The inflection point in many of the different markets still continues to develop. The precious metals complex is approaching a very critical backtest to some important necklines we’ve been following.

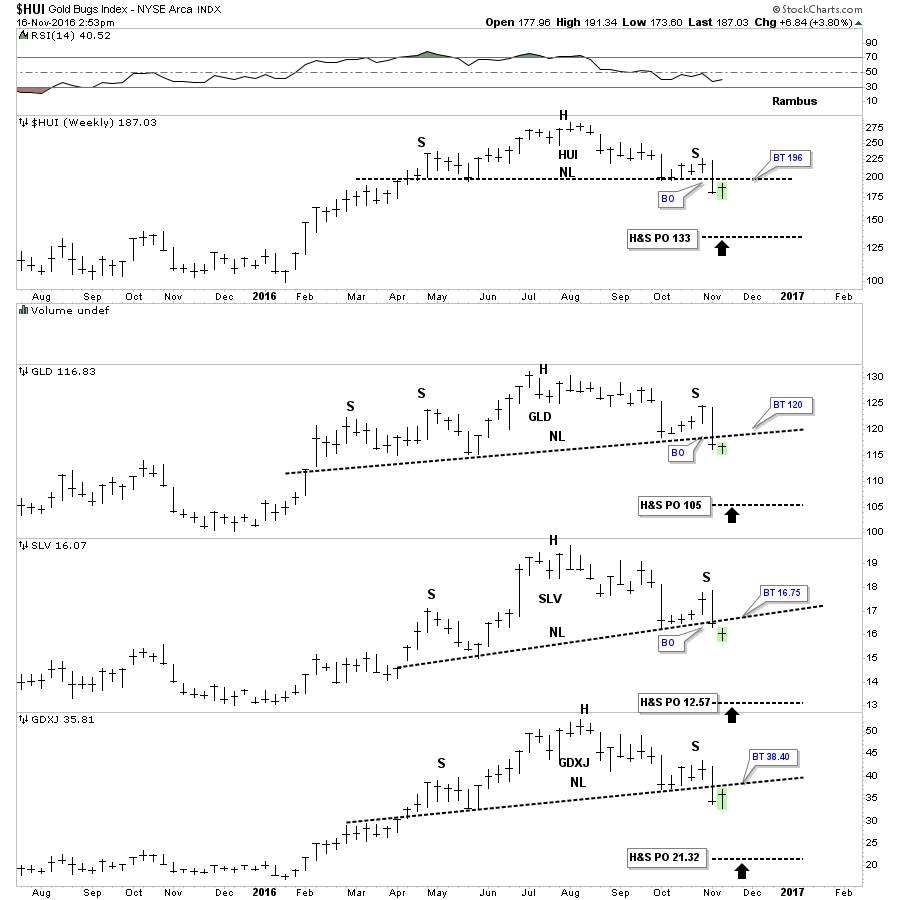

I added the VanEck Vectors Junior Gold Miners (NYSE:GDXJ) to the combo chart which shows the HUI, SPDR Gold Shares (NYSE:GLD), iShares Silver (NYSE:SLV) and the GDXJ have all broken down below their respective necklines and are now in the process of backtesting those necklines from below. I can’t emphasize enough how critical this backtest is to the overall health of the impulse move out of the January low this year.

From a Chartology perspective the price action trumps everything else. It’s possible that these H&S tops may fail but until the price action can trade above those necklines the H&S tops are in place. I have the backtests labeled on the charts that need to be broken to the upside to negate those potential topping patterns. On the other hand if the backtests to the necklines hold I also have the price objectives for those would be H&S tops.

If the price action blasts up through those necklines that would be very positive, but if I see the price action starting to stall out around those necklines I will be forced to exit the remaining 50% of the PM portfolios. This could very well be the shakeout before the breakout higher but these necklines will have to be broken to the upside first.