Upstream Energy firm Cabot Oil & Gas Corporation (NYSE:COG) is set to report third-quarter 2017 results before the opening bell on Oct 27.

Headquartered in Texas, Cabot is an independent oil and gas exploration company with producing properties mainly in the continental United States. The Zacks Consensus Estimate for 2017 earnings for the current quarter has been revised downward by 16.7% over the last 30 days. Further, the Zacks Consensus Estimate for 2017 earnings has also moved south by 3.2% over the last 30 days.

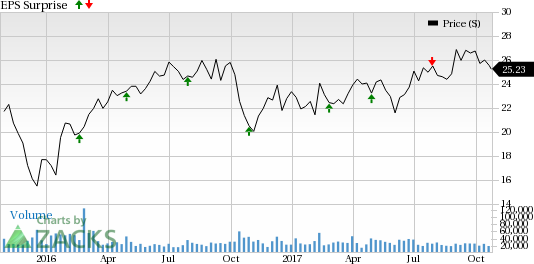

Last quarter, the company delivered a negative earnings surprise of 6.67% owing to increased costs. However, Cabot delivered an average positive earnings surprise of 3.02% in the last four quarters.

Let’s see how things are shaping up for this announcement.

Factors to Consider

Being an upstream firm, weakness in the commodity prices might lower the company’s exploration and production activities. Natural gas prices dropped about 3.5% in the July-September period, owing to the fuel’s tepid demand due to mild weather conditions and hurricane-related power outages.

With natural gas prices trading just around $3 per MMBtu during most part of the third quarter and Cabot being one of the most gas-weighted E&Ps, the company's earnings and revenues are under pressure. The Zacks Consensus Estimate for average realized gas price is pegged at $2.32 per thousand cubic feet, lower than the prior quarter figure of $2.38. Even the crude price realization is estimated at $43.81 per barrel, lower than the $44.03 per barrel recorded in second-quarter 2017.

We also note that the current Zacks Consensus Estimate for the quarterly output stands at 164 billion cubic feet (Bcf) compared with $166 Bcf in second-quarter 2017. This might negatively affect the company’s revenues. Analysts polled by Zacks expect revenues of $410 million for the third quarter, down 10.9% from the prior quarter.

Further, during 2017, Cabot is likely to spend $845 million which is more than twice of the 2016 spending level of around $375 million. This might lower the company's cash flows. Last quarter, Cabot’s operating expenses were higher by around 27% on increased administrative, general and other costs. If the trend continues, the company’s earnings are expected to get hurt.

Earnings Whispers

Our proven model does not conclusively show that Cabot is likely to beat earnings estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

Zacks ESP: Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, is -18.81%. This is because the Most Accurate estimate is 8 cents, while the Zacks Consensus Estimate is pegged at 10 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter

Zacks Rank: Cabot presently carries a Zacks Rank #4 (Sell). Please note that we caution against stocks with a Zacks Rank #4 or 5 (Strong Sell) going into the earnings announcement, especially when the company is witnessing negative estimate revisions.

Stocks with Favorable Combination

Though an earnings beat looks uncertain for Cabot, here are some firms from the energy space you may want to consider as our model shows that these have the right combination of elements to post earnings beat:

Unit Corporation (NYSE:UNT) has an Earnings ESP of +29.17% and a Zacks Rank #3. The company is expected to release third-quarter earnings report on Nov 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Newpark Resources, Inc. (NYSE:NR) has an Earnings ESP of +33.33% and a Zacks Rank #2. The company is likely to release third-quarter earnings result on Oct 30.

Suncor Energy Inc. (NYSE:SU) has an Earnings ESP of +8.07% and a Zacks Rank #2. The company is anticipated to report third-quarter earnings numbers on Oct 25.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Suncor Energy Inc. (SU): Free Stock Analysis Report

Unit Corporation (UNT): Free Stock Analysis Report

Newpark Resources, Inc. (NR): Free Stock Analysis Report

Cabot Oil & Gas Corporation (COG): Free Stock Analysis Report

Original post

Zacks Investment Research