Today I penned my eighteenth guest column for Barron’s, filling in for Steve Sears and the venerable The Striking Price options column. Looking back, I was surprised to see that this is the eighth year I have been contributing to Barron’s, and while I have generally tilted in the direction of volatility topics during this period, I always like to keep my thoughts topical, but with an unusual twist or two.

In Playing Volatile Oil Prices: The ins and outs of the backspread trade, I tackled the recent huge moves in crude oil prices, touched upon some of the fundamental and technical influences on the price of crude and used the current environment of chaos following a huge short squeeze as a backdrop to talk about the opportunities associated with a call backspread.

As Barron’s prefers to structure trade ideas around ETPs or single stocks, I elected to use the popular United States Oil (NYSE:USO) ETF as my underlying, though I also like the idea of call backspreads in oil and gas exploration and production (SPDR S&P Oil & Gas Exploration & Production (NYSE:XOP)) or Russia (Market Vectors Russia (NYSE:RSX)), though the Russia ETF has limited liquidity. As an aside, readers of this blog will surely know that the prices of futures-based ETFs such as USO and iPath S&P 500 VIX Short-Term Futures Exp 30 Jan 2019 (NYSE:VXX), among others, are strongly influenced by the roll yield associated with the shape of the futures curve. For this reason, USO acts most like WTI crude oil in the short-term, but over longer periods the price of USO is more strongly affected by the term structure of crude oil futures, similar to the issues associated with VXX and the VIX.

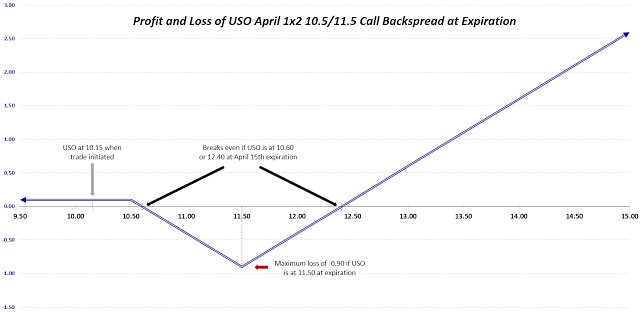

While the Barron’s column discusses the rationale for the trade and some of the details surrounding it, I thought I would post a profit and loss graphic for the USO April 1x2 10.5/11.5 call backspread here as a companion to the Barron’s material.

I am sure this particular call backspread trade idea is not for everyone, yet I think it is important for everyone to internalize backspreads, their Profit and Loss chart and some of the tweaks that can be made. For instance, one can dramatically change probabilities and payoffs by modifying strikes (including making use of in-the-money strikes, for instance) and expirations, whereas the credit or debit for entering the trade is something that can be strongly influenced by adjusting the ratios to the likes of 2x3, 4x5, etc.

Also of note, readers who are new to backspreads may wish to brush up on bear call spreads (and bull put spreads) before tackling backspreads, as I like to think of backspreads as short vertical spreads that are supplemented by the purchase an extra out-of-the-money option, in the time-honored tradition of swinging for the fences with some of the profits from a spread trade.

As I concluded in the column, “In the options world, there are very few trades where you can make money should the underlying shares move sharply in either direction. Backspreads are intriguing in that they have limited risk, unlimited reward (in one direction), and can make money if the underlying moves either up or down.”

Disclosure(s): Long XOP and short VXX at time of writing; Livevol and CBOE are advertisers on VIX and more.