Polypore International, Inc. (PPO) is a global high technology filtration company that develops, manufactures and markets specialized microporous membranes used in separation and filtration processes.

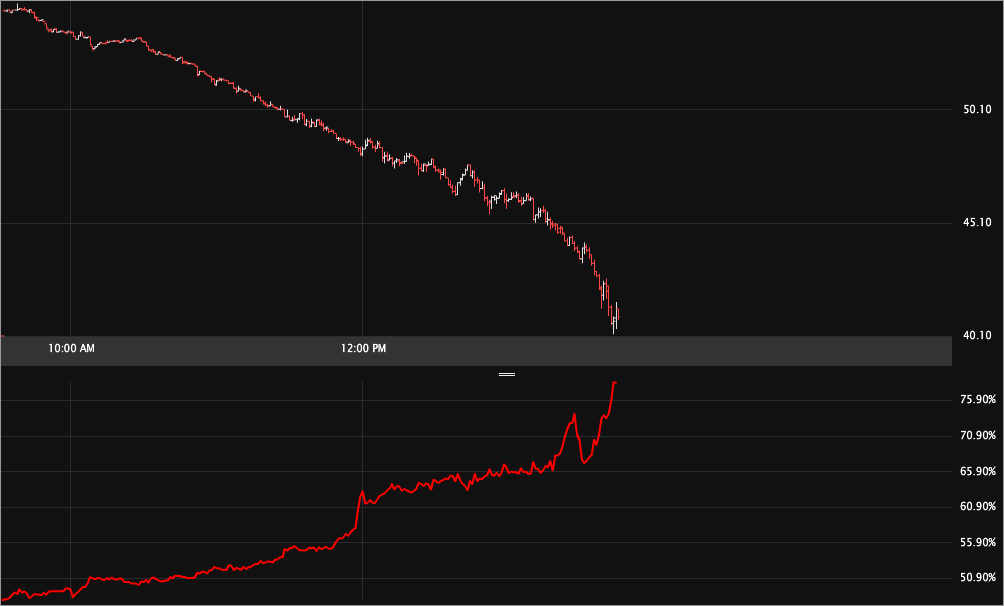

Let's start with the Tick Chart for PPO. The top portion is the stock price, the bottom is the front month vol -- these are one minute bars for yesterday only.

What's so interesting is that the stock has been steadily imploding (and the vol steadily exploding). That is, the stock didn't open down size, nor has it reacted to a bit of mid-market day news. It's just going down... and it's not stopping.

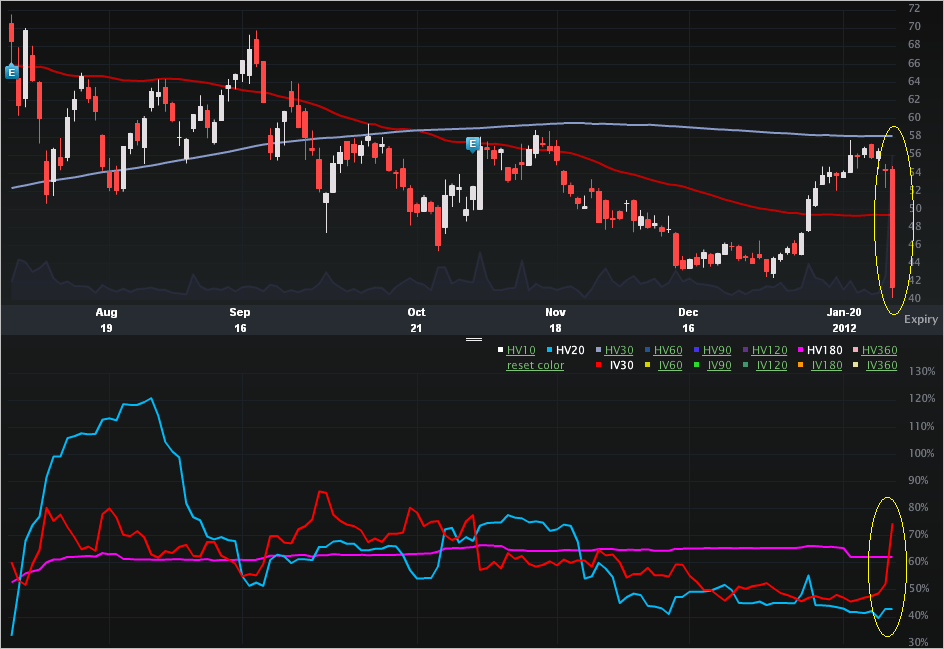

In terms of news, other than a downgrade well after most of the drop, I have no idea what's going on here. Let's turn to the Charts Tab (6 months), below. The top portion is the stock price, the bottom is the vol (IV30™ - red vs HV20™ - blue vs HV180™ - pink).

We can see the collapse yesterday in stock price and the vol pop in relative comparison to the past six months. The 52 wk range in PPO was [$42.43, $74.21] before today. So, in English, the stock has hit an annual low. The 52 wk range in IV30™ is [43.41%, 86.38%]. The current level sits in the 82nd percentile.

The fact that vol isn't well above an annual high essentially assures me that the news (whatever it is) is known. Otherwise I'd bet not only an annual high in vol, but perhaps a multiple of that high. Let's turn to the Skew Tab.

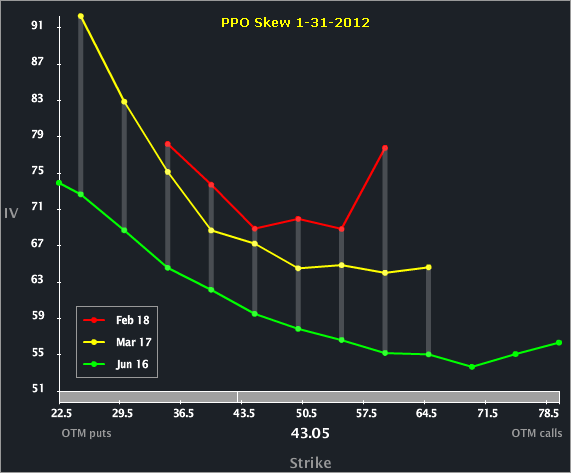

We can see a monotonic vol increase from the back to the front months with Feb showing a parabolic shape. That is, the front month reflects both upside and downside risk. Still, I would have expected the front to be considerably more elevated to the back if this was truly a "mystery." Or, said differently, this isn't a mystery to a lot of people.

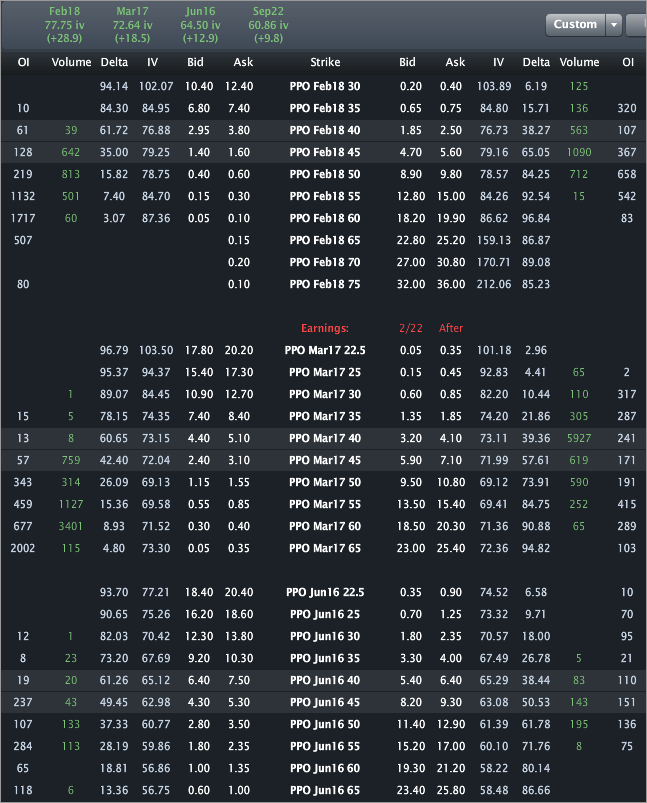

Finally, let's turn tot the Options Tab.

We can see the monthly vols are 77.75%, 72.645 and 64.50%, respectively, for Feb, Mar and Jun. The ATM Feb straddle is quoting at $4.80 x $6.30. The width of that market makes sense. Still, is ~$5.55 (mid-market) for the ATM straddle really expensive given the recent move? I dunno... Seems like it would be higher...

As I'm about to publish this article, the stock is trading down to $39.80 and IV30™ is 80.81%. The ATM straddle market has tightened to $5.85 x $6.40. Mid-market is now $6.125.

This is trade analysis, not a recommendation.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Polypore International: Why Is the Stock Collapsing and Vol Exploding Right Now?

Published 02/01/2012, 12:56 AM

Updated 07/09/2023, 06:31 AM

Polypore International: Why Is the Stock Collapsing and Vol Exploding Right Now?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.