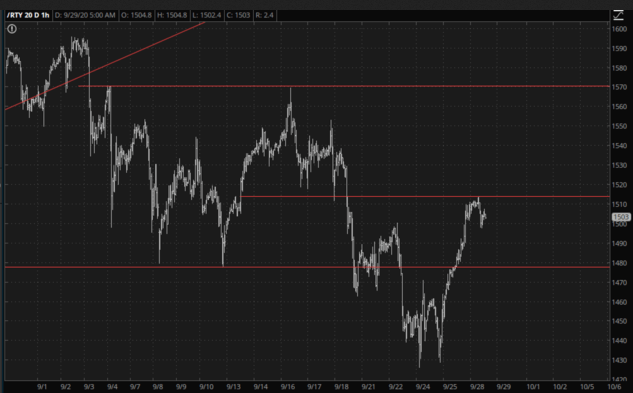

After yesterday’s baseless mega-rally, it was a relief to see a bit of red this morning. Looking at the small caps, there has been a strong burst since early Friday morning, which appears to have taken a U-Turn at the horizontal I’ve drawn in the middle of the chart, which constitutes the base of the head and shoulders pattern from last week.

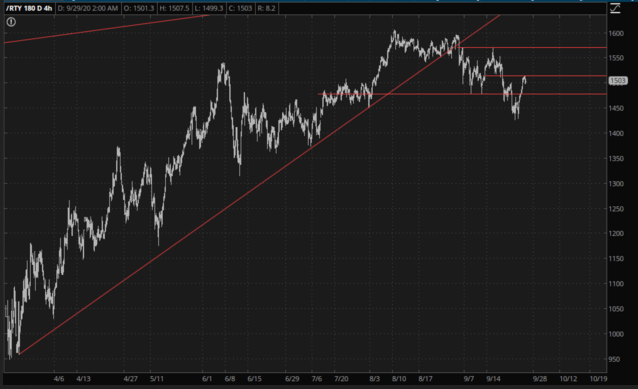

Looking back farther, at a 4-hour chart, you can see the uptrend from March broken, with a topping pattern being hammered out since then. We had a break below this pattern last week, but evidently the misplaced faith in yet another multi-trillion dollar “stimulus” package goosed things higher. I’ve here to tell ya, this once-great republic of ours is going to stimulate itself into oblivion.

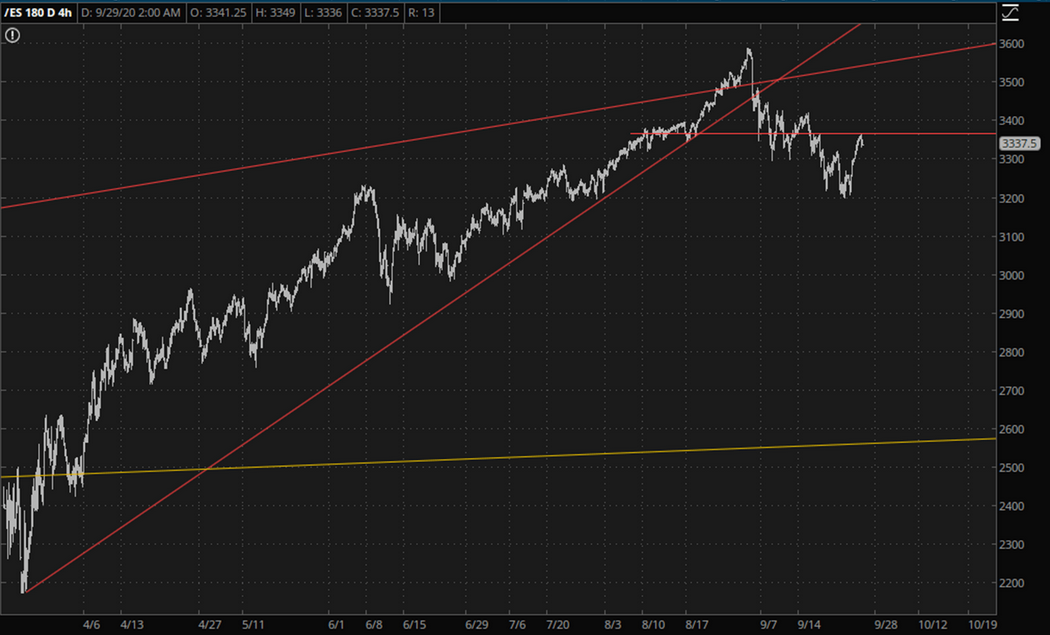

The ES is sporting a similar setup: that is, an ascending trendline from March (now broken) and a fairly recent topping pattern forming over the past couple of months.

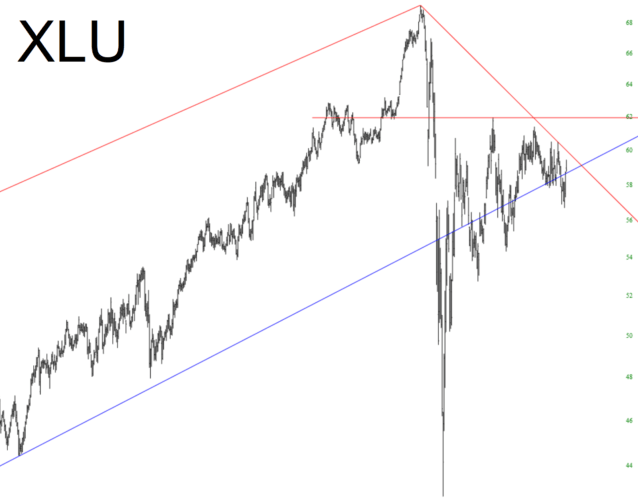

I’ve got 48 individual stocks sold short, and 2 ETF shorts: those are EWZ (Brazil) and Utilities (XLU, shown below). I also have January 2021 puts on XLU, which I find to be a captivating pattern.