These are strange days for the US government bond market. Inflation-indexed Treasuries are pricing in higher inflation expectations as real (inflation-adjusted) yields tumble. In “normal” times the consensus view would probably advise that one of these trends is misguided. But in the new world order of the coronavirus crisis it’s timely to ask: Could both of these market-implied forecasts be accurate or at least reasonable?

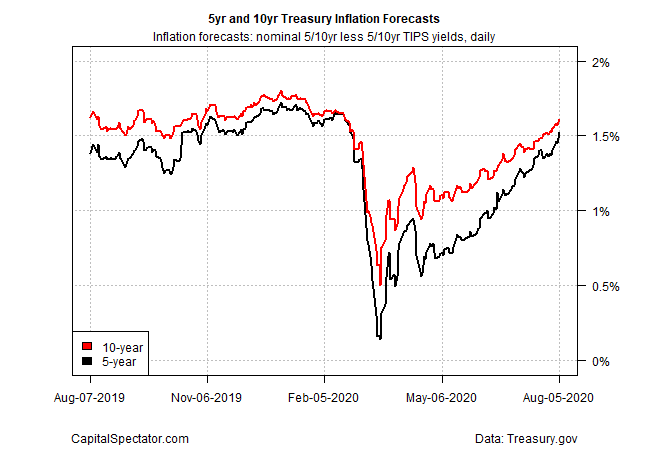

Before venturing a guess, let’s review the numbers, starting with the market’s inflation forecast, based on the yield spread for the nominal Treasury rate less its inflation-indexed counterpart. After falling sharply in March, when coronavirus risk was suddenly priced into the market for the first time, the Treasury market’s implied inflation forecast has been steadily rebounding since April.

The 10-year Treasury’s estimate for future inflation is currently 1.61%, based on daily data via Treasury.gov as of Aug. 5. That’s well above the previous low of 0.5% in March. A similar recovery describes recent activity for the 5-year maturities.

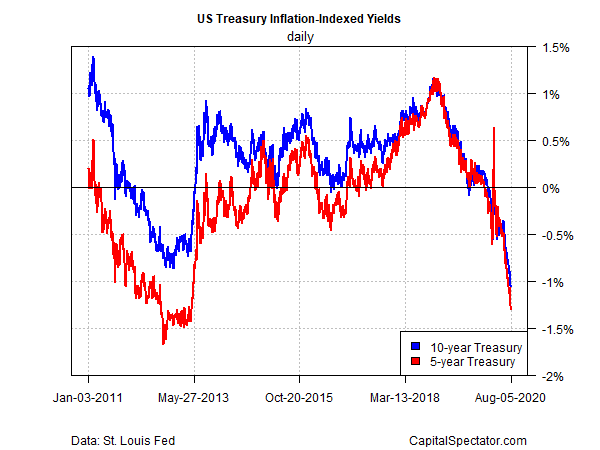

While the Treasury market has increasingly embraced a reflationary narrative, inflation-indexed government bonds have plumbed ever deeper levels of negative real yields. In recent days, the 10-Year TIPS yield, for instance, has fallen to record lows, settling at -1.06% yesterday (Aug. 5).

How can the Treasury market be anticipating firmer inflation and deeper real yields at the same time? Looking at each side of these trends separately suggests there’s a degree of economic logic driving the results.

For inflation, the crowd worries that unprecedented government stimulus, on both the monetary and fiscal fronts, will eventually raise inflation, perhaps substantially.

There’s also a view that the economic shock unleashed by the coronavirus will roll on until a proven vaccine is developed and widely distributed. This implies a disinflation if not deflationary bias for economic activity and a strong appetite for safe havens, including Treasuries. In turn, these trends will continue to drive bond prices up and yields down.

By some accounts there will be a shakeout eventually. After all, deflation and inflation can’t co-exist. True, but for the moment neither outcome can be dismissed, at least not entirely. That may account why real yields continue to fall deeper into negative terrain while reflationary pricing endures.

At some point one (or both) of these trends will flame out. Much depends on how the deflation and inflation numbers evolve in the months ahead, which in turn may be a function of expectations for the coronavirus.

Meantime, the demand for safety and an expectation for firmer inflation co-exist. If recent headlines are a guide, it’s not difficult to imagine that these two trends could persist for the foreseeable future. That may drive some observers batty, but Mr. Market answers only to himself in setting prices. The truly tough part is left to mere mortals: explaining the rationale.