Free Stock Analysis Report

Polaris Industries Inc. (PII): Free Stock Analysis Report

West Marine, Inc. (WMAR): Free Stock Analysis Report

Original post

Zacks Investment Research