We’ve seen a number of false dawns with anticipating rate hikes in recent years, but is the jig finally up this time? Friday’s surprisingly strong jobs report for May has reignited expectations that the Federal Reserve will soon start raising interest rates for the first time in nearly a decade. The day before the Labor Department released the bullish data the IMF asked the central bank to hold off on monetary tightening until next year. But the trends in key interest rates through last week’s close suggest that sooner rather than later is the new new mantra, again, when it comes to estimating the timing for a US rate hike.

“If the labor market continues to improve and inflation expectations remain well-anchored, then I would expect — in the absence of some dark cloud gathering over the growth outlook — to support a decision to begin normalizing monetary policy later this year,” said William C. Dudley, president of the Federal Reserve Bank of New York and a voting member of the Federal Open Market Committee within the Fed that oversees rate changes.

Although Dudley noted that “there remains some uncertainty about whether growth will be strong enough to lead to further improvement in the labor market,” the firming of Treasury yields through June 5 are a vote of confidence that the first round of policy tightening since 2006 is near.

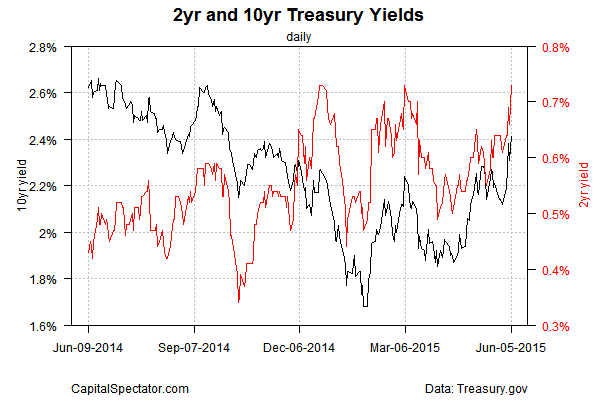

The benchmark 10-Year yield jumped ten basis points on Friday to 2.41%, based on Treasury.gov’s constant maturity data. That’s the highest rate in seven months. Meanwhile, the 2-year yield—the rate that’s considered to be the most sensitive to rate expectations—rose to 0.73% at last week’s close, which matches the year-to-date high reached in early March.

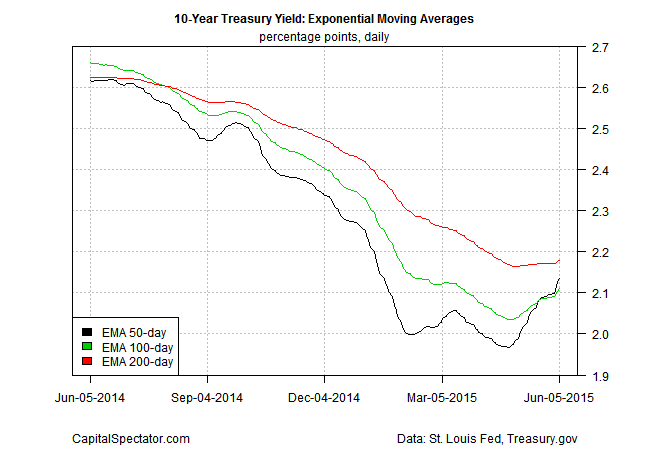

Upward momentum appears to be building when we look at various moving averages for yield. For instance, the 50-day exponential moving average (EMA) for the 10 Year Note climbed above its 100-day EMA last week for the first time in more than a year.

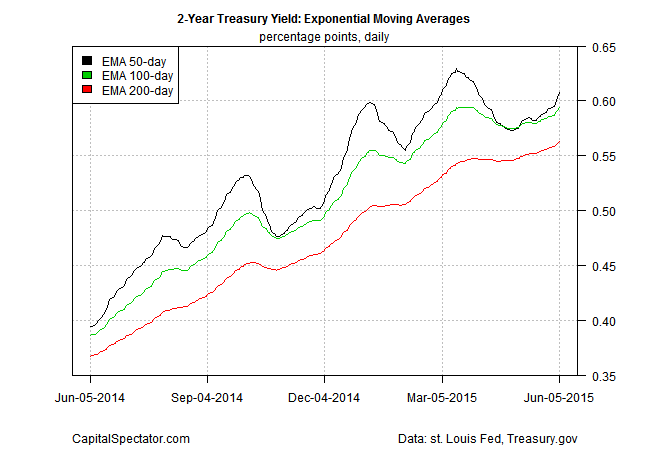

Meanwhile, the 50-day EMA for the 2-Year yield widened its spread over the 100-day EMA, which implies that this key rate will continue to rise in the days ahead.

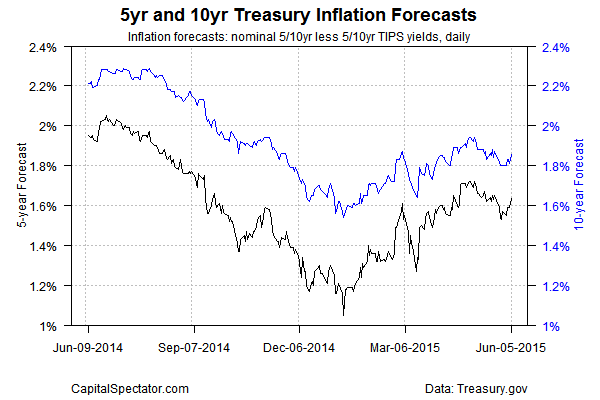

The Treasury market’s estimate of future inflation has also firmed lately. The forecast based on the spread between the nominal and inflation-indexed 10-year Notes, for instance, edged up to nearly 1.86% on Friday. Although that’s modestly below this year’s high of 1.94% in early May, the rising trend so far in 2015 is looking a bit stronger at the moment.

In theory, the Fed could raise rates at the FOMC meeting that’s scheduled for later this month (June 16-17), but that’s unlikely. Instead, this month’s confab may reveal hints on the timing. Meanwhile, the crowd’s considering if the September Fed meeting will deliver the first rate hike. Based on Fed funds futures, however, the crowd is still reluctant to make a strong bet on a rate hike for September. That could change, of course, if the economic numbers in the weeks ahead suggest that last week’s strong rise in payrolls in May wasn’t a fluke.