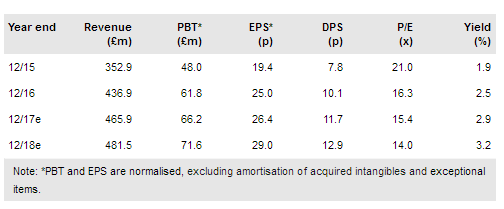

Polypipe Group (LON:PLP) has leading positions in the best performing UK building and construction segments and delivered robust financial performance in H117. The company is well set for this to extend in H2 and beyond and we retain our view that it should continue to attract a premium rating in its sector.

Solid performance in H117

There was a solidity about Polypipe’s H117 trading results, which is attractive to investors. Behind the input cost headwind and FX translation tailwind, Polypipe delivered good volume and profit growth even with variable market subsector demand. While the group EBIT margin was slightly below the previous year (down 80bp to 16.1% on a reported basis), we believe the underlying causes were transitory and pricing effects will wash through. The 16.1% H1 DPS increase provided a clear message regarding management’s view of future prospects. Cash flow exhibited its usual seasonal pattern, with working capital movements exaggerated by market pricing behaviour. While net debt was higher than reported in December, the underlying trend remains firmly downward, in our view.

To read the entire report please click on the pdf file below: