The highly complementary £14m acquisition of Alderburgh expands Polypipe's (LON:PLP) stormwater management portfolio offering, adding design and installation capabilities also. The earnings impact is modest but this serves as a further strengthening of Polypipe’s market position in the relatively robust infrastructure segment. Once wider UK economic uncertainties clear, we expect increased support for Polypipe’s share price.

Enhancing the stormwater management portfolio

In its second deal in the last 12 months (following Manthorpe a year ago), Polypipe has acquired the Alderburgh Group, a well-established, Rochdale-based manufacturer of below ground water/stormwater management products. Alderburgh operates from a single 68,000 sq ft injection moulding manufacturing facility focused on the production of its proprietary modular geo-void products. As well as complementing Polypipe’s existing presence in this subsector (ie Polystorm and Ridgistorm in its Civils portfolio), Alderburgh uses a component-based approach which increases design, freight and installation flexibility. It also supplies related geomembranes and offers a ‘supply-and-fit’ package service to its clients. The company is said to be well invested and we understand there is capacity to accommodate relatively near-term growth aspirations.

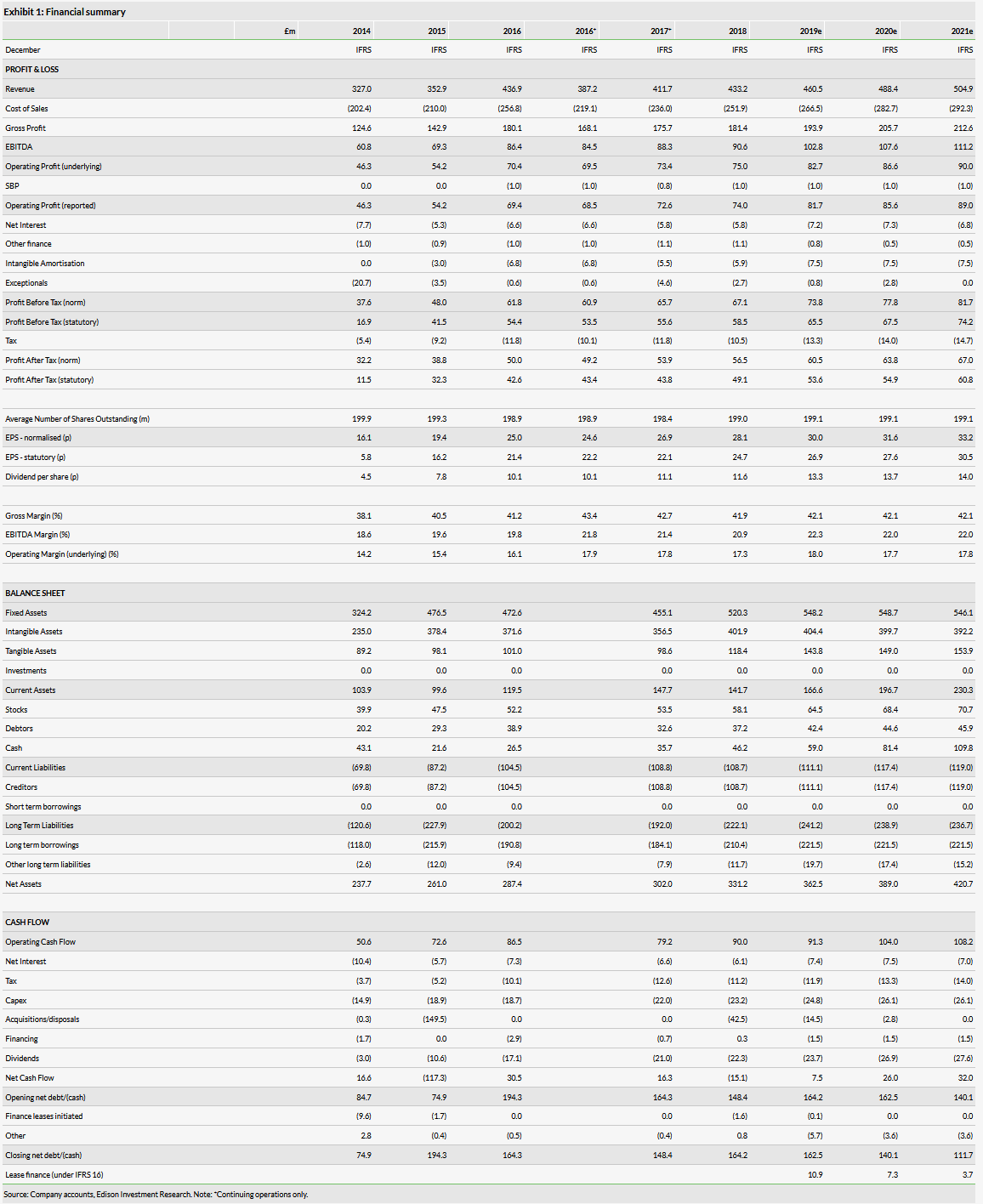

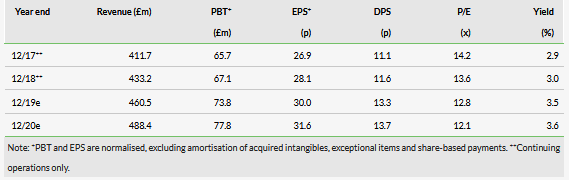

In the year to September, Alderburgh expects to have generated £17m revenue and £2.1m EBITDA (with EBIT of c £1.4m). Hence, EBIT margins on acquisition are below Polypipe’s existing Civil & Infrastructure level (ie 14% in FY18), but there are obvious cost synergies to come from the polymer purchasing and support functions. There are also potential revenue benefits from cross-selling the enlarged portfolio into future projects. After allowing for other minor revenue and IFRS 16 related adjustments, this acquisition enhances our earnings estimates by 1–2% in a full year, with no material benefit factored in for FY19 due to business seasonality. On a pro forma basis, we estimate that the deal will lift Polypipe’s gearing modestly to 1.6x EBITDA at the end of the current year.

Valuation: Subdued performance over the last quarter

Polypipe’s share price is modestly lower and has underperformed the FTSE All-Share Index over the last quarter but is up c 20% against a flat market on a one-year view. While above some building materials peers, the company’s valuation (FY20e P/E 12.1x and EV/EBITDA 8.7x) still trails that of Marshalls (21.2x and 14.6x respectively) by some margin. We acknowledge that wider UK economic and political uncertainties are weighing on sector valuations generally in the near term.

Business description

Polypipe is a leading supplier of largely plastic building products and systems. Operations in the UK (c 90% of revenue) address a broad range of sectors including residential, commercial and civil building demand and a number of subsectors within them. Overseas revenues are generated through exports, particularly to the Middle East, and a small Italy-based specialist fittings business.