The PNC Financial Services Group, Inc. (NYSE:PNC) is scheduled to report second-quarter 2016 results on Friday, Jul 15.

In first-quarter 2016, the Pennsylvania-based company lagged the Zacks Consensus Estimate and declined 4% from the year-ago tally. Results were weighed down by lower non-interest income due to weakness in equity markets and reduced capital markets activity. Also, the quarter recorded higher provisions owing to energy stress. However, on a positive note, the company witnessed higher net interest income and lower expenses.

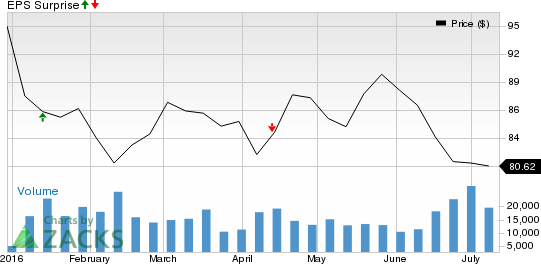

PNC Financial delivered an earnings beat in three of the trailing four quarters with an average positive earnings surprise of 4.06%. Notably, industry-wide weakness and global macroeconomic concerns, which were further fueled by the recent Brexit referendum, took a toll on the bank stocks with PNC Financial falling nearly 15% year to date.

Will the stock turnaround post second-quarter earnings release? Unfortunately, our quantitative model doesn’t call for an earnings beat this time. Also, the Zacks Consensus Estimate of $1.76 for the second quarter indicates a year-over-year decline of more than 6%.

What Our Model Indicates

Our proven model does not conclusively show that PNC Financial is likely to beat the Zacks Consensus Estimate in the upcoming release. This is because a stock needs to have the right combination of the two key criteria – a positive Earnings ESP and a Zacks Rank #1 (Strong Buy) or at least 2 (Buy) or 3 (Hold) – for greater chances of an earnings beat. But that is not the case here, as elaborated below.

Zacks ESP: The Earnings ESP for PNC Financial is -0.57%. This is because both the Most Accurate Estimate of $1.75 is lower than the Zacks Consensus Estimate of $1.76.

Zacks Rank: PNC Financial’s Zacks Rank #3 increases the predictive power of ESP. However, we also need to have a positive ESP to be confident of a positive earnings surprise.

What to Expect in Q2?

While results of PNC Financial in the last quarter were undoubtedly a reflection of the stressed operating environment that the overall banking industry experienced in the first quarter, the picture for second quarter is no different. Let's have a look at the different factors at play.

Continued Pressure on Net Interest Margin (NIM): As the Federal Reserve held back on further rate hike so far this year, the company is not likely to record improvement in its NIM in second-quarter. Lower investment securities yields might have further weighed on the margin.

Seasonally Higher Expenses: Though the company remains focused on driving operational efficiency through its ongoing cost-containment efforts, the upcoming release may reflect pressure on the expense base. Notably, management noted in its first-quarter 2016 conference call that non-interest expense is projected to rise in mid-single digits during the second quarter on a sequential basis, due to higher expected business activity and seasonality.

Modest Net Interest Income (NII) Growth: NII is expected to rise modestly in second-quarter 2016. Notably, supporting NII, period-end loans may exhibit modest rise during the quarter.

Fee Income to Exhibit Strength: Fee income is likely to exhibit an increase in the range of 10–12%, reflecting higher expected business levels in the second quarter. Among fee revenue categories, management is optimistic about mid-to-high single digit growth in consumer services. Further, treasury management business is predicted to bolster corporate services income through product innovations as well as cross-selling. Additionally, growth in residential mortgage income is based on expected production gains.

Benign Energy Headwinds: Management expects provision within $125–$175 million including the impact of expectations of continued stress in energy lending. However given the rebound in oil prices that hit rock bottom in February, the provision to cover potential losses tied with energy portfolio should not be significant.

PNC Financial’s activities during the quarter were inadequate to win analysts’ confidence. As a result, over the last seven days, the Zacks Consensus Estimate for the quarter remained unchanged at $1.76.

Stocks that Warrant a Look

Here are some stocks worth considering, as according to our model they have the right combination of elements to post an earnings beat this quarter.

Comerica Incorporated (NYSE:CMA) , which is expected to report on Jul 19, has an Earnings ESP of +1.47% and a Zacks Rank #3.

Regions Financial Corporation (NYSE:RF) has an Earnings ESP of +5.00% and carries a Zacks Rank #3. The company is scheduled to release results on Jul 19.

Federated Investors, Inc. (NYSE:FII) has an Earnings ESP of +2.13% and carries a Zacks Rank #3. It is scheduled to report results on Jul 28.

PNC FINL SVC CP (PNC): Free Stock Analysis Report

COMERICA INC (CMA): Free Stock Analysis Report

REGIONS FINL CP (RF): Free Stock Analysis Report

FEDERATED INVST (FII): Free Stock Analysis Report

Original post

Zacks Investment Research