The U.S. dollar saw another day of losses yesterday, giving up 27 points (0.2%) against the Canadian dollar and 108 points (0.98%) against the euro as markets are concerned with the lack of discretion from President Trump, whose ability to deliver on his economic and tax policies is also being called into question. U.S. economic news released yesterday, particularly regarding the real estate market, did little to reverse this recent trend.

The USDCAD pair has lost a great deal of ground in recent days, and we could soon reach major support levels if the trend continues. Canadian inflation and retail sales data on Friday will no doubt have a material impact in determining the direction. It is important to keep in mind that discussions surrounding NAFTA and the anticipated key rate increase in June in the United States could send the USDCAD back towards1.3700. In short, volatility could well become a reality in terms of the loonie’s value in the weeks to come.

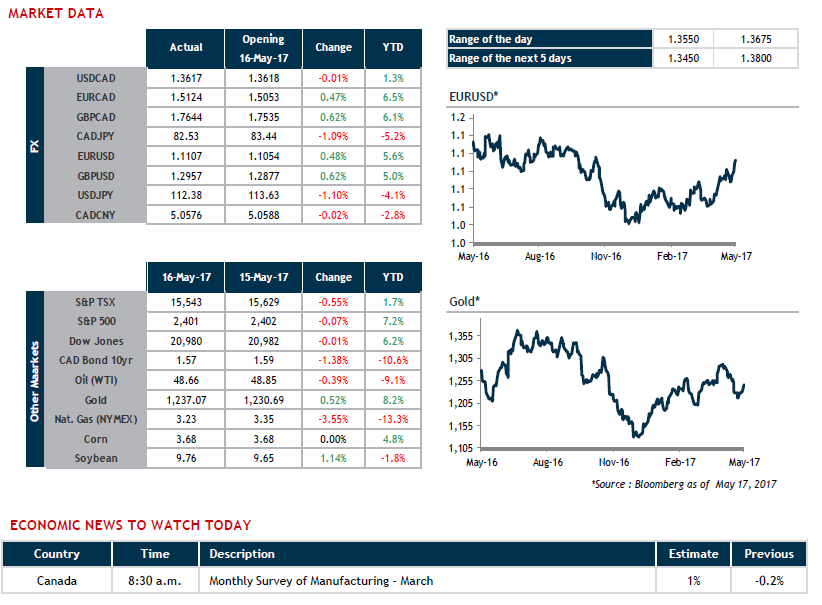

This morning, we’ll be keeping an eye on Canadian Manufacturing Shipments and Crude Oil Inventories in the United States.