It should be no surprise that it's a rather anticlimactic start to a new forex week. It was always going to be hard to follow last week, where the Fed's surprisingly dovish stance had the dollar under pressure rather than in full flight and supported by higher US yields. Even flash data of polar extremes from opposite sides of the globe overnight is finding it difficult to get the forex market excited. It seems that investors may be more interested in who makes the last sixteen in Brazil than these optioned contained currency ranges.

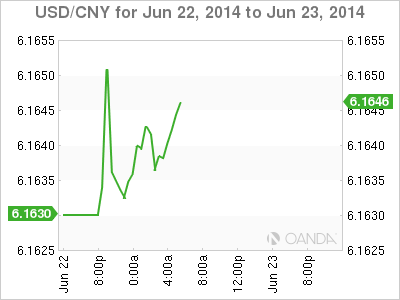

Asian investors got to cheer a much stronger than expected June flash manufacturing PMI for China from HSBC. Coming in at a six-month high and the first instance of expansion in 2014, the data (50.8 vs. 49.7) also showed reversal in input prices (inflationary) and employment decreased at a slower rate, while the growth in new export orders slowed. The improvement was broad-based, with both domestic orders and external demand sub-indices in expansionary territory. The uptick points to Chinese "mini-stimulus" finally filtering through to the real economy, which would suggest that the PBoC will continue to use accommodative policy until the recovery is sustained.

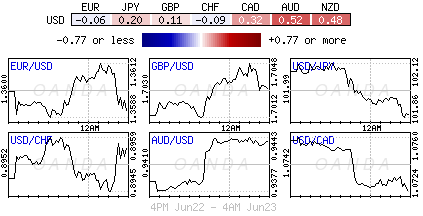

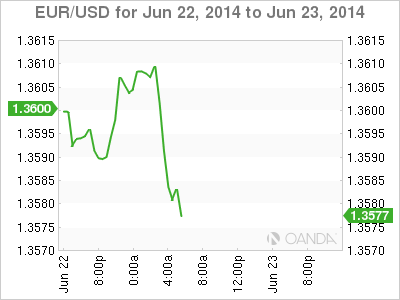

In contrast, the Euro-zone flash PMI's for June missed their mark resulting in the composite reading slipping to 52.8 from 53.3 in May. Breaking it down even further, weaker economic data from France (flash manufacturing and services both retreated) is overshadowing China's 'back on track' report, and putting pressure on European bourses as the market heads stateside. The EUR is now trading on top of its day's lows (€1.3580) while the AUD was the biggest winner in China's good fortune, rising +0.5% outright ($0.9434). Yield differentials continue to favor interest and commodity sensitive currencies like the Aussie and the loonie ($1.0730). The CAD has got some help from last Friday's stronger-than-expected Canadian inflation report, which may pressurize Governor Poloz at the BoC to change his downside risks to inflation copy. The AUD/USD hit a 2-month high above $0.9440 in the wake of the data, while front month Copper rallied 3/4% above $3.14. Crude prices have managed to remain elevated amid continuing turmoil in Iraq. Brent has added another +0.5% to trade at $115.39 per barrel, aside of last week's nine-month high.

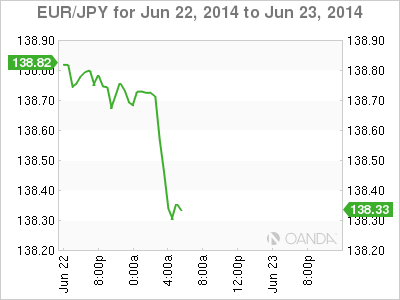

The forex market remains locked in tight ranges with dealers hoping for signs that volatility will pick up. With the lack of Euro option expiries this week, perhaps the single currency will be influenced more by the ECB's intentions than option dealers. The 18-member currency has been on the back foot ever since the EUR PMI release earlier this morning. The contraction of the French economy was the instigator, however, more cross-related flows like EUR/JPY (€138.32) will be expected to provide further pressure, especially have failing to penetrate the 200-DMA (€138.96). Slower growth for the Euro-zone as a whole has the EUR challenging the 100-DMA (€1.3585). Nevertheless, with US bond yields (+2.65% for US 10's remains key) also lower will temporary support the EUR, at least until this morning US home sales data (expected +2.2%).

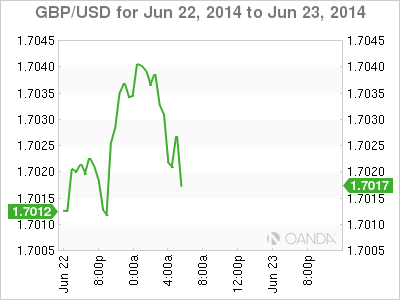

The UK loan demand data this morning suggests that their economy continues to gather steam. Business demand loans rose for a second straight quarter and a sure sign that investment is picking up and should continue to support the UK's economic recovery. The BoE informed that lender reported demand for loans rose significantly in Q2, and is expected to rise further over the next three-months. The loans are being used predominately to fund M&A activity and for investment in commercial real estate. To date, the UK's economic recovery has been driven by consumer spending. A shift like this will please the BoE and Governor Carney. He has always been concerned about the longevity of economic recovery solely depending on the consumer. The pound remains a forex darling (£1.7017), with strong support scattered below the £1.70 handle down to £1.6975. The market is comfortably continuing buying GBP on dips; nevertheless, a daily close above the August 2009 high (£1.7045-50) would give the bulls an added reason to look for a move into the mid £1.73's. The uptrend will remain intact as long at £1.6730 is not penetrated below.