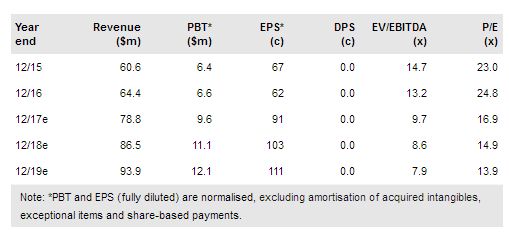

Pointer Telocation (NASDAQ:PNTR) has released record Q217 results showing the success of recent sales initiatives, particularly in the fleet management side, as well as the benefits of high operating leverage via its SaaS model, which resulted in an almost doubling of PBT vs Q216. With earnings underpinned by strong recurring revenue streams, a major new $2-3m pa CelloTrack Nano product order from the US and strong prospects for PNTR’s connected car and Internet of Vehicles offerings, we have increased our 2017 and 2018 normalised EPS forecasts by 16% and 5%, respectively and increased our DCF and peer-based valuations to $16.3/share and $15.4/share, respectively.

Record second quarter results

Pointer Telocation has released record Q217 results, with 25% y-o-y growth in subscriber numbers and a still high 16% excluding acquisitions, translating to 24% growth in revenues. The benefit of high operating leverage emerged decisively with normalised group EBITDA surging 56% y-o-y and PBT up 95% y-o-y.

To read the entire report Please click on the pdf File Below: