On January 15, Standard & Poor’s unexpectedly downgraded Poland’s credit rating from A- (positive) to BBB+ (negative), or just three notches above junk.

In its report, the agency said that Poland’s new ultra-conservative government – led by President Andrzej Duda – has weakened the independence of the nation’s institutions.

The key trigger was a perceived lack of effectiveness of Poland’s key institutions, particularly the National Bank of Poland.

While a BBB+ rating is still considered investment grade, S&P has indicated that it could cut the rating further in the next two years, if the credibility of Poland’s monetary policy is undermined.

Statements from Moody’s and Fitch also pointed to a deterioration in Poland’s perceived creditworthiness.

While Fitch held the rating at A- stable and Moody’s chose a grade of A2 stable – which is higher than the other two – both have assessed Poland’s change in fiscal strategy, governance issues, and bank tax as credit negative.

The rate cut was S&P’s first for Poland’s hard currency debt. It’s a major hit to the nationalist-minded government of the Law and Justice (PiS) party, which won the October 2015 election by promising greater welfare and shared economic prosperity.

Investors Feel the Fear

Poland, which joined the European Union (EU) in 2004, gained a reputation as an exemplar of European post-communist transformation. The nation registered the highest economic growth in the bloc over the last decade while attracting billions of dollars in foreign direct investment.

Since 2007, Standard & Poor’s held Poland’s rating at A- and even increased the outlook to positive in 2015 based on Poland’s declining deficits and uninterrupted economic growth over the last 20 years.

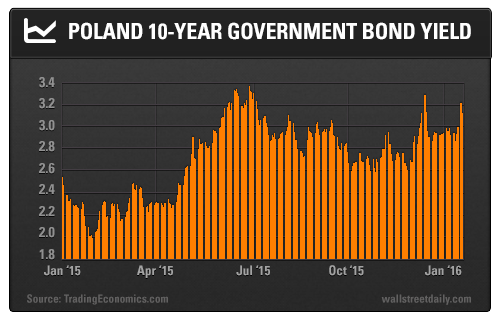

Thus, the credit downgrade caught economists and traders off-guard, and the markets reacted immediately. The zloty fell 1.5% to a four-year low versus the euro, and the yield on Polish 10-Year government bonds shot over 3.2%.

Indeed, investors are now wary of future downgrades weighing on Polish assets, particularly in a period of prolonged deflation.

In an attempt to calm the markets, government spokesman Rafal Bochenek indicated that there were no economic grounds for the downgrade, stating, “Nothing has changed in the economy and Poland is not experiencing any turbulence.”

Additionally, the Polish finance ministry said the rating downgrade was “incomprehensible” in economic and financial terms.

But the government’s recent actions seem to support the decision by Standard & Poor’s to downgrade Poland’s credit rating.

The Government Tightens Its Grip

Prior to the downgrade, the EU had begun an unprecedented inquiry into whether Poland had breached the bloc’s democratic standards by passing a series of new laws.

In December, the Polish Parliament (Sejm) approved a controversial new bill that paralyzed the Constitutional Tribunal, essentially eliminating the top legislative court’s ability to act as a check on new laws. PiS has also made it a goal to consolidate its hold over state media, a move that’s expected to bring a purge of journalists critical of the new government.

Standard & Poor’s said, “A law that moves the power to appoint the management… of public broadcasters to the Treasury… significantly weakens the independence of these institutions and has the potential to make them political instruments.”

The situation further deteriorated when Polish President Duda expressed his belief that refugees should be allowed to go wherever they like, such that migrants fleeing Syria should “have the choice of country of destination and enjoy the freedom of movement.”

Not surprisingly, this created a rift with Brussels on the highly sensitive issue of migration across Europe.

What Should Investors Expect?

The downgrade has already started to put pressure on Polish government bonds and equity markets, and the zloty may continue to weaken, as the world focuses on Poland’s deteriorating system of checks and balances.

Meanwhile, Polish markets have already felt the initial blow, especially now that expectations of future rating downgrades have been confirmed. The result will be higher debt service costs in addition to narrowing monetary space.

Still, a rate cut in the next few quarters seems unlikely. While the downgrade reflects valid concerns over the general policy mix, Poland’s economy continues to be supported by strong macro fundamentals, which Standard & Poor’s itself highlighted.

However, any additional political pressure on the central bank would further undermine the credibility of Poland’s monetary policy and new media laws, which going forward will be highly scrutinized by rating agencies and the financial markets at large.

Thus, for the time being, Poland should be sold out of your emerging markets portfolio. Let’s wait until the situation improves.

Good investing,