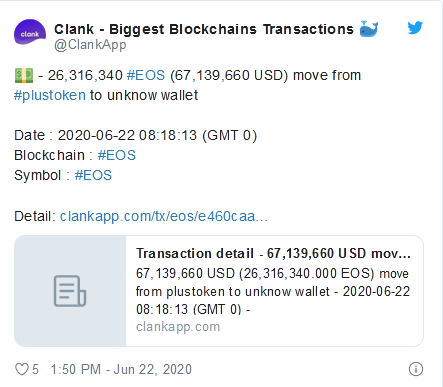

On-chain data reveals that EOS could go through a sell-off as scammed tokens begin to change hands. The PlusToken Ponzi looks like it is preparing to dump $67 million in EOS on the market, which could cause prices to crash. CoinHolmes, a Chinese-based blockchain analytics provider, has identified the movement of more than 23.6 million EOS related to the PlusToken scam. The funds are worth roughly $67 million and are currently parked in an unknown wallet, with only 350 EOS remaining in the original address. The anti-money laundering analytics provider maintains that based on historical data, the perpetrators of the PlusToken scam could be preparing to sell this massive number of stolen tokens. “Further analysis revealed that the [new] address belongs to the cold wallet “coldlaregist” address, which means that the PlusToken group may be prepared to further sell the funds,” said CoinHolmes. A further increase in the selling pressure behind EOS could have severe implications on its price. The smart contacts token is one of the top cryptocurrencies by market cap that has struggled to recover from March’s market meltdown. As a result, losing the current support level could be catastrophic. From a technical perspective, EOS’ price action has been contained within a parallel channel for the past two months. Since early April, each time this altcoin surges to the upper boundary of the channel, it pulls back to hit the lower boundary, and from this point, it bounces back up again. This price action is consistent with the characteristics of a parallel channel. In the event of a sell-off, EOS may have the ability to break below the $2.4 support level, which has held steady since this technical pattern began to take shape. By drawing a parallel line equal to the distance of the height of this channel, it is reasonable to assume that this cryptocurrency could plunge towards $2 or even lower. PlusToken has a disproportionate impact on prices because of its enormous holdings. For this reason, one could argue that it may allow prices to go higher before it starts dumping on unaware investors. Under such circumstances, moving past the middle line of the parallel channel will enable EOS to rise to the upper boundary that sits around $2.8. It is worth mentioning that the last time the individuals behind the PlusToken scam moved a significant number of tokens was back in mid-February. During that time, approximately 12,000 BTC were transferred to an unknown address. A few days later, Bitcoin peaked at a high of $10,500 and entered a downward trend that saw it lose nearly 70% of its value. The flagship cryptocurrency plummeted to a low of $3,600, marking one of the biggest crashes in its 11-year history. Now, a similar scenario could be about to take place following the recent movement of 23.6 million EOS. Precautions must be taken immediately to avoid the risks of another massive correction.Key Takeaways

Trying to Lose Sight

EOS Continues Consolidating

History Might Repeat Itself

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EOS Could Go Through A Sell-Off. Here's Why

Published 06/23/2020, 06:00 AM

EOS Could Go Through A Sell-Off. Here's Why

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.