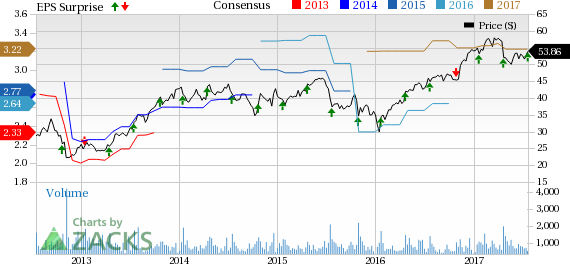

Shares of Plexus Corp (NASDAQ:PLXS) were up 6.1% after reporting better-than-expected third-quarter fiscal 2017 results. Quarterly adjusted earnings of 74 cents per share and revenues of $618.8 million beat the Zacks Consensus Estimate of 72 cents and $610 million, respectively.

However, on a year-over-year basis, earnings fell 2.6% while revenues declined 7.3%.

Revenues from the Communications sector (16% of total revenue) plummeted 36.5% year over year to $99 million.

Healthcare/Life Sciences revenues (34%) were up 1.4% from the year-ago quarter to $210 million.

Industrial/Commercial revenues (32%) were almost unchanged year over year at $201 million.

Defense/Security/Aerospace segment revenues (18%) grew 5.8% on a year-over-year basis to $109 million.

Region-wise, revenues from the Americas decreased 26.2% to $265 million. However, revenues from the Asia Pacific region increased 11.3% to $326 million on a year-over-year basis. Revenues from Europe, the Middle East, and Africa, which totaled $53 million, also grew 29.3% year over year.

Margins

Plexus reported adjusted operating profit of $29.5 million in the quarter, down 9.9% year over year. Adjusted operating margin decreased 10 basis points (bps) year over year to 4.8%.

Balance Sheet & Cash Flow

Plexus exited the fiscal with cash & cash equivalents worth $519.2 million compared with $433 million as of Oct 1, 2016. The company had long-term debt and capital lease obligations of about $26.1 million compared with $184 million as of Oct 1, 2016.

For the quarter, the company generated $16.3 million in cash flow from operations and used $9.8 million for capital expenditures. Free cash flow came in at about $6.5 million. Share repurchases for the quarter amounted to $10 million.

Outlook

For the fourth quarter of fiscal 2017, revenues are projected in the range of $660–$700 million. GAAP earnings are projected within 77 and 87 cents per share.

The Zacks Consensus Estimate for revenues stands at $678.2 million.

Our Take

We believe new program wins, together with global expansion, will drive growth over the long term. In the last reported quarter, Plexus won 32 new manufacturing programs worth approximately $220 million and added over $839 million in revenues in the trailing four quarters due to new wins. Additionally, the consolidation of the company’s production facilities in low-cost areas is expected to boost margins, going forward.

However, a mature electronic manufacturing services market and intense competition from the likes of Jabil Circuit (NYSE:JBL) , Celestica Inc. (TO:CLS) and Flextronics (NASDAQ:FLEX) remain headwinds. Additionally, the company expects weakness in the Communications market to impact business in the near term. Over the past one year, shares increased 17.7% compared with the Zacks categorized Electronic Manufacturing Services (EMC (NYSE:EMC)) industry's gain of 35%.

Currently, Plexus carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

Plexus Corp. (PLXS): Free Stock Analysis Report

Jabil Circuit, Inc. (JBL): Free Stock Analysis Report

Flextronics International Ltd. (FLEX): Free Stock Analysis Report

Celestica, Inc. (CLS): Free Stock Analysis Report

Original post