Looking across the dollar, euro and yen majors; there are plenty of pairs that look well positioned from a technical perspective. Yet, once again the fundamentals may act as a barrier for follow through. With uncertainty or the focus pushed forward, expectations could pump the break on what looks like otherwise clean technical setups.

For the euro setups, there are good looking setups; but resolution on Greece - for better or worse - is necessary. EUR/USD in particular is in a diminishing wedge below 1.1500, but needs a decisive outcome from the debt standoff to have a fighting chance for follow through. A clear fundamental outcome would be good for either direction, but I prefer a scenario where the deal falls through and it clear 1.1250. The same is true of EUR/JPY, which could easily clear 138 congestion floor if a Greek crisis proved contagious.

For a euro long view scenario, one of the better positioned pairs is EUR/CAD which puts a listless Canadian dollar against a theoretically motivated counterpart. Clearing a 16-month channel resistance around 1.40 would be the key technical move, but fundamentals are crucial here.

For the yen crosses, a clear risk view is necessary and we are as lacking of conviction there as anywhere else. A USD/JPY move towards 125 on a clear risk appetite drive could be an opportunity but it has a narrow window and dubious support. I'd prefer seeing risk aversion pull down equities and the yen crosses. USD/JPY below 122.50, 121.50 and then 120 are the key stages. I am also partial to NZDJPY given it broke a major neckline on a six-year rise and head-and-shoulder pattern. A staging from a retest at 85.50 or projection below 84 may prove viable levels to work with.

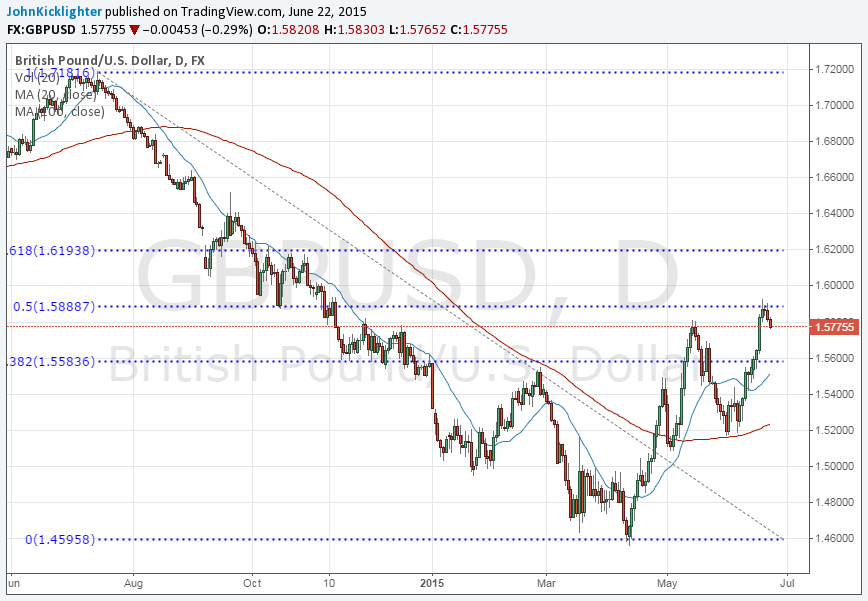

From the dollar crosses, focus on rate forecasts is still strong but the wait-and-see mentality is not as magnetized to the future as it was last week leading into the FOMC decision. That may ease trend development on pairs that aren't 'distracted' by upcoming event risk. I'm watching GBP/USD as it turns from its 50% Fib of the July 2014 to April 2015 bear phase around 1.5900. Without something to hold it back, perhaps this pair finds follow through more readily.