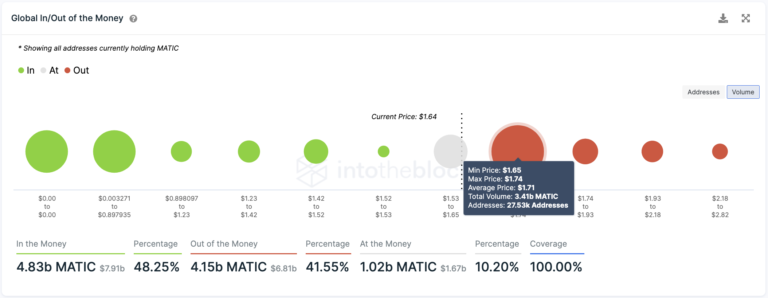

Polygon’s MATIC token appears to be preparing for a bullish impulse, but it must first overcome stiff resistance. Polygon’s MATIC token appears to be bottoming out after declining by more than 58% from its all-time high. Still, on-chain data shows a significant supply barrier ahead that may prove challenging to overcome. Polygon is approaching a critical area of resistance that could determine where it heads next. The Ethereum scaling solution’s MATIC token has risen by more than 11% over the past five days as it appears to be developing an Adam & Eve double bottom pattern on its four-hour chart. This technical formation is considered a bullish reversal pattern. It developed after Polygon dropped to $1.24 on Feb. 24 to form a V-shaped valley, surged to $1.70 on Mar. 2, and pulled back again to form a rounded valley near the $1.32 level. A spike in buying pressure that pushes MATIC above the middle peak of the Adam & Eve at $1.70 could signal the beginning of a new uptrend. If the asset did see a spike in demand, it could surge by nearly 26% to surpass $2. Still, transaction history shows that the $1.70 resistance zone could prove challenging to break. IntoTheBlock’s In/Out of the Money Around Price model reveals that more than 27,500 addresses have previously purchased over 3.41 billion MATIC at an average price of $1.72. In other words, MATIC has a large supply wall that may absorb some of the recent buying pressure and prevent it from advancing further. Given the number of underwater holders at $1.71, MATIC needs a decisive four-hour candlestick close above resistance level to validate the bullish outlook. Failing to overcome the $1.71 hurdle could result in investors selling their holdings to avoid significant losses. A potential increase in downward pressure could push prices to $1.50 or lower.Key Takeaways

Polygon Encounters Supply Wall

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Polygon Could Soon Surge To $2

Published 03/27/2022, 01:36 AM

Polygon Could Soon Surge To $2

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.